Occasionally we write articles that don’t focus solely upon current real estate market conditions. This is not one of those times. The real estate market in the valley has been providing headlines since late 2004. Until the market fully returns to “normal†(it has been so long since a normal market we wonder if we will recognize it) we are no doubt destined to continue that focus. As always, our best source for market statistics remains the brilliant Michael Orr of the Cromford Report.

First, let’s begin with some numbers comparing September 2012 with September 2011:

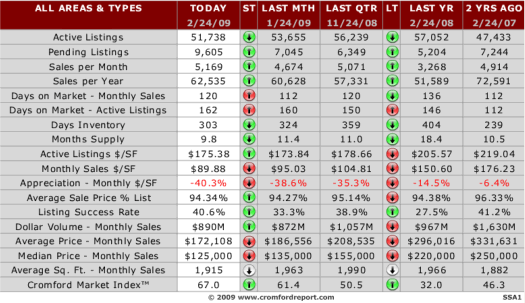

*Active listings with no offers – 14,405 versus 19,216 last year – down 25% but up 7% from August.

*Pending listings – 10,125 versus 11,508 last year – down 12% – and down 3% from August

*Monthly sales – 7,573 versus 8,470 last year – down 11% – and up 3% from August

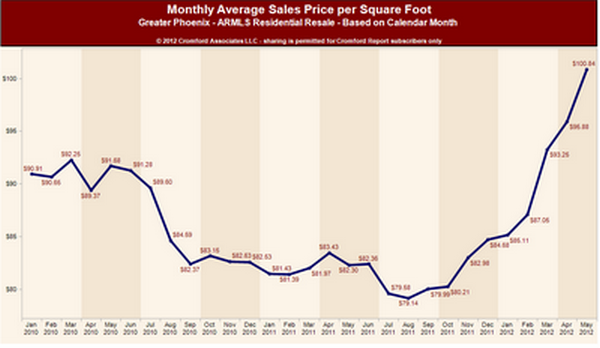

*Monthly Average Sale Price per square foot – $97.45 versus $79.64 last year – up 23% – and down .7% from August

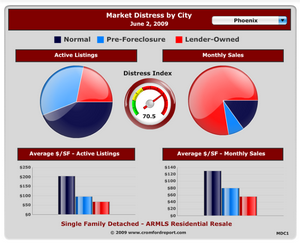

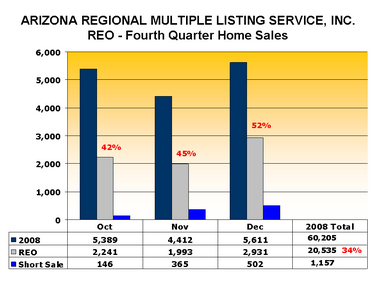

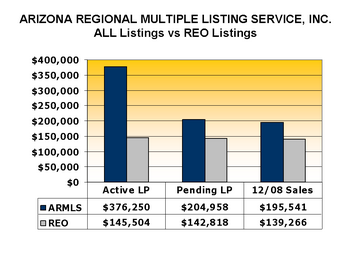

Greater Phoenix foreclosures (REO) are once again below 14% of the monthly sales total. At their peak in February 2009, they constituted 71.1% (gasp) of the monthly sales. At this point, they are not a major factor in the market. To put this in perspective, there were 12 times as many foreclosed homes available for sale in January 2009 as there are today. Short sales however, comprised 30.4% of all sales in August. This figure seems to be now holding steady after an initial drop in the first quarter.

The only real shift in REOs is in regards to Bank of America, who suddenly appear to have shifted their policies and are now taking back homes rather than primarily selling them at auction to investors as they (and pretty much all lenders) did. We now expect to see them re-enter the market as listings – no doubt to encourage higher prices as well as owner occupant purchasers. Even with BofA composing 25% of the foreclosure pipeline, the numbers still will not hugely impact our market supply.

Normal (equity) sales continue to rise to 56.1% of sales. This is a clear signal that sidelined sellers are finally re-entering the market as prices are beginning to allow traditional sellers to sell once again. This number will continue to improve as the distress sales drop.

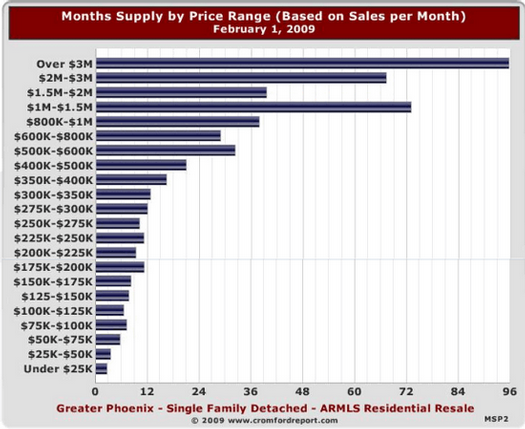

Supply continues to increase gently as is normal for this time of year – but we are seeing more significant increases particularly in Queen Creek and Maricopa – the epicenter of the price crash. The luxury market is seeing steady supply with some small areas decreasing in supply. The luxury market is weaker in the summer so this is not really news worthy to find supply steady with a little weaker pricing.

It should be interesting to see if builders can respond quickly to the lowered supply and begin adding to the supply through increased building. Their challenges remain finding lots at competitive prices and qualified workers who vacated our crashing job market.

What does this mean to the homeowner? The increased values should encourage sellers to begin to monitor values to see if they now can enter the marketplace again. Just a note on this point, we do NOT encourage homeowners to use their county assessor valuations or “Zestimates†for determining value. A supply/demand analysis for your neighborhood still gives the best accuracy in a marketplace that is shifting. As always, we are here to help.

Russell & Wendy Shaw

(mostly Wendy)