You’re a seller in today’s market. What does it take to get your house noticed  with all the other houses out there for sale? Short answer? The very same thing it takes in any market.

with all the other houses out there for sale? Short answer? The very same thing it takes in any market.

Or sure, in the market we had three years ago the average busboy or cab driver could have sold a house. In fact, many of them did and are now back to doing what they did prior to the market going wild. What is funny is that even in that market where a home seller could just put their home on Craigslist or pound a sign in the ground and from either of those actions, find their own buyer (at one point, in less than a day) – it still wasn’t the same as what we did for the seller. I understand that this can come across as self-serving but in most cases that seller cost themselves about 40k (estimated average loss in the Phoenix area) by “saving the commission”. They found A buyer. At that same time, the top agents were “finding” around 25 buyers per house. Really. This created a bidding war and drove the price of the house up. Way up.

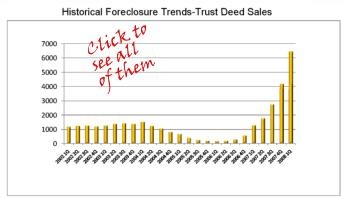

This market isn’t that market. Now, the balance between sellers and buyers is completely reversed. Now, we have more sellers than buyers and it is going to be that way for a while.

So, is now a “good” time to buy? Is now a “good” time to sell? Well, it depends: if you are a first-time buyer the important question is how would your house payment compare with what you are paying right now in rent. Are the prices going to continue to slide? Maybe. There is no YES or NO answer to that question because it depends on the price range and the part of the valley. Some areas will not have any further meaningful price declines. Some will. My counsel to a person currently renting would be to see how the payment (using only a 30 year fixed rate loan, thank you) would compare with projected rent increases. You can make that type of comparison here.

What if you are a local home changer? You live here now and would be buying another home here. Then it makes NO difference what the market is doing. If the market “went up” it does not help you. If the market “went down” it does not hurt you. The only significant variable in this instance is interest rates. Interest rates moving up or down does make a difference – but not the prices of the houses.

Selling and not buying another home? Better to sell now or wait? The real answer depends on the location of your home (the one thing you can not change). To give a specific (as in correct) answer requires doing a supply – demand analysis of the immediate neighborhood. It doesn’t take long for us to do and is the only way to give you a real answer to that question.

What does it take to get your house noticed (the only way to actually get top dollar) is effective marketing. Literally letting agents and buyers know that the house is for sale. Can a sign on the property cause a buyer to call? Sure, but the only people who will see the sign are those people driving down that street. Same for an open house and in today’s world you can have an “open house” 7 days a week, 24 hours a day with a virtual tour. So having the house on the internet is vital but isn’t enough. Anyone can put any house on a web site (just about every home for sale today is on one or more web sites) but that isn’t enough to get the home viewed or sold. There must be the right kind of traffic to that web site. The right kind of traffic. People looking for homes because they want to own one. Do enough of that last one, and have the home priced correctly and it will sell. It doesn’t have to take a long time either – even in this market.