In our last paper we discussed demand and its strong rebound (up 8%) from 2018. But we didn’t expound upon the supply side of the story. We will now attempt to remedy that. While demand is more elastic (and therefore perhaps the sexier story) supply might actually be the buried headline.

now attempt to remedy that. While demand is more elastic (and therefore perhaps the sexier story) supply might actually be the buried headline.

The valley has been chronically low in supply for so long that it has become somewhat normalized – but it isn’t normal. As of the writing of this article, residential properties actively for sale are at 17,460 (and only 13,241 without offers). To put that in perspective, average supply would be just under 30,000. While we have certainly seen more extreme past markets such as in 2005 (8,342 active) this low supply is putting tremendous pressure on buyers trying to find properties. It isn’t just the increased demand that is causing the issue – it is also the dearth of sellers coming to market. June 2019 was the second lowest new listings to market for a June since the Cromford Report began tracking it in 2001. July 2019 was the lowest July recorded for new listings. August, the second lowest August. To quote Michael Orr of the Cromford Report:

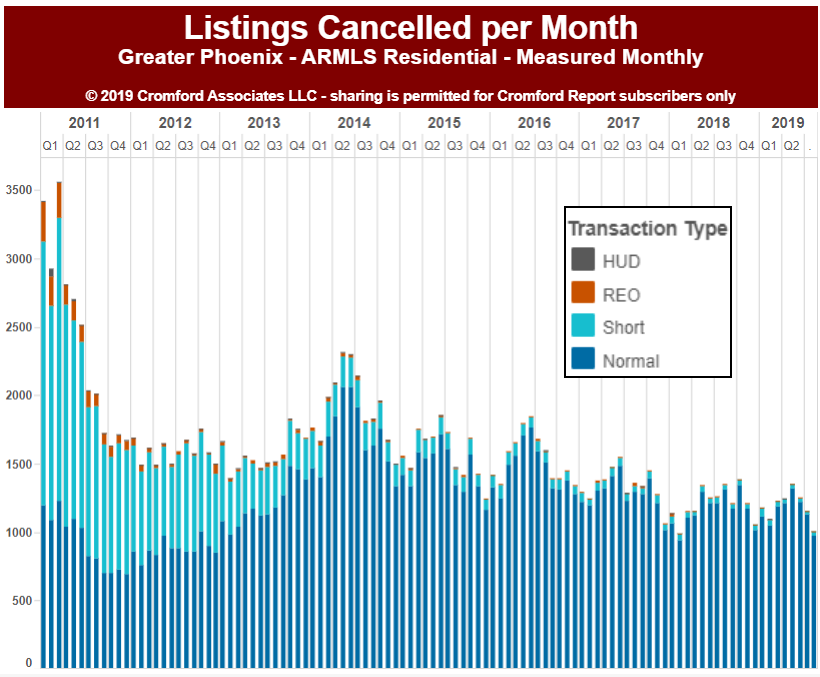

What is unusual is that supply is 43% below normal. We have had supply below normal ever since May 2011. But the weak flow of new listings has exacerbated the situation.

Does this mean prices are skyrocketing? Perhaps surprisingly to most, the answer is not yet. To understand why Michael Orr further explains:

Pricing is showing no excitement whatsoever, behaving as if the market was normal. This cannot last. Remember that sales pricing is a trailing indicator, often as much as 12 months behind the leading indicators. We expect to see fireworks in pricing over the next 12 months. In fact the current situation reminds us of 2004. The huge imbalance between supply and demand and the absence of distressed properties are very similar.

Now before you scream in fear that if this year resembles 2004, then we are just a year or two away from another housing meltdown, read on:

The big difference is that 2004 was seeing large price increases and a significant number of the homes were being bought for resale by speculative investors and remained empty. The level of mortgage fraud in 2004 was also extraordinary. Hopefully that is not the case in 2019.

These are very interesting times, unlike the past 5 years which were stable and predictable.

Interesting indeed. In fact this year began headed towards a balanced market and has now evolved in to one of the best seller markets in 13 years. But no market lasts forever. Supply and demand are constantly in flux.

What affects demand? The factors are interest rates, affordability, inbound relocation, income/employment, lending practices (i.e. strict vs. easy), population growth, consumer sentiment. It is noteworthy that the millennials have overtaken baby boomers as the largest US adult population.

What affects supply? New builds, equity (positive and negative equity), foreclosures, outbound relocation, personal events (divorce, illness, tragedy, job loss), conversion to rentals or Airbnb, homeowner tenure, consumer sentiment.

How the factors affecting supply and demand will play out is anyone’s guess. We do expect demand to cool in the last quarter as part of our normal seasonal patterns. This should stabilize supply until we arrive at our next spring buying season in February. Pricing of course, will respond to these two factors and affect them as Michael Orr points out:

Once prices have increased sufficiently then we can expect a cooling of demand will follow and the market will start to move towards balance again. No market can stay unbalanced indefinitely.

As always, we will keep you posted as the future unfolds.

Russell & Wendy Shaw

(Mostly Wendy)