“The market will never come backâ€. How many times have sellers told us that in the last five years? The problem with that sentiment is that it’s untrue. All financial cycles are just that – a cycle.  But for the last five years homeowners were justifiably gloomy about the great American dream. It is very hard to describe something as a “dream†when its value is plummeting below not only what is owed but the sheer cost of the commodities that make it up (i.e. the concrete, plumbing, roofing, etc.) Once the mindset of the consumer shifts to gloom, it can be very hard to shift back to sunshine.

However, the current strong recovery that is underway in the Phoenix market should encourage sunshine. In light of that, we’ve put together some reasons that we believe might make now a very good time to consider selling.

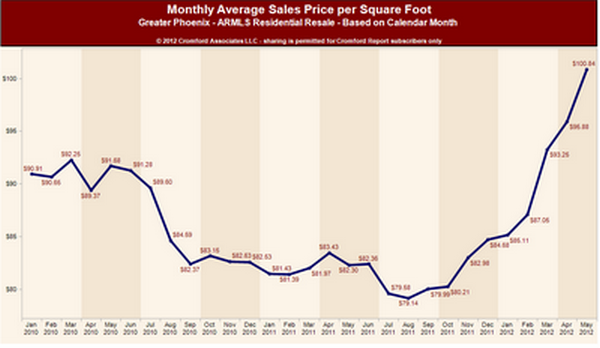

1. Because you CAN sell your house and you might NOT be a short sale. Values are moving up at a very strong clip – as quickly and strongly as the 2005 market. So much so that the pace is not sustainable long term. Sellers who couldn’t sell in years past, now with the increase in value, can finally come to market. How can you tell if you now have equity or can sell? Simple. Ask us for a free market analysis.

2. If values haven’t risen enough and you must sell, short sales are both easier and faster than ever. Although we would not describe the banks as efficient on processing short sales (of course they are not that good at banking either) – it still has gotten so much easier to complete a short sale. The success rate only a year or so ago was probably at 50% as an industry and now the rate is closer to 90%.

3. Low Interest Rates. For those looking to sell and buy, the most important factor in the timing of the sale is interest rates. Since the house you’re selling and the house you’re buying are appreciating at approximately the same rate – then the primary impact on affordability becomes interest rates. Right now rates are amazingly low. But, again, low rates will not be with us forever history says.

4. Condition and the overall look of your home is NOT all that important right now. The condition of the home always impacts pricing, but in some markets the condition determines if you can sell at all. Right now regardless of condition, we can probably find a buyer for your home. Additionally, thanks to the last few years of “as-is†distress sales, many sellers can sell their home in “as-is†condition avoiding costly and aggravating home repairs.

5. Speed of sale – less time on market, less intrusive to sell now. In a strong buyer’s market, sellers might expect the average marketing time to be around 5-7 months. That’s a lot of bed making and potpourri. Now most sellers will secure a buyer in 3 weeks or less.

7. High percent of cash buyers. While all sales are “cash†to the seller at close, the fact of the matter is buyers who need financing are part of any normal market. Currently we have an unusually high number of transactions that are cash sales. This is good news for sellers because the issue of low appraisals (the most common problem in a rising market) is eliminated with cash.

8. Easier for seller to dictate the terms of the offer. Higher purchase prices of course are what most sellers focus on as a benefit in a strong seller market. But just as important is the evaluation of the terms. Issues like the right to take certain fixtures, the ability to dictate the close of escrow date, the right to rent back, these are all benefits available to sellers in today’s marketplace.

9. You can afford to hire an agent. It sounds strange that this would be a benefit of today’s market, but it is. In a strong seller market, a great agent can actually attract enough buyers to effectively pit them against each other. It is not unusual for a skilled agent to jump the pricing by strategically bidding the offers against each other more than offsetting any cost of commission. We have seen many a seller sell to a neighbor or friend to “save the commission†only to forfeit the commission amount and then some through the elimination of competitive bidding.

Hopefully we have given you a reason or two to think “sunshineâ€. If you would like market information on values, please let us know. As always, we will keep you informed.

Russell & Wendy Shaw

(Mostly Wendy)