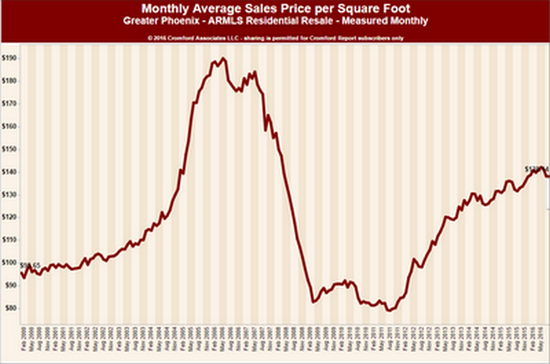

The market is remarkably stable at this time despite some headlines in the past few months implying otherwise. The “Most Improved†award goes to the luxury market – with Scottsdale, Paradise Valley and Carefree all posting great improvements thanks to higher demand and lower supply (quite a reversal from the 2nd quarter). No matter how interesting the luxury market is – 93% of the sales occur at 500K or below. Therefore a much broader

look is required.  Michael Orr of the Cromford Report gives a very succinct summary of the market:

“Inventory in the higher sales ranges has fallen sharply over the last 3 months, as it tends to do every year. This means remaining sellers have much less competition. So far this has not resulted in much improvement in sales prices because it takes a very long time for lower inventory to feed through into pricing. In addition it is usual for inventory to rise just as strongly between October and March so we do not think the luxury market has escaped its problems just yet. If we end up with more luxury inventory in April 2017 than we had on April 2016, then luxury home pricing is likely to continue its current weak trend.

We are seeing a little more inventory at the affordable end of the market in certain areas. If it continues this should have a moderating impact on the high appreciation rates we have been seeing below $200,000. Buyers should also see a mild reduction in the number of competing offers for the homes they want. However the effect is currently only weak and could possibly peter out quickly.

The mid-range continues to enjoy healthy supply and healthy demand plus volume increases far in excess of the low or high ends. I see little to concern us in the market between $200,000 and $500,000 at the moment and for the next few months.

… in the short term the vast majority of our local housing market is looking unusually positive and stable.â€

In a stable market, it would seem easy to properly sell a home. Yet, surprisingly, we find the same mistakes being made by sellers no matter the market. Because we are in the position to hear these horror stories, let us give you a quick “Reader’s Digest†version of a few pitfalls to avoid.

Accept a solicitation offer.Â

The latest trend in exploiting sellers comes from “direct to seller†investors. We’ve all received postcards and solicitations from the “We will buy your house†gang. Whether well-funded by Wall Street (Open Door) or simply a local investor, the basic formula is the same. The promise is to save you money and time – “no commissions†“sell as-is†and the promises go on and on. The devil is in the details. Commissions just get renamed “fees†and “as-is†just means swapping unhandled condition issues for large price deductions. Often times the initial offer drops precipitously as inspections are done and the close date approaches. After all, in any negotiation the party who needs the deal loses. In this case, the losing party is the seller weeks from closing who suddenly finds themselves forced to agree to last minute changing terms.

These investors are using the fact that many sellers are unaware that they can sell a home “as-is†through a traditional brokerage sale. Competition from multiple buyers (even if only multiple investors) will best protect seller’s price. The fact is investors who solicit benefit by the lack of competition for a home and misleading terms at the expense of the seller.

Not list your home on MLS (i.e. believe that both you and buyer can “save the commissionâ€).

The primary reason sellers attempt to sell their home “For Sale by Owner†or use a “Limited Service†real estate company is to “save the commissionâ€. Although we fully understand the impulse (who doesn’t want to “save†money?) the statistics tell a different story. The most recent study of this was posted in ARMLS Stat: “When we test our model against MLS sales only, properties that were sold using a real estate agent via the MLS sell between 8.5% and 9.0% higher than properties not listed on the MLS.â€Â Is it because agents just “know moreâ€? Hopefully your agent in fact does know more (promise us you will select an experienced agent) but that is not the reason. Go back to our first point – it is competition for a home that protects value. That is the purpose of MLS – to employ the 35,000 +/- agents and their buyers to compete for the home. Secondarily, imagine for a moment why a buyer would select a “By Owner†home? Since buyers don’t pay the commission – why would they care if the home is sold by a broker or by owner? They would only care if they could “save the commissionâ€. But isn’t that the very reason the seller is selling by owner to “save the commissionâ€? How do two people save the same commission? Additionally, if you have only one buyer looking, have you really received “top dollar’ from the market – or just that buyer’s top dollar?

Bad Pricing. Thanks to the internet, sellers and buyers have more instantaneous and, sadly, erroneous information at their fingertips. This bad information has led to both underpricing and overpricing of homes.  Establishing pricing through an AVM (automated valuation model – for example Zestimates) while fun and interesting, is by no means is an accurate way to determine market value. Algorithms cannot take in all the factors that make up pricing – site selection, competition, property condition, variances in square footage, supply/demand shifts, etc. Ask yourself why after all these years lenders still require an appraisal – where an actual person (gasp!) views the home and compares it to other sales. There is simply no substitute for judgment. Overpricing a home in the critical first three weeks can be a problem not easily overcome with reductions in the subsequent weeks and months. Buyers can view “days on market†and make assumptions about whether this is a “good home†since no one else has purchased it, or exploit the seller’s increasing desperation as the marketing time extends.

Hire an agent you can’t fire. This may be the least obvious of the errors, but it is an error. Why would this matter? Many sellers may be unaware that once they list with an agent, they cannot cancel the listing agreement –even if they are unhappy. Being tied up in a 6 month listing agreement with the wrong agent (bad agent, bad marketing, improper preparation of the home, etc.) can not only rack up days on market but can eliminate the opportunity to sell during prime market periods waiting for the listing to expire. Some agents will “agree to cancel†for a fee. The best protection for you is obtaining the right to cancel at no charge as part of the listing agreement.

While there certainly are other errors we could elaborate upon, we tried to hit some of the most common. Want to know more? As always, we are here to discuss your particular concerns.

Â

Â

Â

Â