The shift from the strong seller market we saw in the first half of 2013 to a buyer’s market in 2014, has created a certain level  of disbelief. Local markets shift fairly rapidly – and changes in supply and demand are generally the cause. Although we have commented on this shift in past articles, it is worth looking at again because shifts don’t always become trends. In this case, it is looking like a trend. Although supply is building, that is not the driving force behind the shift. The puzzle in today’s market seems to be “where did the buyers go?â€Â

of disbelief. Local markets shift fairly rapidly – and changes in supply and demand are generally the cause. Although we have commented on this shift in past articles, it is worth looking at again because shifts don’t always become trends. In this case, it is looking like a trend. Although supply is building, that is not the driving force behind the shift. The puzzle in today’s market seems to be “where did the buyers go?â€Â

To quote our favorite real estate guru Michael Orr of the Cromford Report “…the number of active listings continues to grow. Although the total number…is quite normal at 30,314, we would usually be seeing declining numbers by now because March through May is the peak season for active listings going under contract. If the number of active listings manages to grow even slightly during March then it is likely to soar during the second half of the year, unless there is a major change in market direction. … the total today…is the highest we have seen since April 2011 and 60% higher than March 15, 2013.

New listings continue to arrive much faster than last year, but not in excessive numbers. We have seen 26,353 year to date, 11% more than the 23,813 we counted last year. This would normally not be considered excessive, but the shortage of buyers means there are more new listings than the market needs.â€

So again, the real problem is the drop in buyers. Sadly, we haven’t heard much “expert explanation†for this but we have a few theories:

-  The major investors that have been heavily buying (because they are well funded hedge funds – such as Blackstone Group and Colony) have largely ceased purchasing in the valley. We believe this composes the largest percentage of the “missing buyersâ€. While this drop does impact our market, we do not consider this purely a bad thing. Hedge funds purchased to hold and rent for 3-7 years and are not end users. While this helped push up values in the valley, it did take away properties to end user buyers who could not compete with these cash offers.

- The basic economic picture has still not fully recovered. To obtain loans to purchase properties (as the average buyer must) one must have employment. Although the employment rate is better than it was at the depth of the Great Recession, it is far from “normal†or “optimumâ€. No housing market fully escapes the basic economics forever. So although we consider the housing market “recoveredâ€, we do not consider the job market recovered.

- The Millennials who largely compose the pool of first time homebuyers are not buying in normal volumes. Some of this is being subscribed to changes in their belief systems as to the value of home ownership – having seen housing equate foreclosure in the distress market. Personally we believe it has less to do with psychology and more to do with mounds of student loan debt and the lack of financial ability to purchase.

- Lending practices have not returned to the standards of previous years. Locally, FHA loan limits have been lowered down to 271K from the previous 350K range. Additionally, self employed borrowers even with perfect credit and sizable down payments are struggling to obtain loans. Too many viable buyers are being denied loans.

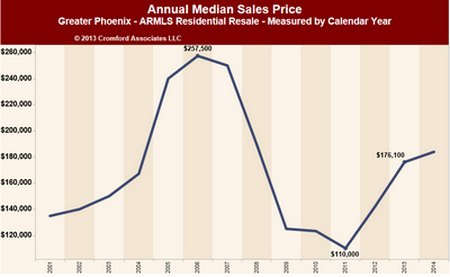

- Prices have risen over the last two years. Just as rapidly falling prices cause sellers to withdraw from the housing market, rising prices can cause buyers to withdraw as they find renting more attractive. This seems to be proven by the rental rates in the valley which have been in an upswing since January of this year. As rents continue to rise due to increased demand (after all if you are not buying, you are renting) purchasing will again become more attractive. When you can purchase and have a payment equal to or below what you can rent a comparable property for – most renters become buyers. If rental rates continue their rise – look for the pendulum to swing again to purchasing.

- We suspect net migration in to Arizona has faltered recently (see point 2 – jobs and weather seem to drive migration) although the census numbers seem a bit unreliable.

Does the drop in buyers mean that homesellers should despair? Absolutely not! But it does mean that the dynamics that drive a home sale are more important than ever – marketing, pricing, condition, location, accessibility and of course your choice of agent. You knew we were going to say that, didn’t you?Â

As always, we will continue to monitor our market as it shifts. If you are curious as to your home’s shifting value, feel free to contact us.