We hope your holiday season was wonderful. With the season now behind us, we can see what Santa brought the real estate market.

A cooling trend that began in August of 2015 quieted by November and by the end of December stabilized. Neither supply nor demand showed up in any great strength in December, so at the moment, stability seems to be the watchword. Typically, supply begins building in the 4th quarter with a sudden drop in supply at the end of the year as many listings expire. The first week of the year can therefore be misleading – with lower than normal levels of supply. The good news is that sellers return to the market in January (usually by the Super bowl, if not by MLK Day) and typically so do the buyers.

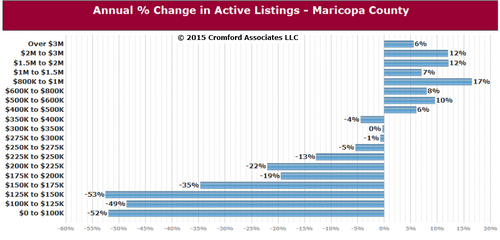

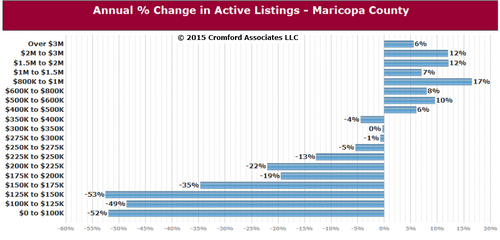

Our market still remains the “tale of two markets†at the moment. Supply for single family homes is constrained below 400K and shows no signs of easing. New inventory can come from traditional sellers, bank owned properties, and new builds. At the moment, traditional sellers below 400K are not making any strong appearance in the marketplace, banks are at below normal levels of delinquency (4%), and builders are primarily providing single family homes above 400K. Consequently, we don’t see any large increase of supply of single family homes under 400K appearing in 2016. This suggests that pricing will at a minimum hold strongly in this price range. Specifically, areas such as El Mirage, Glendale and Avondale are seeing demand strongly outpacing supply.

Probably the biggest impact the market saw was from the new financing government guidelines that were implemented in October – “Truth in Lending Real Estate Procedure Act Integrated Disclosure Rule†– thankfully known by the acronym TRID. This consumer protection act is designed to give greater transparency between lender and borrower. Like most governmental programs – new overlays of disclosure result, at least initially, in delays and confusion. This caused delays in closings which resulted in lower than normal November closed transactions and slightly higher than normal December closings due simply to delays. So any headlines regarding the booming December market should be viewed with some skepticism.

Michael Orr with the Cromford Report summarizes the market with these comments:

“It remains very much a seller’s market in the price ranges under $250,000 while the market from there up to $500,000 is close to balance with a slight edge for sellers in a few areas. Over $500,000 the advantage is slightly in favor of buyers in a number of areas, especially those that are remote from major shopping and employment centers. Some of the outlying areas, such as Casa Grande, are also weak for sellers despite their lower pricing. The strongest markets are those closest to the center of the valley with the most affordable pricing. This includes much of the inner West Valley, less expensive parts of Phoenix such as the South Valley and areas like West Mesa and the older parts of Chandler and Gilbert…

The average price per sq. ft. has moved up a healthy 2% in the last month and 6% since last year, both of which look encouraging for the market as a whole….

In summary we would say that there are no strong positive or negative trends right now. Supply remains far too low at the lower end of the market and demand is unusually weak at the very top end. However this is compensated by stronger demand between $500,000 and $1,500,000….

We would expect the next 31 days to see a drop in supply, an increase in closings and further strength in pricing. However the next real test of demand will be in early February.â€

As 2016 enters the spring buying season, trends will form and we will do our best to decipher them and share them with you. In the meanwhile, we are happy to respond to your questions and concerns as always. Here’s to a fabulous 2016!