The market is on the cusp of the “spring buying season” and early prognostications are beginning to form. As with all economic markets, supply  and demand determine our market forecasts. Typically we see one side of the equation having a bigger impact than the other – a situation that our market is currently experiencing.

and demand determine our market forecasts. Typically we see one side of the equation having a bigger impact than the other – a situation that our market is currently experiencing.

Demand

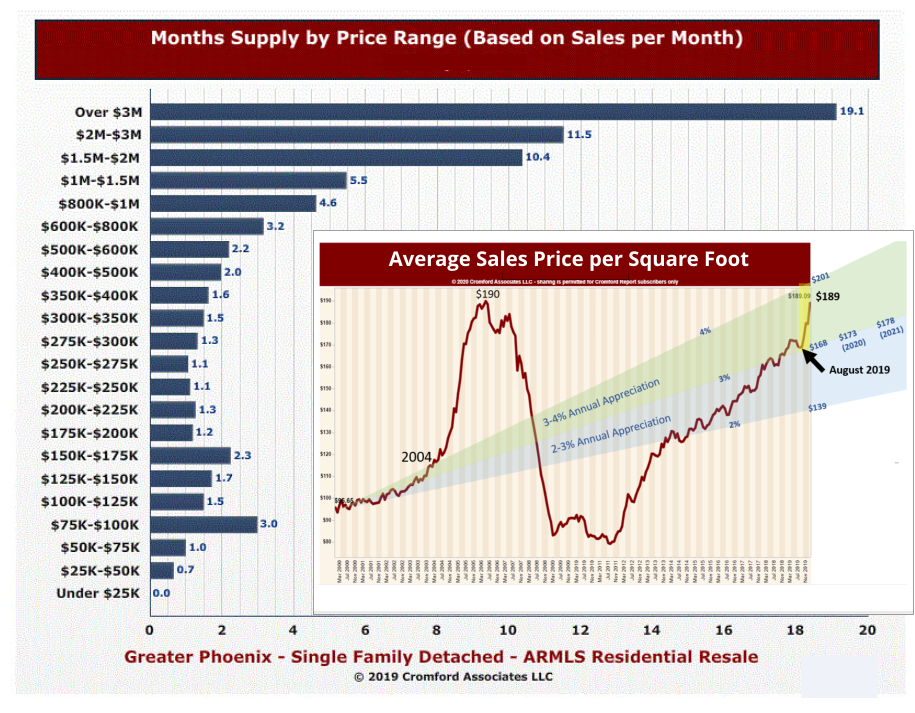

Demand is staying in a normal range – about 1-2% above average. This is always good news – given that it is the more elastic of the two factors. It is all the more impressive considering the last quarter of 2019 saw a push up in price per square foot, typically a dampener of demand. As Michael Orr mentions “…this comes after a rise of over 7% over the 4 months between September 15 and January 15. The market is generating strong upward pressure on prices.” A rise of 7% in 4 months is a fairly remarkable number. The fact that demand remains strong despite this rise, is fairly remarkable as well.

Supply

Supply is a very different story. It should not be surprising that since demand is in a normal range, supply must be well below normal to see an upward push in pricing. Exactly. In fact supply is less than half of what is needed for a balanced market. New listings are arriving to the market in much smaller than usual numbers. Although it is a bit early to confirm a trend, the first two weeks of the year had 15% fewer new listings than 2018 did. Add that to an already very low base supply of homes for sale, and 2020 is running at a 30% deficit of homes for sale compared to early 2019. Obviously different price points can have different supply issues – but this shortage is impacting all price levels up to one million. In fact it is the weakest start to a year since 2005. No one comments on this issue better than Michael Orr of the Cromford Report:

“The lack of supply can only be described as shocking. A 30% decline since this time last year to reach the lowest level since August 2005. This to satisfy a population that has grown more than 20% since 2005. Anyone who thinks this severe shortage will not result in a significant rise in prices is going to have another thought coming pretty soon. The median sales price is already up 11% over the last 12 months and the average price per square foot is up almost 9% and probably heading for a double figure appreciation rate.

…The big hope for buyers must be for a surge in new listings arriving over the next 12 weeks. Perhaps sellers will be tempted by the higher pricing they can achieve. However if they are staying around Phoenix, they will have to pay more for their new home too. Phoenix is currently the strongest large-city housing market in the USA and this is fueled by inter-state population movements. Retirees are a big part of that, but so are people moving here from California and other Western states for work and the lower cost of living. Demand is likely to remain healthy despite the rising prices.

The primary question is whether we will see any change in the meager supply of homes for sale. If this is to take place it is likely to be visible over the next few weeks. There has been no sign of an improvement in new listing flows in the last several weeks of 2019. But 2020 is a new year, so we will be watching closely for signs of change.”

Seller Motivation

This lack of inventory has spawned some interesting theories as to why homes are not coming to market as usual –with theories ranging from “shadow inventory” (the theory that floated around erroneously during the mortgage meltdown years) to interest rates and pocket listings. But let’s remember why people sell at all. People sell for one of two reasons – personal motivation and market conditions. Personal motivation encompasses things like job changes, household formation or disintegration, and retirement. The second reason -market conditions – encompass things like home values, interest rates, and consumer sentiment (fear/greed). It is worth remembering too, that homeowners are keeping homes longer than in years past. Why? The average number of people occupying a home is less than in earlier decades and homes are generally larger. Meaning they are staying longer because there is less personal motivation to move. The average home today can accommodate the average number of family members. If it is suitable, why move? Hence, market conditions are left to impact home selling. At some point pricing if it continues its move upwards will spark selling (i.e. market conditions) and ultimately dampen demand. We saw that in the 2006/2007 market. The real question is when.

At the moment, 2020 looks to be firmly a seller’s market. As always, we will keep you informed on market changes as they manifest.