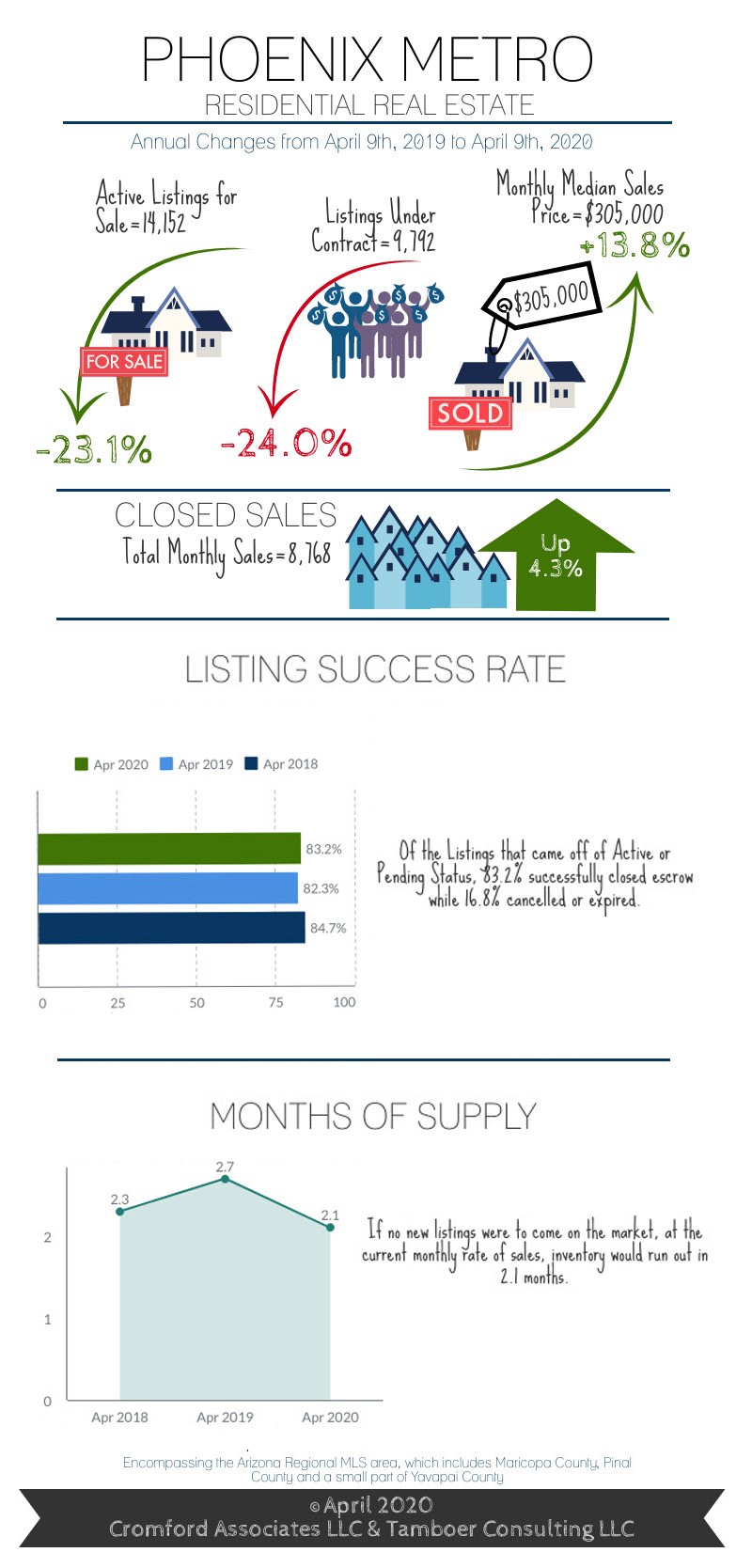

Month: April 2020

See our newest market update through YouTube as Wendy Shaw discusses the effects COVID-19 has had on the marketplace.

The Housing Market Isn’t Stopping!

The real estate market is still alive and functioning –despite social distancing and stay at home orders. Like food, shelter is not  optional. Understandably there have been changes. The number of transactions has dropped, but prices are not dropping as supply continues to be much lower than current demand.

optional. Understandably there have been changes. The number of transactions has dropped, but prices are not dropping as supply continues to be much lower than current demand.

2020 began with such a disparity between supply and demand that many buyers were shut out of the housing market trying to compete against multiple offers (we would receive as many as 10-30 offers on homes). Add to that the iBuyers and investors trying to pre-empt the purchasing of homes prior to coming to market and you can see why normal buyers had a very tough road to obtain housing. The extreme lack of homes for sale resulted in accelerating prices – causing many to compare it to 2005 (erroneously I might add, as 2020 had very different traits from what was fueling the 2005 marketplace).

And then came COVID-19. To quote Tina Tamboer, Senior Housing Analyst with The Cromford Report:

“The COVID-19 pandemic came in like a wrecking ball in March shutting down tourism and crashing the stock market single-handedly over the course of a few weeks. Hedge funds and iBuyers (funded by Wall Street) bowed out of purchases and vacation rental buyers put their plans on hold. This is providing much needed relief to normal home buyers, if only they could leave their house. Stay-at-home orders to stem the impact of the pandemic has “pinched the hose” on what is arguably one of the hottest housing markets in the country. This is causing a build-up of pent up demand that will undoubtedly return with some gusto when travel restrictions are lifted and a level of stability returns. Do not expect prices in Greater Phoenix to drop like they did in 2008, however. Back then when investors pulled out of the market, prices were so high that families making the median income could only afford 27% of what was selling. This time around as investors once again pull out of the marketplace, families making the median income can afford 68% of what’s selling with today’s incomes and interest rates. This is well within normal range and puts regular home buyers in a better position to pick up the pieces left by Wall Street and vacation rental investors.”

As usual, housing markets are not only local in nature but different price points within that local market behave differently. While the under 500K price point seems to be functioning well, the luxury market has felt a larger impact. Tina Tamboer further explains:

“… The effects of COVID-19 span the job market, stock market, corporate profits, and exchange rates. This has had the highest impact on high-end luxury market buyers. Not only are these buyers restricted from leaving their home cities at the moment, they have instability in their portfolios as well. Under these circumstances it should not come as a surprise to see that weekly contract activity over $500K has slowed down by 64% since their peak on February 24th while price points under $500K have only seen a 30-40% slow down.”

If you are struggling to understand whether to buy or sell in this market, and the changes we have put in place to do so safely, please contact us. We are here to answer questions with facts and advice.

Officially a Frenzy: 11% More Contracts Than Listings For Sale Contracts Over $1M Up 60% Over Last Year

The COVID -19 virus and the housing market are squaring off. It is early in the fight, so we are loathe to predict too much at this point. In our 42  years of practicing Phoenix real estate in all its iterations – a pandemic virus is one we haven’t lived through. But “disasters” whether war or terrorism or a housing bubble – all have one thing in common. They do not survive long term. So really, what is the worst case? Demand drops until the virus abates or is medically solved (vaccines, medication etc.) Demand can only be suppressed for so long. In the long run, the basic needs of man – food and shelter, always prevail.

years of practicing Phoenix real estate in all its iterations – a pandemic virus is one we haven’t lived through. But “disasters” whether war or terrorism or a housing bubble – all have one thing in common. They do not survive long term. So really, what is the worst case? Demand drops until the virus abates or is medically solved (vaccines, medication etc.) Demand can only be suppressed for so long. In the long run, the basic needs of man – food and shelter, always prevail.

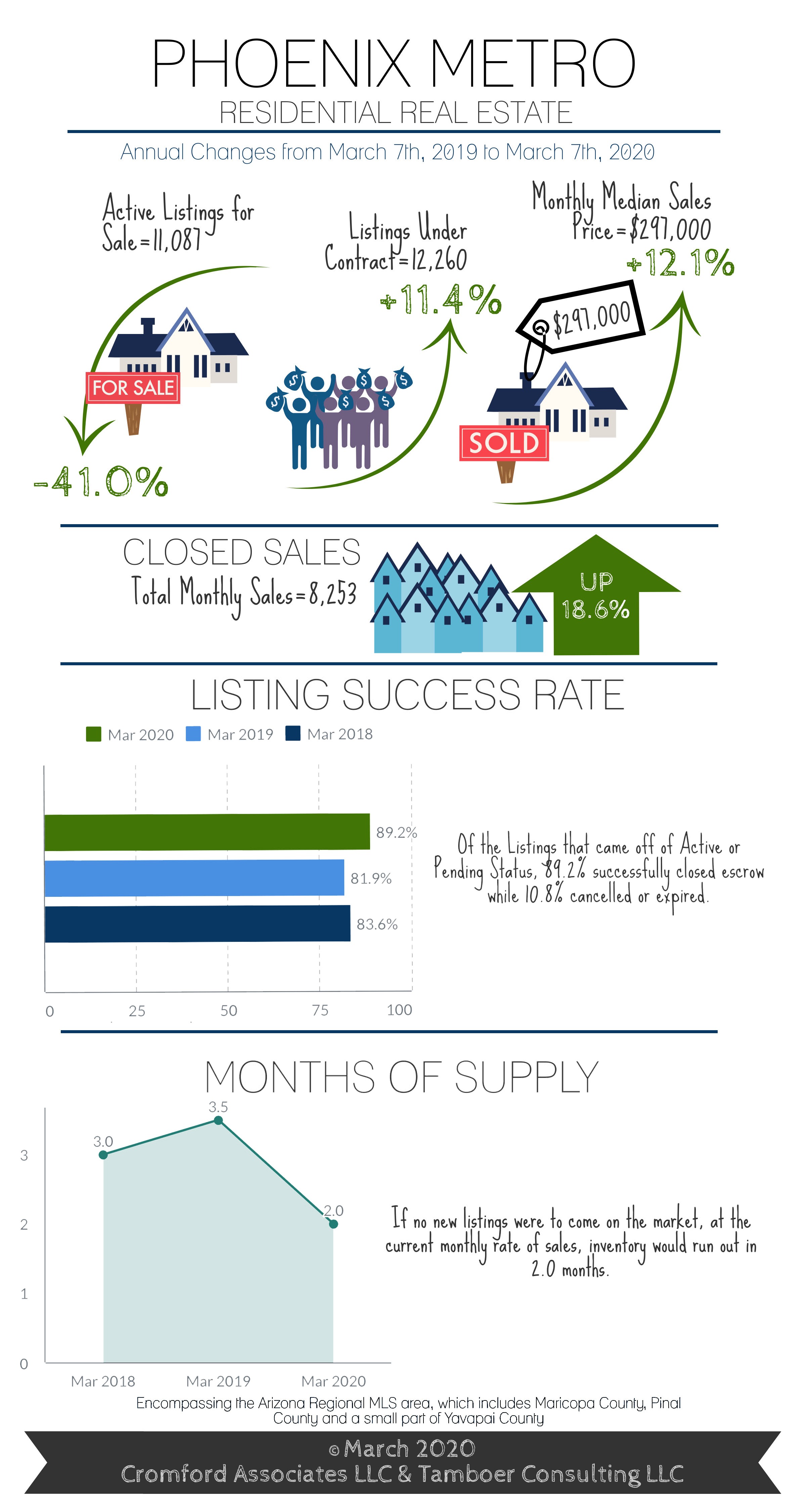

Given how strikingly low the valley’s housing supply is – our market has the potential to weather a significant drop in demand. Let’s look to the Tina Tambour of the Cromford Report for some interesting statistics. Tina points out the number of active homes for sale is running chronically below the number that have contracts on them – i.e. the active supply is being gobbled up by contracts:

“For every 100 active listings in the Arizona Regional MLS there are 111 that are already under contract. Greater Phoenix is officially a frenzy and it’s only March. We can expect to see this continue at least through May without relief as buyer demand is typically highest in the Spring.

It’s even more dramatic in the Southeast Valley, West Valley and North Phoenix and all areas where prices land between $175K-$300K. For a stark example, on March 7th in Glendale there were 3 properties for sale between $175K-$200K and 25 under contract. In Chandler there were 3 properties active between $200K-$250K and 37 under contract. In the North Phoenix Moon Valley area there were 8 properties for sale between $250K-$300K and 30 under contract.

There is a reason why people continue to pounce on what’s available for sale. The average price for a 1,500-2,000sf home is now $331K and continues to rise. That may seem alarming considering it was $324K at the peak in 2006, but contrary to popular belief it’s more affordable today because of the interest rates. In April 2006, with an average of 6.51% the monthly principle and interest payment on a 30-year fixed loan with 10% down was $1,854. Today at an average of 3.45% the same home is $1,331, a savings of $523. More recently, over the last 16 months despite prices having risen 9.4% for median-sized homes the monthly payment dropped by approximately $112/month.”

In short, whatever the impact to the market – we will keep you informed. We would urge you to not be overly concerned at this point. We have one of the strongest housing markets in the country and any change to that would be a temporary one. This too shall pass.