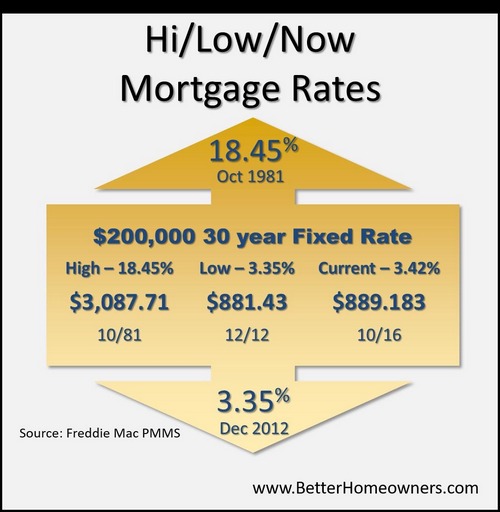

Seeing historic highs and lows put today’s rates in perspective.

Category: Financing

Should You Buy A Short Sale Listing?

It depends. There are definite advantages to buying a short sale listing. There are also definite disadvantages. And there are some possible additional disadvantages – depending on which agent you have.

We will take these up – one at a time.

Advantages: Price and Condition. If the transaction is handled correctly, you can usually get much more home for the money than you could get otherwise. For about the same price as a lender owned home, you can buy a short sale home in MUCH better condition.

Disadvantages: Time and Certainty. You don’t have to talk to a lot of people to find some who will tell you to NEVER BUY A SHORT SALE. It takes forever and you don’t know if the bank will ever get back to you. That can be a true statement. It can also be a false statement. This “disadvantage†is largely dependant on the point below.

Possible Additional Disadvantage: Incompetent listing agent. This is probably the single biggest variable currently. If the listing agent knows what they are doing (and many listing agents do a wonderful job in this area) communication to the bank is effective and efficient. If they don’t have experience, pricing is at a level no bank will approve, communications with the bank breakdown, and the file may straggle on for 6 or more months only to be denied.

How does a buyer combat this final disadvantage? Know your agent and make sure they have an interview sheet for the listing agent so they can determine the probability of a successful close. While this is no guarantee, it is possible to significantly jump your odds of obtaining the short sale home of your dreams.

8,000 Reasons

After a false start, details of the new program that allows home buyers to use the first time home buyer tax credit at closing have finally been released here. Here are the major points:

The program can only be used on FHA-insured loans. VA, conventional, and other programs are not included.

The credit cannot be used towards the required 3.5% down payment. Closing costs, mortgage discount / origination point(s), and other closing costs can be covered by the credit.

So although you can’t get your new home with no money out of pocket, you can use the credit to “buy down” your mortgage interest rate and/or even possibly negotiate a lower price on the home by minimizing the amount of money you would have to ask for from the seller for closing cost assistance.

This is very good news!