At the risk of dating ourselves with that song’s line, today’s market reminds us a bit of those words. What do we mean by  that? Simply that our gentle balanced market appears to have now tipped to a buyer’s market. At least for the moment. A balanced market is where supply and demand are in equal supply. In fact, a balanced market is a supply of 4-6 months. If supply begins to exceed demand – the shift is to a buyer’s market. If demand exceeds supply, you are in a seller’s market. So what shifted?  Supply or demand? The real answer is both. The supply of homes coming to market is certainly up from the drought of listings in 2013 – but the supply is only abundant when compared to last year. However, demand is weak – weaker than any year since 2001. Gulp. So the real shift and the real story is in the decreased demand.

that? Simply that our gentle balanced market appears to have now tipped to a buyer’s market. At least for the moment. A balanced market is where supply and demand are in equal supply. In fact, a balanced market is a supply of 4-6 months. If supply begins to exceed demand – the shift is to a buyer’s market. If demand exceeds supply, you are in a seller’s market. So what shifted?  Supply or demand? The real answer is both. The supply of homes coming to market is certainly up from the drought of listings in 2013 – but the supply is only abundant when compared to last year. However, demand is weak – weaker than any year since 2001. Gulp. So the real shift and the real story is in the decreased demand.

To better make these points let’s turn to our real estate guru Michael Orr of the Cromford Report:

“ In true Phoenix tradition, the balanced market did not last very long – from October 27 to February 8 to be precise. We are now in a confirmed buyer’s market … Demand is weak …its lowest level since May 2008. Supply is not high, but it is growing fast … its highest level since July 2011. The deterioration in market conditions for sellers is across the board. No geographic area or price range is improving. However some sectors are much more favorable to sellers than others. In general the luxury market and the active adult areas are more favorable for sellers than the rest of the market. In the majority of sectors, prices are now under downward pressure, although they have not responded much yet due to residual seller optimism. However, if current market conditions prevail we are likely to see lower sales prices in many of these areas before too long.â€

Going further he states:

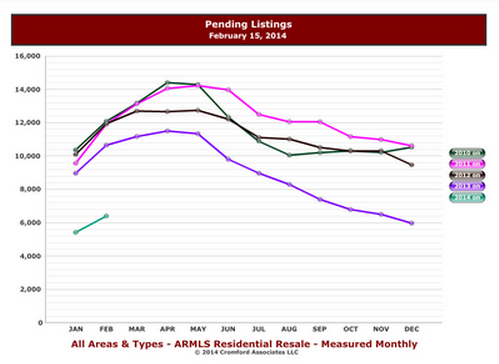

“One easy way to observe how weak demand is at the moment is to compare the count of pending listings on January 15 and February 15. In every year there is normally strong growth in this number between these two dates. We have been measuring these numbers since 2001 and 2014 is the first year the increase has been less than 1,000. Even in 2007, which was a very soft year, pending listings grew by more than 2,000 from 5,201 to 7,255. In fact, the previous worst year was 2008 with a growth of only 1,317 from 3,610 to 4,927. In this context 2014’s growth from 5,420 to 6,396 looks very disappointing for sellers. The best year for this measurement was 2005, when pending listings grew from 7,831 to 11,208.â€

So what do all these facts mean to the average home seller? It means that the approach sellers (and their agents) took in 2012 & 2013 will not work in today’s market. The approach of throwing the home on the market and allowing the velocity of the market to overcome a lack of marketing, inadequate home condition, and faulty pricing – simply will not work in today’s market. It is a time to get back to basics . But as in years past, the basics will work. A properly marketed home will result in a sale. Happily, some things never change.Â