The spring buying season is now underway (sadly accompanied by the flu season) and trends are now becoming observable. Supply is up – 8.5% over 2015, 3.3% higher than 2014, and 13.2% more than in 2013. This would be good news for buyers,

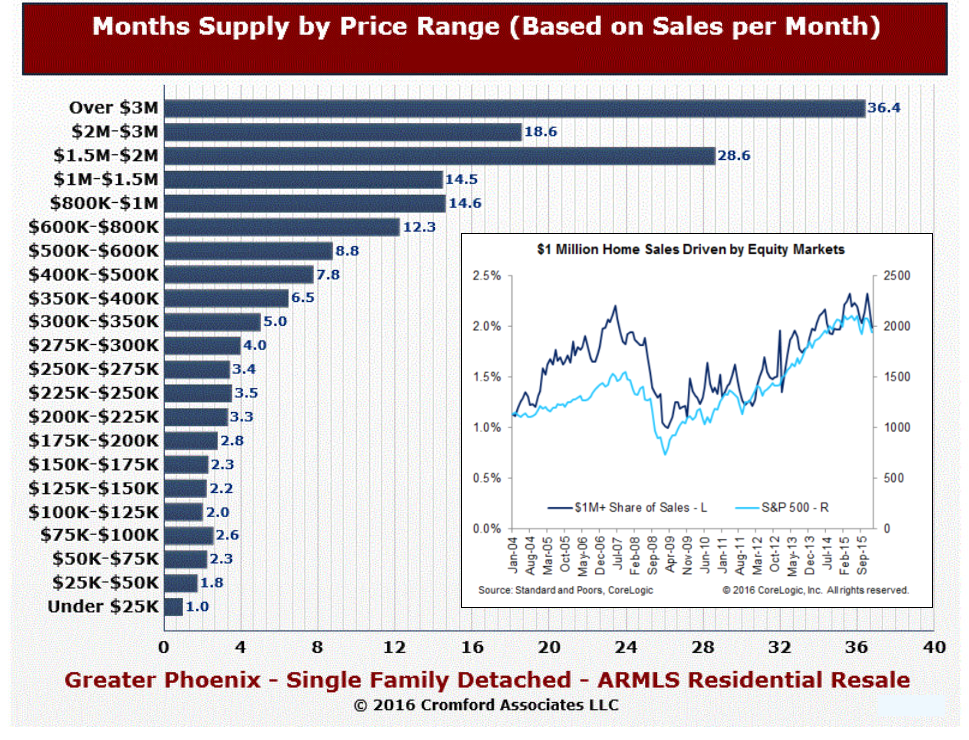

except the mix of the new listings in not matching the mix of the demand. More on that in a moment, but first a word on demand. Demand, which was looking rather neutral at the start of 2016, is up – reflected in the 5% increase in all greater Phoenix sales over this time last year. However, that number is misleading in a couple of aspects. A closer look shows the sales numbers are being held down in the lower price points based on lack of supply. Homes under 200K are in very scarce supply (and in the range of 125K-175K the lack of supply is extreme) with the demand far outpacing the inventory. This has resulted in a lower number of sales in this price range than last year – over 10% lower – due only to the fact that buyers cannot find enough homes to buy. This is not going to improve, as we opined before, as we see no additional supply in single family homes forthcoming. This lack of supply has changed what is selling. Entry level buyers, unable to find homes to purchase under 200K, are turning in greater numbers to manufactured homes and townhomes/condominiums. Sales for attached homes are up 10% and an astonishing 14% for mobile and manufactured homes. As Michael Orr of the Cromford Report explains (in italics and quotes):

“At the lowest end of the market, supply was already very low last year and it had gone down another 20%. Under contract listings are barely higher and closed sales are down more than 10%. This is a market crippled by far too little supply and consequently average appreciation is over 8%. This market cannot be described as healthy because of the chronic supply problem, but it is a great market for sellers as long as they are not over-ambitious with their pricing.â€

The picture changes for the mid range – the $250,000-$500,000 priced homes. Demand is much stronger than 2015, and supply is slightly increased. However, this increase is largely confined to the 400K-500K range. Again, deferring to Michael Orr who says is best:

“In the mid range, supply is modestly higher than last year while demand is sharply higher. Despite the stronger demand it is not enough to eat into the supply, but it is good enough to give us moderate appreciation of 2.6%. This is the picture of a very healthy and expanding market, good for sellers and buyers.â€

The picture changes dramatically for the $500,000 and up market. Here supply has increased strongly and demand while improved, is simply normal. This is not a good recipe for sellers in this range.

“In total contrast to the low end, the market above $500,000 is wallowing in too much supply. Note that we have almost as many active listings above $500,000 as we have below $250,000. Yet we see almost 7 times as many homes sold below $250,000 than we see over $500,000. Supply was already high last year and has increased by another 15%. The contract writing and closing activity is good and we can conclude that demand is stronger than last year. But despite February sales being up 30% and a strong 21% rise in listings under contract, new listings keep flooding into the market and there is still well over a year of supply. Competing among themselves, most sellers have the weaker hand in negotiations and so pricing is suffering. Based on the monthly average $/SF, the current annual average appreciation rate for homes over $500,000 is a negative 5%.

With sales down 10% below $250,000 and up 30% above $500,000, the overall market price statistics are all being skewed much higher. The true pricing environment for the luxury market is far worse than most sellers appreciate. Even for mid range sellers, appreciation is more modest than many of them realize. Only for homes below $250,000 are the overall market’s price appreciation numbers a realistic guide.

It is still fair to describe the bulk of the market as healthy, because only 8% of the homes that sell are over $500,000. That means 92% of sales are coming from appreciating markets. However 30% of sellers are trying sell homes over $500,000 and for them, the market is not looking so great right now.â€

So no matter what the headlines state or your friends who just sold their home, the experience when buying and selling in 2016 is going to depend on which segment of the market you are participating in. A $250,000 seller is going to have a very different experience from the 1.5 million dollar seller. No matter the price or area, we can help you decipher “your marketâ€. As always, we are here to help.