“The report of my death was an exaggeration”

— Mark Twain

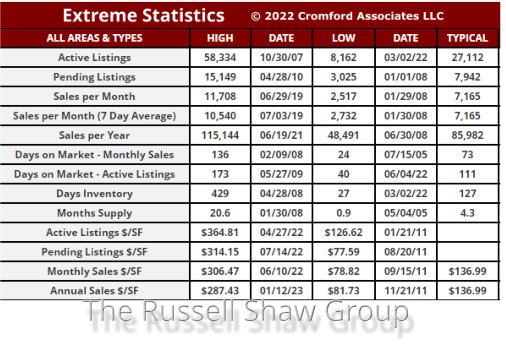

2022 ended in a whimper. After a promising spring buying season, the market sagged under the weight of affordability issues – largely courtesy of rapidly rising interest rates. The seemingly unstoppable sellers’ market that began the year, in fact stopped. By November and December of 2022, the valley’s market landed squarely in the buyer’s camp. That buyer’s market lasted approximately 4 weeks (qualifying for the shortest buyer’s market on record in the valley). But that is so 2022. Where are we in 2023?

Most buyers and sellers would be surprised to hear that the greater Phoenix real estate market is primarily a balanced market – and is now tipping in favor of sellers. But it’s true. Why doesn’t it feel that way? We think it feels unbalanced primarily for 4 reasons:

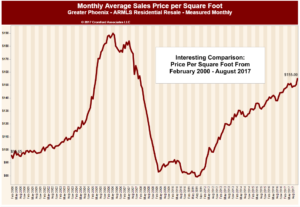

1. Appreciation has been strong since 2015 making the relatively minor 2022 price correction feel awful to sellers by comparison.

2. The number of transactions (market shrink) are much lower than normal as buyers and sellers headed to the sidelines. Sellers feared equity loss, buyer’s feared rising housing expense due to increasing interest rates.

3. Human emotion – it’s not what’s true but what feels true. Skepticism is the current market emotion. Therefore, improvement is viewed with suspicion.

4. Not all valley cities are having the same experience. Of the largest 17 cities, the Cromford Report shows 4 currently in a buyer’s market (Goodyear, Queen Creek, Maricopa, Buckeye), 3 balanced (Gilbert, Peoria, Surprise) and 10 in a seller’s market (Fountain Hills, Paradise Valley, Chandler, Cave Creek, Scottsdale, Phoenix, Avondale, Glendale, Mesa, Tempe, Gilbert)

𝗠𝗲𝘀𝘀𝗮𝗴𝗲 𝘁𝗼 𝘀𝗲𝗹𝗹𝗲𝗿𝘀: Now is a good time to sell if you have owned your home for 2 years or more. The Cromford report gives these appreciation numbers for sellers : “ The long-term appreciation rates for homes in Greater Phoenix are as follows using January sales to date: 25% for 2yrs., 50% for 3yrs., 63% for 4yrs., 70% for 5yrs., and 86%+ for 6yrs or more.” Balanced markets mean little to no downward pressure on pricing. However, demand is much quicker to shift than supply is. If interest rates rise, we could see a demand drop once again putting downward pressure on pricing.

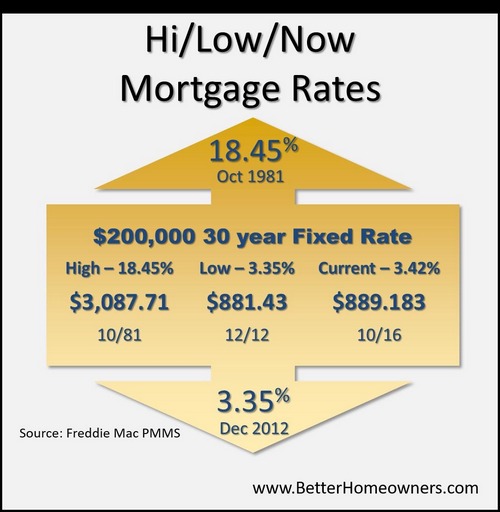

𝗠𝗲𝘀𝘀𝗮𝗴𝗲 𝘁𝗼 𝗯𝘂𝘆𝗲𝗿𝘀: The buyer’s market lasted for a short 4 weeks – November/December of 2022. Interest rates have now settled back to below historic averages. In a balanced market, competition amongst buyers is minimal (i.e. no spiraling bidding wars). Prices declined around 13% in 2022 – providing buyers a better value. Don’t be caught waiting for further price drops when the market numbers don’t support that happening. As we mentioned above, balanced markets mean little to no downward pressure on pricing. Also, interest rates are still subject to change. They go up fast, and down slowly. Take advantage of the relative (and perhaps temporary) interest rate stability. Be skeptical of interest rate forecasts. To quote Michael Orr “No-one has ever been very good at forecasting mortgage interest rates more than a couple of weeks in advance. This includes the Mortgage Bankers Association and it especially includes Goldman Sachs whose track-record on interest rate forecasts is extremely poor. This is not saying much because there is no-one who gets them right more than by random chance.

Any time spent listening to people making interest rate forecasts is time you could have spent more productively.”

None of us can predict the future. But at the moment – this market is a green light for both sides.

Russell & Wendy Shaw

(Mostly Wendy)

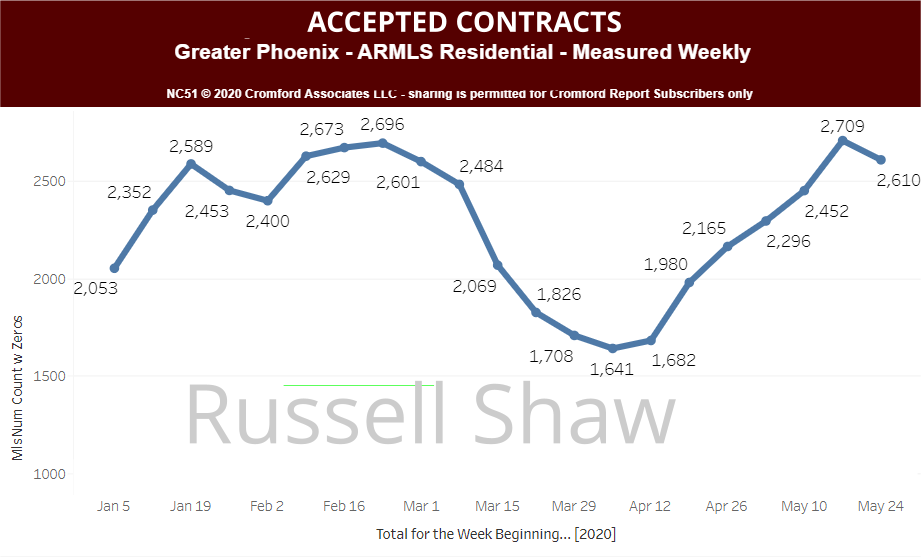

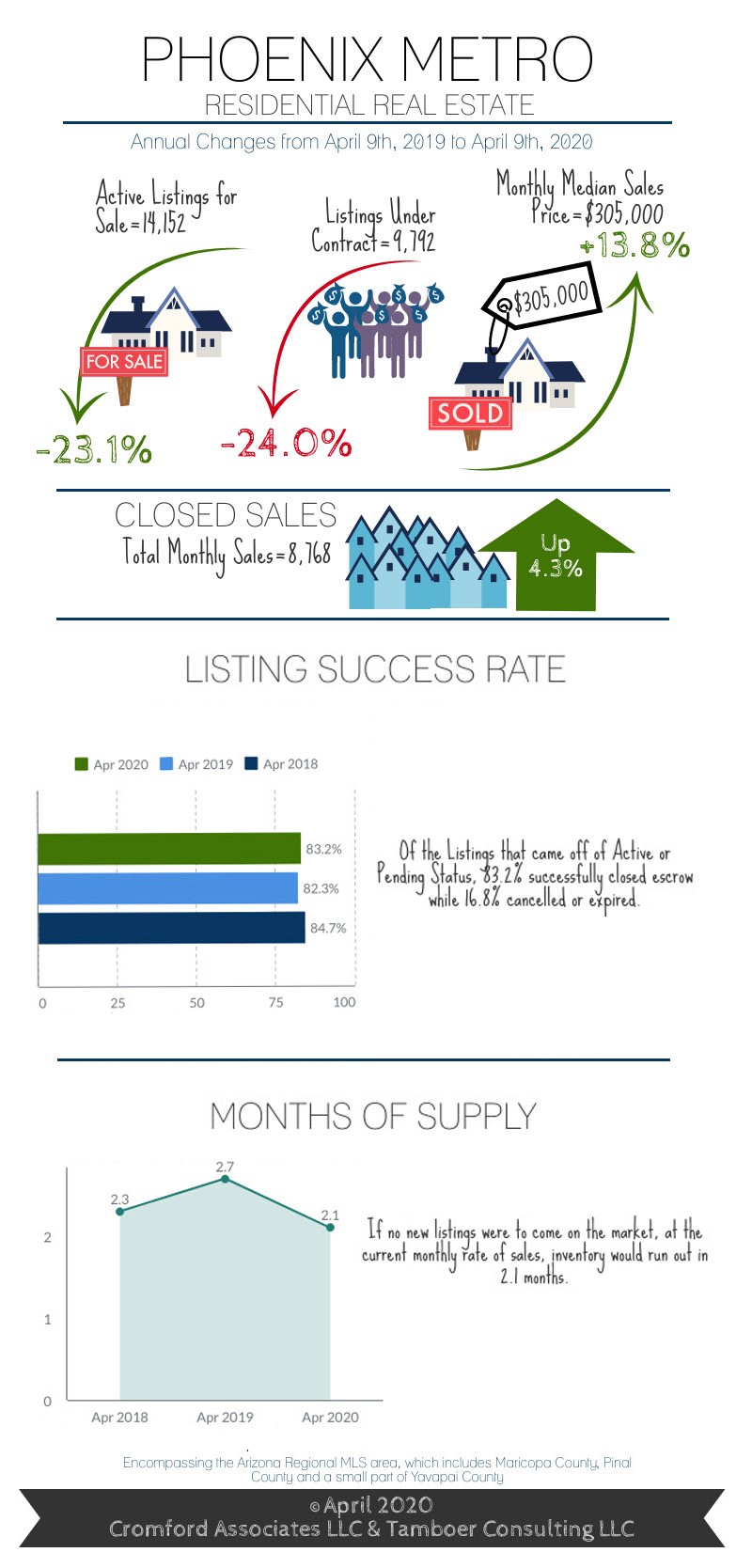

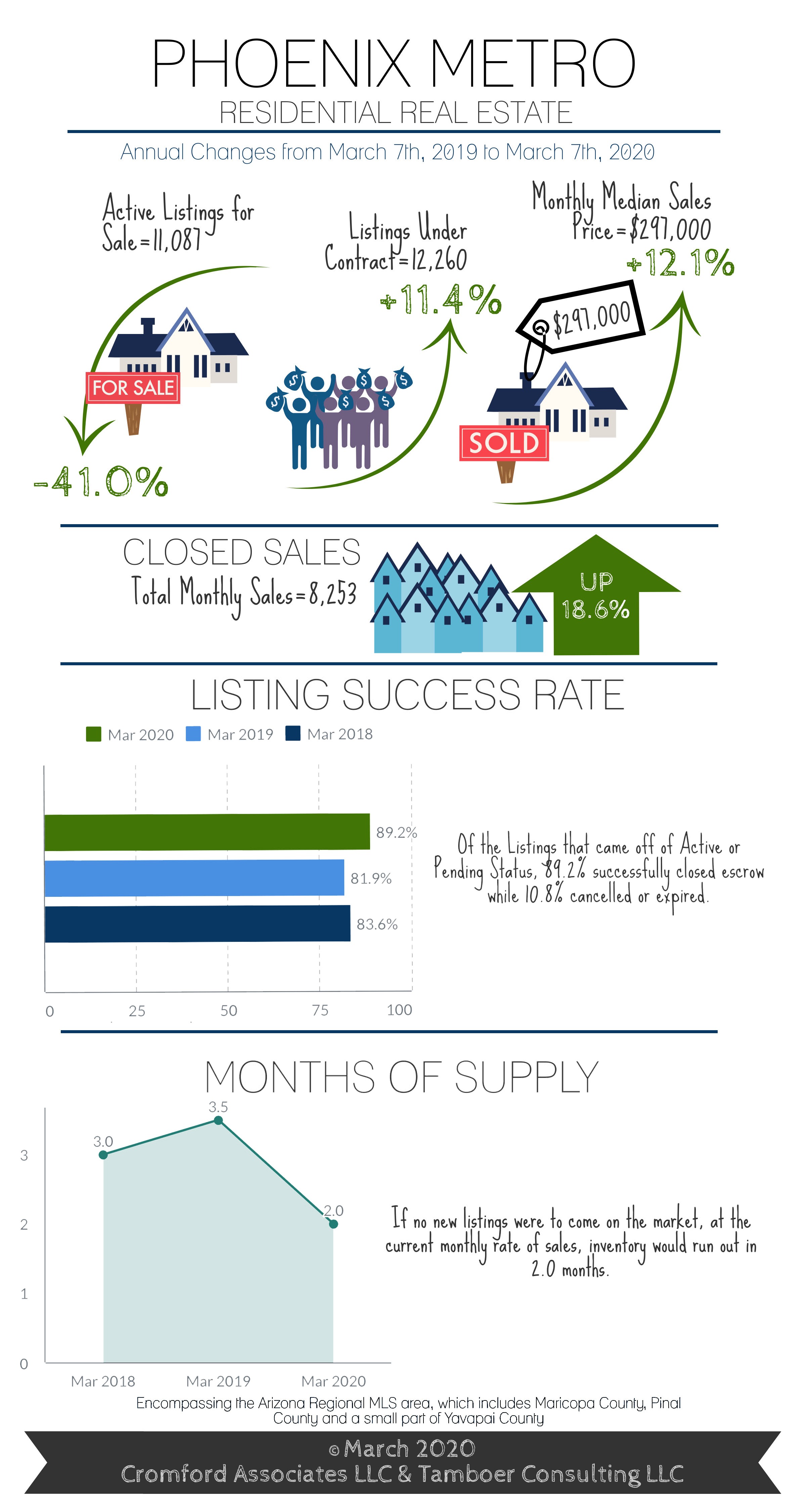

impact looked like rather than what they assumed would happen. Let’s examine the impact in the key areas that compose a real estate market.

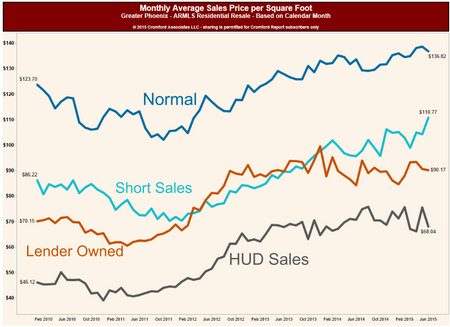

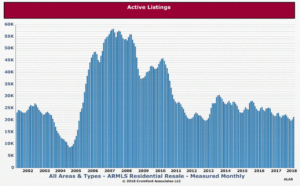

impact looked like rather than what they assumed would happen. Let’s examine the impact in the key areas that compose a real estate market. optional. Understandably there have been changes. The number of transactions has dropped, but prices are not dropping as supply continues to be much lower than current demand.

optional. Understandably there have been changes. The number of transactions has dropped, but prices are not dropping as supply continues to be much lower than current demand. years of practicing Phoenix real estate in all its iterations – a pandemic virus is one we haven’t lived through. But “disasters” whether war or terrorism or a housing bubble – all have one thing in common. They do not survive long term. So really, what is the worst case? Demand drops until the virus abates or is medically solved (vaccines, medication etc.) Demand can only be suppressed for so long. In the long run, the basic needs of man – food and shelter, always prevail.

years of practicing Phoenix real estate in all its iterations – a pandemic virus is one we haven’t lived through. But “disasters” whether war or terrorism or a housing bubble – all have one thing in common. They do not survive long term. So really, what is the worst case? Demand drops until the virus abates or is medically solved (vaccines, medication etc.) Demand can only be suppressed for so long. In the long run, the basic needs of man – food and shelter, always prevail. ultimately resulting in a balanced market.

ultimately resulting in a balanced market.