It is understandable that both Buyers and Sellers (and if we are completely honest, most real estate agents) are scratching their heads as to  the state of this market. We have listened to the sides argue we are in a “buyer’s marketâ€, no wait we are in a “seller’s marketâ€! The underlying fact is that the real estate market is a moving target. This means that the market conditions are in flux – there is what the market condition is now and then there is the lag until people know where the market is. If you haven’t fallen asleep at that concept, let us share some interesting facts:

the state of this market. We have listened to the sides argue we are in a “buyer’s marketâ€, no wait we are in a “seller’s marketâ€! The underlying fact is that the real estate market is a moving target. This means that the market conditions are in flux – there is what the market condition is now and then there is the lag until people know where the market is. If you haven’t fallen asleep at that concept, let us share some interesting facts:

- Active listings are down 14% since March of this year. If you’re a seller – low supply – that sounds like a seller’s market doesn’t it?    Of course, if we compare active listings now to this time last year, we are up 28% in supply. That sounds like a buyer’s market doesn’t it?    See how confusing this gets?

- Price appreciation for the last year came in at a paltry 1.9% (for non-distress sales). By the way, inflation is running around 1.9%. So essentially, houses have not really appreciated in the last year. The seeds of weakness in pricing started with the market shift that began in 3rd quarter of 2013. But as we stated before, there is what is happening and then when the market knows what is happening – which can cause a lag in price changes.    Indeed this is the case as the softness in pricing that began a year ago finally showed up in this year’s 3rd quarter. So that’s a buyer’s market right?

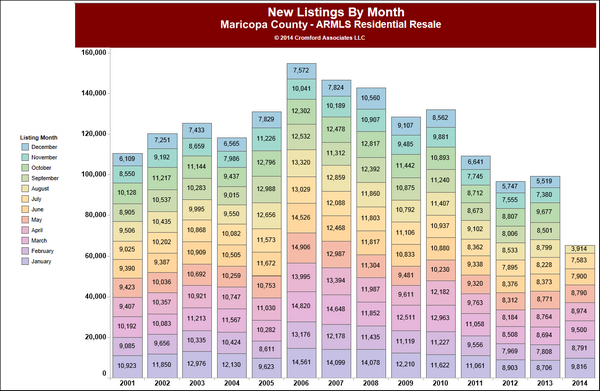

- New listings coming to market began the year up 9% over last year’s new listings. But again, as the market is a moving target, new listings suddenly dried up as the 3rd quarter began, coming in 10% less than the same time in 2013 and 8% less than in 2012. This is notable because in 2012 new listings to market hit the lowest levels since 2000 – a shocking and record breaking event.    Yet in the 3rd quarter we hit the lowest new listings to market ever for this time period.    So that’s a seller’s market right?

- Demand was grabbing all the headlines this year, as buyer demand cooled significantly. The causes were attributed to tougher lending guidelines, interest rates climbing, Millennials (i.e. first time home buyers) not buying, and investors going away. Interest rates seemed like a red herring – as when rates dropped there was no corresponding jump in demand. Millennials are in fact not buying. This has been attributed to “seeing their parents lose their homes in the distress marketâ€. Hmmmm, maybe. Millennials seem to be delaying all traditional signposts of adulthood – marriage, children and housing – so it would seem to be a cultural change in commitment, not housing per se. It is certainly causing a boom in rental demand at the moment. Investor demand definitely shifted – going from 33.5% of the single family market purchases in 2012 to only 11.8% in 2014. So, no matter the cause, if buyer demand drops that’s a buyer’s market right?

So let’s try to answer that nagging question. The market is swinging slowly and surely back towards a balanced market primarily due to the weakest arrival of new listings in 14 years.  But, if that is the state of the overall market – it does not preclude the fact that the market is really a series of markets within a market. Depending on price and location – some markets are definitely in a seller’s market and some are most definitely in a buyer’s market. How can a consumer know the reality of their market? At the risk of sounding self-serving you need the analysis of a competent real estate professional. The study and accurate interpretation of supply and demand in the submarkets is the only way to truly understand your marketplace. As always we are here to help. Our thanks go to the one and only Michael Orr for his incredible Cromford Report statistics.