As we live and breathe real estate, even the tiniest variation of the same old news is interesting to us. It is our hope that we are not taxing our readers sharing the nuisances of this market. The big headlines of 2005-2012 are gone, and frankly we couldn’t be happier. What is good for selling papers, is rarely good for a marketplace because, in fact, drama sells. So when you read the paper these days and it is claiming alarming trends in our market – a healthy suspicion should be maintained. The lack of headline news on real estate is not a bad thing and  news should not be framed to make it so.

news should not be framed to make it so.

The story for over a year now has been supply and demand shifts. For over a year, demand has receded to very low levels.  It is understandable that this has created some concern, especially after the marketplace had adapted to being a demand oriented marketplace with investors gobbling up inventory at every opportunity. At that time “normal†buyers were struggling to compete for properties as cash investors with insatiable appetites seemed to win every battle for a home. By 2013 the investor portion of the market began withering away – a positive sign in a recovering market. It is difficult to claim recovery at the same time you are known for being one of the best bargains around. Vultures rarely circle a healthy animal. So as the investor market returned to the small portion of the market demand looked anemic and alarming. The investor withdrawal exposed what true demand existed, a fact that was obscured in the distress market.

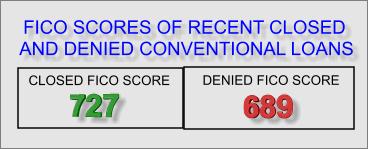

So what is causing this low demand? We have addressed this before by discussing the economy, lending guidelines, and the millennials and their buying behaviors.  The one thing we strongly disagreed with as theories go, was the idea that real estate had somehow lost its appeal after the distress market. If that were true, you would have never seen the high volume of the market in the midst of the distress – and the savviest of buyers (hedge funds) would not have come to Phoenix in force for a buying frenzy. No the appeal of the West, and Phoenix in particular, for real estate remains. Just as food never goes out of style, housing doesn’t either. What does trend is renting vs. buying. This year, in the valley, renting has jumped in demand as purchasing slumped. This is a pendulum that moves from time to time depending on economic factors and net migration. We are of the opinion that demand for housing is there and is being held down by the economic factor of severe lending constrictions resulting from the distress market. If what fueled unprecedented demand acceleration in the marketplace (insanely loose lending guidelines) then the counter balance to low demand is overly constricted lending guidelines. As Sir Isaac Newton pointed out “for every action there is an equal and opposite reactionâ€. We are not advocates for the insane lending that was going on in 2004 & 2005, but neither do we believe the Dodd/Frank bill and restrictions of this kind are any better. There are valid purchasers who simply cannot get loans at this time due to the lenders fear now that lending risks have been placed back on their shoulders where they belonged all along. Here are some interesting numbers by real estate expert Michael Orr of the Cromford Report:

“Approved home loans are the fuel that drives the housing market. The year 2000 was a relatively normal year for home loans. With roughly the same level of applications as in 2000, 15% more mortgage applications are being denied in 2014 than in 2000….†And…†The weighted credit score at origination for non-GSE loans stands at about 750. In 2006 it was 670.†(GSE = Government Sponsored Enterprise, as in Fannie Mae & Freddie Mac)Â

Alarming? Not really, just the counter balanced reaction to over-lending. As lenders only make money when they lend, eventually they will loosen their purse strings. It may take a year or two, but memories fade with time and the need to seek profit will likely show up eventually.

Normally such a pause in demand would send the market tipping strongly to a buyer’s market. Although demand faltered and did in fact create a buyer’s market last year, a rather unexpected shift followed – dropped supply. Normal additions to supply from sellers placing their homes on the market failed to arrive and supply became constricted. Let’s take the month of August as an example. To quote Michael Orr:

“New listings have been arriving at a rate which is lower than in any August we have seen since 2001. In the last four weeks we saw 15.6% fewer new listings than last year and 13.2% fewer than in August 2012, the previous low record holder.

It is quite surprising that a slump in demand would be followed by a slump in supply, but it is certainly good news for sellers who might otherwise be facing growing competition from other sellers. If demand were to recover to normal levels now we could be facing a supply shortage fairly quickly.â€

In fact, that supply has been so constricted that we have slowly and surely been moving away from a buyer’s market and into a fully balanced market, where we are now. Of course there are marketplaces within marketplaces – meaning there are areas and price points that are varying from this balanced picture. For instance, below 225K demand is showing a slight increase and so properties in this range may experience more than one offer. Some areas are a “seller’s market†such as Sun City. It is best to get a supply/demand analysis of your specific area to understand “your marketplaceâ€.