“The bad news is nothing lasts forever. The good news is nothing lasts forever.”

― J. Cole

In our last article, we speculated that the market may have peaked. More and more signals of a shifting market seem to reaffirm our suspicions. But, as we try to remind both buyers and sellers, the real estate is not the stock market. Housing moves slowly. Shifts in demand are quicker than shifts in housing supply. So while the scarcity in supply has been the controlling factor in the housing market for a number of years, demand is now the impedance behind this subtle shift.

Demand is dropping

What is driving this drop in demand? Not surprisingly – reduced affordability. The combination of rising prices and rising interest rates are doing exactly what they are supposed to do, reduce demand. At least in the case of the owner occupied buyer. However, supply and demand are still strongly unbalanced in favor of sellers. This makes the change imperceptible to most. From the Buyers perspective, selection is sparse and prices steep. On the Seller’s side, they have gone from receiving the once typical 20+ offers in the first 2 days, to now typically only 3-4 in the first week. But sellers are still selling at above asking prices to exhausted buyers.

Tina Tamboer of the Cromford Report confirms what we are seeing:

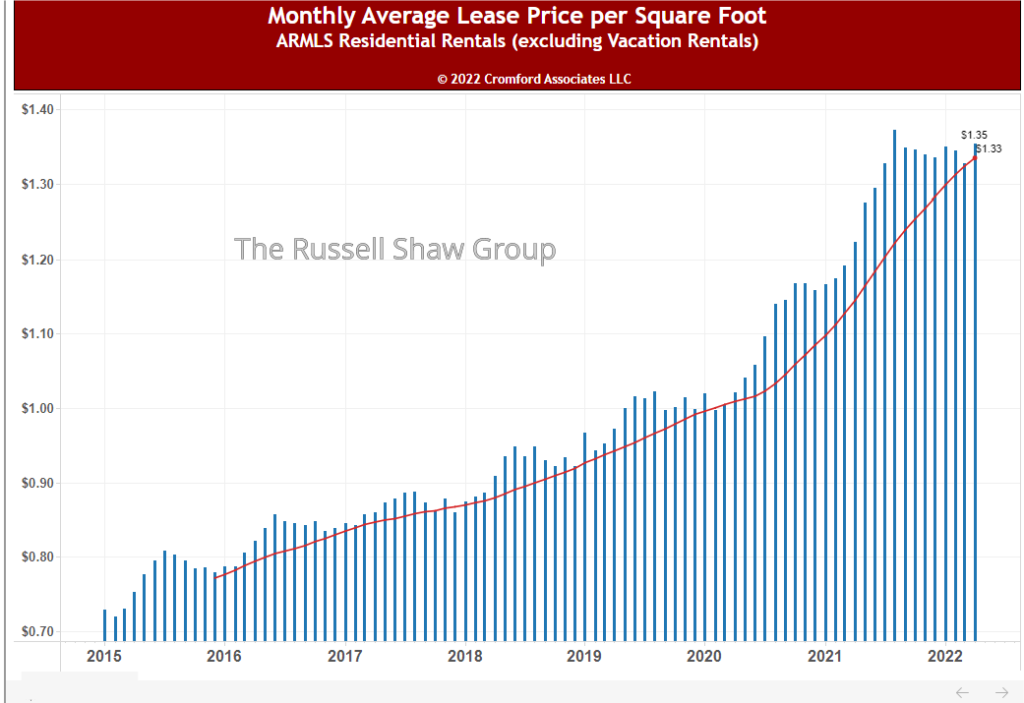

The market continues to heavily favor sellers. Supply is still 76% below normal for this time of year and demand is 6% above normal. However, demand is declining in response to recent increases in interest rates. Just 30 days ago, demand was 12% above normal, and 30 days prior to that it was 21% above normal… However, in just a few short months, the average interest rate increased from 3.1% in December to 4.7% by April. This resulted in a $500 increase in the estimated payment on a 1,500-2,000 sq. ft. home, pushing the cost to buy significantly higher than the cost to rent in Greater Phoenix.

This does not mean the market is at its peak, or at the precipice of a price decline. The only response we are seeing at this time is a sharp increase in supply between $500K-$1M over the past 2 weeks, a price range that happens to have less interest from investors and 2nd home owners and a higher market share of owner-occupants.

Rental rates are dropping

Most people think that the rental market and the resale market are two very distinct markets with little connection. Not exactly. Any increase in net migration to the valley must be met with the near equivalent in housing –either in the form of ownership or rental. When rentals become more plentiful than tenants, rental rates decline. When rental rates decline below the cost of a house payment, first time home buyers rent rather than buy. This further reduces demand for resale homes and interrupts the chain of buying (i.e. the first time homebuyer does not buy the entry home which allows that seller to buy their next home, and so on up the chain about 7homes deep). Losing thefirst time home buyer to the rental market has a serious impact on the resale market. Further, when rental rates decline, investors with a rent and hold business model leave the home purchasing market for better returns on their dollar– further weakening demand. As the Cromford Report confirms:

“Over the past 4 weeks we have seen a 34% increase in the number of new rental listings added to ARMLS compared with the same 4 weeks in 2021. There has also been a 20% increase in the number of rental homes available in Phoenix on the Progress Residential web site over the past 4 weeks.

Renters of single-family detached homes are seeing far more choice than they did last year and we are starting to see homes advertised with “the first month’s rent is free”. Rental supply is particularly strong in Gilbert.

This appears to be a significant turnaround in the rental market and it does not seem to have been recognized by the media outlets, who are mostly still referring to rising rents. That is so 2021.”

Supply is slowly rising

When demand drops, it allows for supply to increase. As of the writing of this article, the active properties for sale on MLS sits at a meager 5,487. To achieve a normal level of supply, we still need about 20,000 more properties for sale than are currently on the market. As we mentioned, increases in supply take time. How quickly that supply builds will determine the alacrity with which the market rebalances.

Pricing

Does this mean prices are posed to plunge? In the short term, no. Price is a trailing indicator in housing, not a leading indicator. In order for prices to level out or drop, supply needs to exceed demand. Pricing can trail a shift in the market by as much as a year or more. Therefore, we expect pricing to continue to rise this year. As the Cromford Report points out: “While it’s reasonable to expect price appreciation to slow down at some point, there is little evidence at this stage to show prices declining in the near future.”

Selling your home

This market has allowed for all methods of selling to appear successful – as a strong market can cover up mistakes. As this market shifts, it will be increasingly important that sellers hire the right agent to sell their home. Whether seeking a no commission cash offer or professional marketing program to maximize your net – the right agent can give you all the choices that protect your selling power. We certainly know that we can.

Have more questions or are curious about your home and when is the best time to sell? Contact us we are always here to help.

Russell & Wendy Shaw

(mostly Wendy)