The COVID -19 virus and the housing market are squaring off. It is early in the fight, so we are loathe to predict too much at this point. In our 42  years of practicing Phoenix real estate in all its iterations – a pandemic virus is one we haven’t lived through. But “disasters” whether war or terrorism or a housing bubble – all have one thing in common. They do not survive long term. So really, what is the worst case? Demand drops until the virus abates or is medically solved (vaccines, medication etc.) Demand can only be suppressed for so long. In the long run, the basic needs of man – food and shelter, always prevail.

years of practicing Phoenix real estate in all its iterations – a pandemic virus is one we haven’t lived through. But “disasters” whether war or terrorism or a housing bubble – all have one thing in common. They do not survive long term. So really, what is the worst case? Demand drops until the virus abates or is medically solved (vaccines, medication etc.) Demand can only be suppressed for so long. In the long run, the basic needs of man – food and shelter, always prevail.

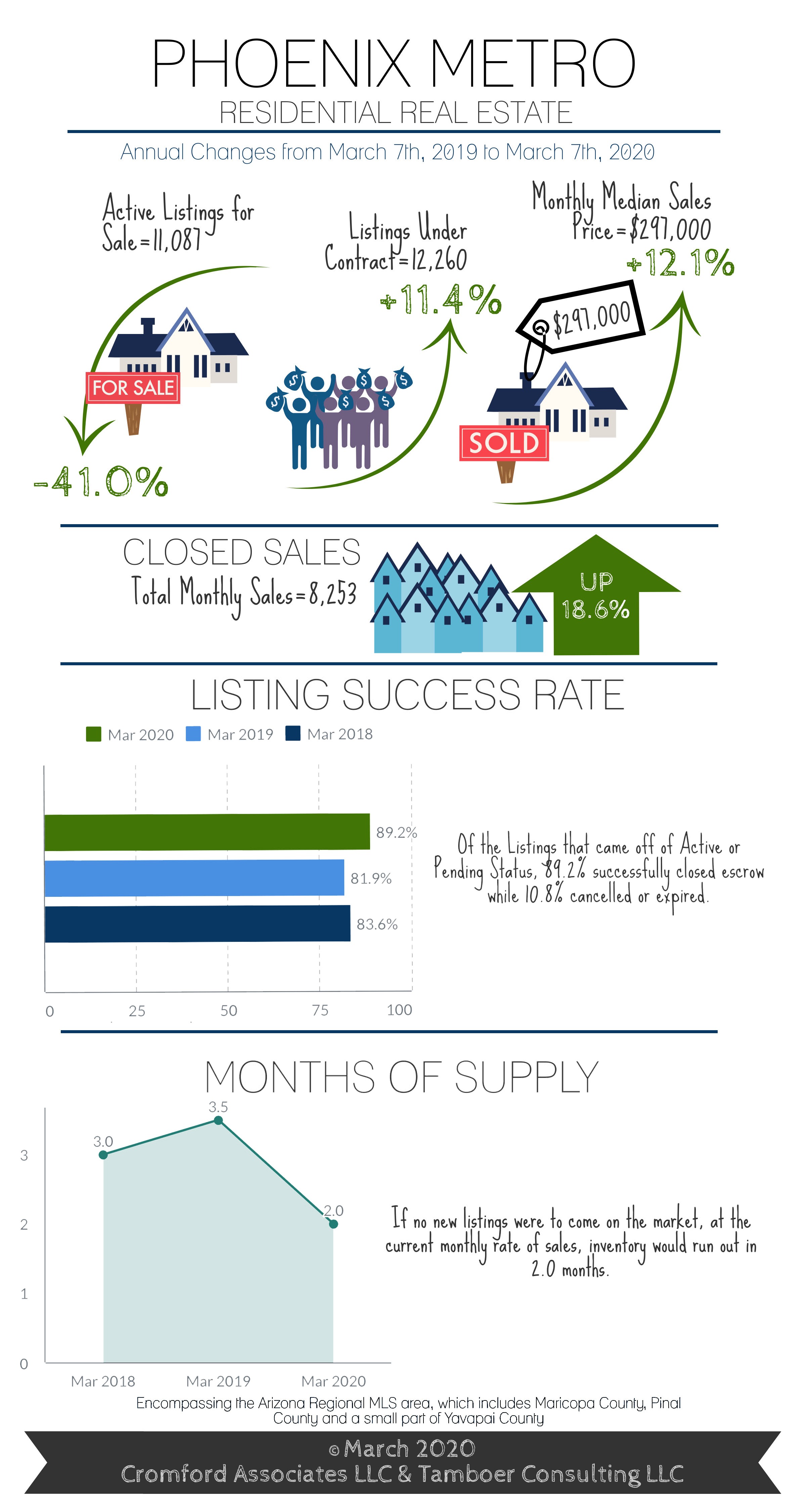

Given how strikingly low the valley’s housing supply is – our market has the potential to weather a significant drop in demand. Let’s look to the Tina Tambour of the Cromford Report for some interesting statistics. Tina points out the number of active homes for sale is running chronically below the number that have contracts on them – i.e. the active supply is being gobbled up by contracts:

“For every 100 active listings in the Arizona Regional MLS there are 111 that are already under contract. Greater Phoenix is officially a frenzy and it’s only March. We can expect to see this continue at least through May without relief as buyer demand is typically highest in the Spring.

It’s even more dramatic in the Southeast Valley, West Valley and North Phoenix and all areas where prices land between $175K-$300K. For a stark example, on March 7th in Glendale there were 3 properties for sale between $175K-$200K and 25 under contract. In Chandler there were 3 properties active between $200K-$250K and 37 under contract. In the North Phoenix Moon Valley area there were 8 properties for sale between $250K-$300K and 30 under contract.

There is a reason why people continue to pounce on what’s available for sale. The average price for a 1,500-2,000sf home is now $331K and continues to rise. That may seem alarming considering it was $324K at the peak in 2006, but contrary to popular belief it’s more affordable today because of the interest rates. In April 2006, with an average of 6.51% the monthly principle and interest payment on a 30-year fixed loan with 10% down was $1,854. Today at an average of 3.45% the same home is $1,331, a savings of $523. More recently, over the last 16 months despite prices having risen 9.4% for median-sized homes the monthly payment dropped by approximately $112/month.”

In short, whatever the impact to the market – we will keep you informed. We would urge you to not be overly concerned at this point. We have one of the strongest housing markets in the country and any change to that would be a temporary one. This too shall pass.