As we hit the mid-way point for 2011 the trend that began as a trickle in the beginning of the year seems to be established. The cliff note version is as follows:

As we hit the mid-way point for 2011 the trend that began as a trickle in the beginning of the year seems to be established. The cliff note version is as follows:

• Supply continues to decline and demand remains at a high level almost everywhere.

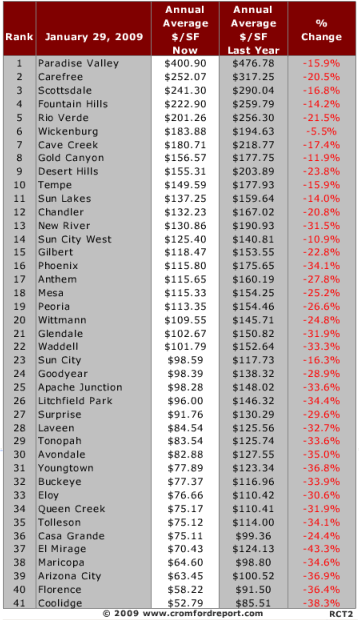

• Having hit bottom in January, average price per square foot is now moving higher.

• Buyers are active at all price levels, and multiple offers are returning to the market.

• Pending foreclosure counts are dropping at an accelerating rate.

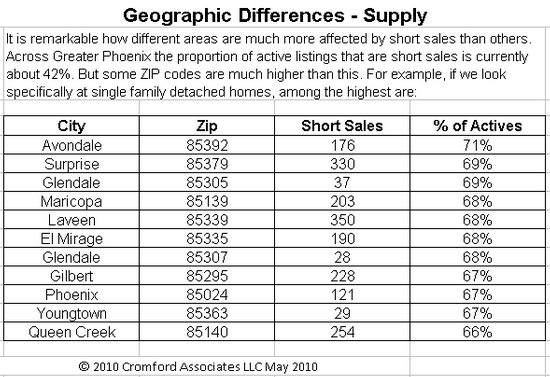

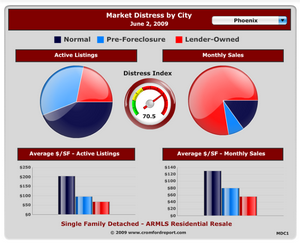

For those who want more detail, read on. The overall price per square foot inched up by 2.93%. How did that happen? The simple answer is that normal sales gained market share, moving from 34.2% to 35.9% of sales, while foreclosed homes lost market share (always a good sign). Foreclosed homes dropped in market share moving from 46.9% to 44.2%. Short sale and pre-foreclosures also gained market share moving from 18.9% to 19.9%. Generally, increased market share in the normal sales and short sales and away from foreclosures, result in a higher price per square foot. The one opinion all experts share is that foreclosures have an extremely negative impact on home prices.

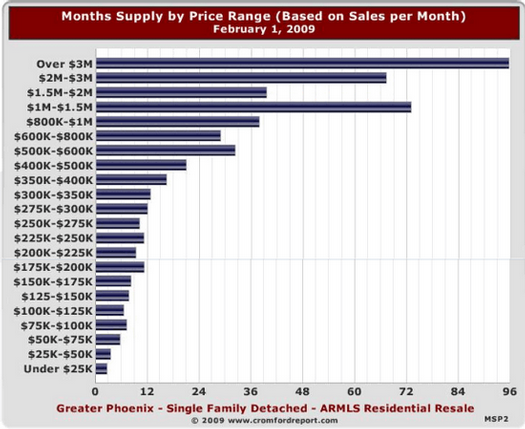

New notices of foreclosures are dropping rapidly. April’s figure is looking lower than anytime since 2007. Wow, that is something we have waited a long time to say. The actual trustee sales also are down, which combined with the lowered new notices is helping drop the inventory of pending foreclosures. Anyone looking for foreclosure bargains will be sadly disappointed soon with the lack of inventory. Supply is falling at a fast rate and in fact supply levels have not been this low since January 2006. If this trend continues, we expect to see even more multiple offers and bidding wars over the dwindling supply of all homes, not just distressed homes.

Another interesting trend is that investors are buying more than ever at the courthouse steps. A record 30% of the homes being auctioned off were sold to investors in April. As a comparison, when foreclosures really began their climb in April 2008, 95% of all foreclosures reverted to the lender. As these foreclosures continue to dwindle, look for pricing to continue to struggle upwards. As we mentioned so many times, price is a trailing indicator – meaning that supply/demand imbalances occur first, with pricing to follow.

Here are the positive trends:

• Economy and jobs are improving slowly

• Homes supply has been declining fast since November

• Low prices are stimulating stronger demand for homes – intense low-end demand primarily from investors; Affluent buyers are returning to the luxury market

• Foreclosure notices are now declined to late 2007 levels

Here are some negative trends:

• Strong shift from ownership to rental occupancy

• Financing still remains a challenge for owner occupants (41% of purchse are all cash; another 22% have more than 10% down)

• Arizona population has declined since 1st quarter of 2009

Short term, the trends appear to be that pricing is moving upwards, demand is outpacing supply, rental supply and demand are in balance. Long term trends remain elusive as economic recovery must continue and the dreaded “option arm resets†that were to peak in 2011 bringing a wave of foreclosures with them must be responsibly resolved by the banks and the homeowners.

A word of warning, expect to see a report from Case-Shiller explaining that housing prices are falling. That’s right, just the opposite of what you see here. The missing information on the Case-Shiller index is one thing: time. Case-Shiller is 6 months after the fact. That means that any current information is actually speaking of what was occurring last November, not mid-year. So, you have been warned.

The best trend of all from our perspective is bitterly acquired success of the short sale. Apparently after just 3 short years, the banks finally have gotten some systems in place for dealing with short sales. Further, the banks are once again postponing trustee sales for sellers who are truly working in cooperation with the banks to sell their homes through a short sale. Compared to the foreclosure-fest of August 2010, these indeed appear to be halcyon days. One year after HAFA (the government pre-approval program for short sales which pays up to 3K to sellers completing a short sale) was implemented; the banks actually are doing the program. This allows sellers to retain some dignity and cash in the elimination of their over-encumbered homes.

So there is the current market of the moment. As always, we thank Mike Orr and Tom Ruff of The Cromford Report for their exhaustive research. Our hope is that the W shaped recovery is underway for real and that we have begun our true climb out of this housing hole.

Russell & Wendy Shaw