The Supply and Demand Seesaw

The spring buying season is now underway and the current numbers seem to confirm the early signals of 2017.

New listings to market are tracking almost exactly with 2016. While this would seem to be good news for supply starved buyers – after all it is 6% more supply than 2015 – is likely to be far more disappointing than buyers may yet understand. Yes, new supply levels are remaining consistent with 2016 so far, but demand has risen far more than buyers may realize. Demand is far more elastic than supply – so surging demand cannot be quickly solved with the conversely slow moving supply. To be specific, Michael Orr from the Cromford Report states:

“Unfortunately for buyers, the same number of new listings as last year will not be adequate, since the sales rate in 2017 is much higher than 2016. As of yesterday we had seen 16% more closed listings year to date than in 2016… Homes for sale are going to seem thinner on the ground than last year. Although this is bad for buyers, it is good for sellers and will provide fuel for home price inflation. The appraisal industry can only apply limited braking power when supply and demand are out of balance. “

Of course, not all price points and areas are affected equally. The low end price ranges are notoriously sparse along with the mid-range housing. Further, we see no relief in sight for these ranges. Builders have scaled back on building new supply, largely due to higher land costs and limited labor forces. Foreclosures in Maricopa County (remember when those were the largest source of new listings?) have hit all-time lows and are trending to go even lower still. That leaves re-sale sellers to fill the void, and they are not filling it in adequate numbers. The Cromford Report states:

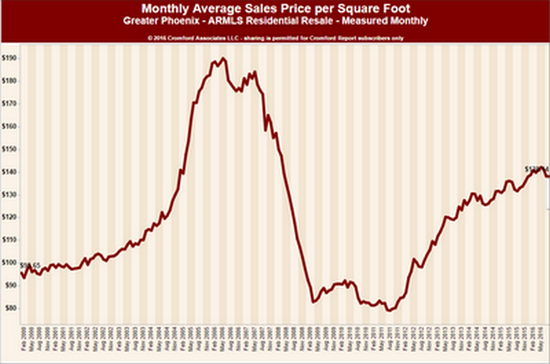

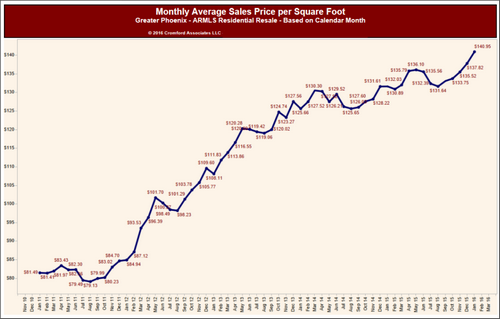

“This imbalance between supply and demand is true throughout most of the low and mid price ranges, but is less of a factor in the higher price areas, particularly in the outer locations. While this imbalance persists, it is likely to lead to further price rises. We saw a substantial 1.1% rise in the average price per sq. ft. during last month, but the median sales price remained flat for the second month. The average price per sq. ft. is a better reflection of what is going on.

Top appreciating cities (based on the 12 month change in the annual average $/SF) are:

Arizona City (13.9%)

El Mirage (13.7%)

Tolleson (11.4%)

Maricopa (10.6%)

Laveen (10.4%)

Buckeye (9.4%)

Avondale (9.1%)

Sun City (9.1%)

Sun City West (9.0%)

Litchfield Park (7.6%)

Casa Grande (7.3%)

Phoenix (7.3%)

Queen Creek (7.2%)

Â

The weakest price trends are in:

Gold Canyon (-0.3%)

Scottsdale (1.4%)

Anthem (1.6%)

Paradise Valley (2.6%)

Sun Lakes (3.5%)

Fountain Hills (3.5%)

Cave Creek (4.5%)â€

What is the takeaway from these trends? If you’re a seller in the mid to lower price ranges – you are in a stronger negotiating position than in 2016. If you’re a buyer, your bargaining power is further eroding, so act quickly or shift to areas with a better balance of supply and demand. If you have questions about the market in your area, as always we are here to help.

Russell & Wendy Shaw

(Mostly Wendy)

How to give up Equity (or what not to do as a Seller)

The market is remarkably stable at this time despite some headlines in the past few months implying otherwise. The “Most Improved†award goes to the luxury market – with Scottsdale, Paradise Valley and Carefree all posting great improvements thanks to higher demand and lower supply (quite a reversal from the 2nd quarter). No matter how interesting the luxury market is – 93% of the sales occur at 500K or below. Therefore a much broader

look is required.  Michael Orr of the Cromford Report gives a very succinct summary of the market:

“Inventory in the higher sales ranges has fallen sharply over the last 3 months, as it tends to do every year. This means remaining sellers have much less competition. So far this has not resulted in much improvement in sales prices because it takes a very long time for lower inventory to feed through into pricing. In addition it is usual for inventory to rise just as strongly between October and March so we do not think the luxury market has escaped its problems just yet. If we end up with more luxury inventory in April 2017 than we had on April 2016, then luxury home pricing is likely to continue its current weak trend.

We are seeing a little more inventory at the affordable end of the market in certain areas. If it continues this should have a moderating impact on the high appreciation rates we have been seeing below $200,000. Buyers should also see a mild reduction in the number of competing offers for the homes they want. However the effect is currently only weak and could possibly peter out quickly.

The mid-range continues to enjoy healthy supply and healthy demand plus volume increases far in excess of the low or high ends. I see little to concern us in the market between $200,000 and $500,000 at the moment and for the next few months.

… in the short term the vast majority of our local housing market is looking unusually positive and stable.â€

In a stable market, it would seem easy to properly sell a home. Yet, surprisingly, we find the same mistakes being made by sellers no matter the market. Because we are in the position to hear these horror stories, let us give you a quick “Reader’s Digest†version of a few pitfalls to avoid.

Accept a solicitation offer.Â

The latest trend in exploiting sellers comes from “direct to seller†investors. We’ve all received postcards and solicitations from the “We will buy your house†gang. Whether well-funded by Wall Street (Open Door) or simply a local investor, the basic formula is the same. The promise is to save you money and time – “no commissions†“sell as-is†and the promises go on and on. The devil is in the details. Commissions just get renamed “fees†and “as-is†just means swapping unhandled condition issues for large price deductions. Often times the initial offer drops precipitously as inspections are done and the close date approaches. After all, in any negotiation the party who needs the deal loses. In this case, the losing party is the seller weeks from closing who suddenly finds themselves forced to agree to last minute changing terms.

These investors are using the fact that many sellers are unaware that they can sell a home “as-is†through a traditional brokerage sale. Competition from multiple buyers (even if only multiple investors) will best protect seller’s price. The fact is investors who solicit benefit by the lack of competition for a home and misleading terms at the expense of the seller.

Not list your home on MLS (i.e. believe that both you and buyer can “save the commissionâ€).

The primary reason sellers attempt to sell their home “For Sale by Owner†or use a “Limited Service†real estate company is to “save the commissionâ€. Although we fully understand the impulse (who doesn’t want to “save†money?) the statistics tell a different story. The most recent study of this was posted in ARMLS Stat: “When we test our model against MLS sales only, properties that were sold using a real estate agent via the MLS sell between 8.5% and 9.0% higher than properties not listed on the MLS.â€Â Is it because agents just “know moreâ€? Hopefully your agent in fact does know more (promise us you will select an experienced agent) but that is not the reason. Go back to our first point – it is competition for a home that protects value. That is the purpose of MLS – to employ the 35,000 +/- agents and their buyers to compete for the home. Secondarily, imagine for a moment why a buyer would select a “By Owner†home? Since buyers don’t pay the commission – why would they care if the home is sold by a broker or by owner? They would only care if they could “save the commissionâ€. But isn’t that the very reason the seller is selling by owner to “save the commissionâ€? How do two people save the same commission? Additionally, if you have only one buyer looking, have you really received “top dollar’ from the market – or just that buyer’s top dollar?

Bad Pricing. Thanks to the internet, sellers and buyers have more instantaneous and, sadly, erroneous information at their fingertips. This bad information has led to both underpricing and overpricing of homes.  Establishing pricing through an AVM (automated valuation model – for example Zestimates) while fun and interesting, is by no means is an accurate way to determine market value. Algorithms cannot take in all the factors that make up pricing – site selection, competition, property condition, variances in square footage, supply/demand shifts, etc. Ask yourself why after all these years lenders still require an appraisal – where an actual person (gasp!) views the home and compares it to other sales. There is simply no substitute for judgment. Overpricing a home in the critical first three weeks can be a problem not easily overcome with reductions in the subsequent weeks and months. Buyers can view “days on market†and make assumptions about whether this is a “good home†since no one else has purchased it, or exploit the seller’s increasing desperation as the marketing time extends.

Hire an agent you can’t fire. This may be the least obvious of the errors, but it is an error. Why would this matter? Many sellers may be unaware that once they list with an agent, they cannot cancel the listing agreement –even if they are unhappy. Being tied up in a 6 month listing agreement with the wrong agent (bad agent, bad marketing, improper preparation of the home, etc.) can not only rack up days on market but can eliminate the opportunity to sell during prime market periods waiting for the listing to expire. Some agents will “agree to cancel†for a fee. The best protection for you is obtaining the right to cancel at no charge as part of the listing agreement.

While there certainly are other errors we could elaborate upon, we tried to hit some of the most common. Want to know more? As always, we are here to discuss your particular concerns.

Â

Â

Â

Â

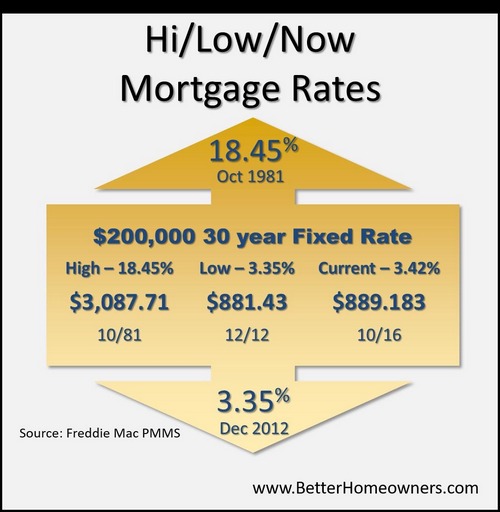

Historic Mortgage Rates

September Market Update

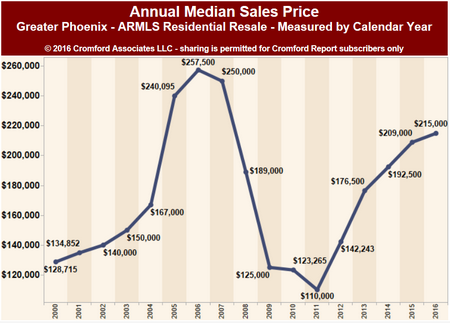

As we enter the last quarter of the year, we begin reflecting on how 2016 has compared to 2015. It has been a remarkably similar year to 2015 – with only some minor variations.

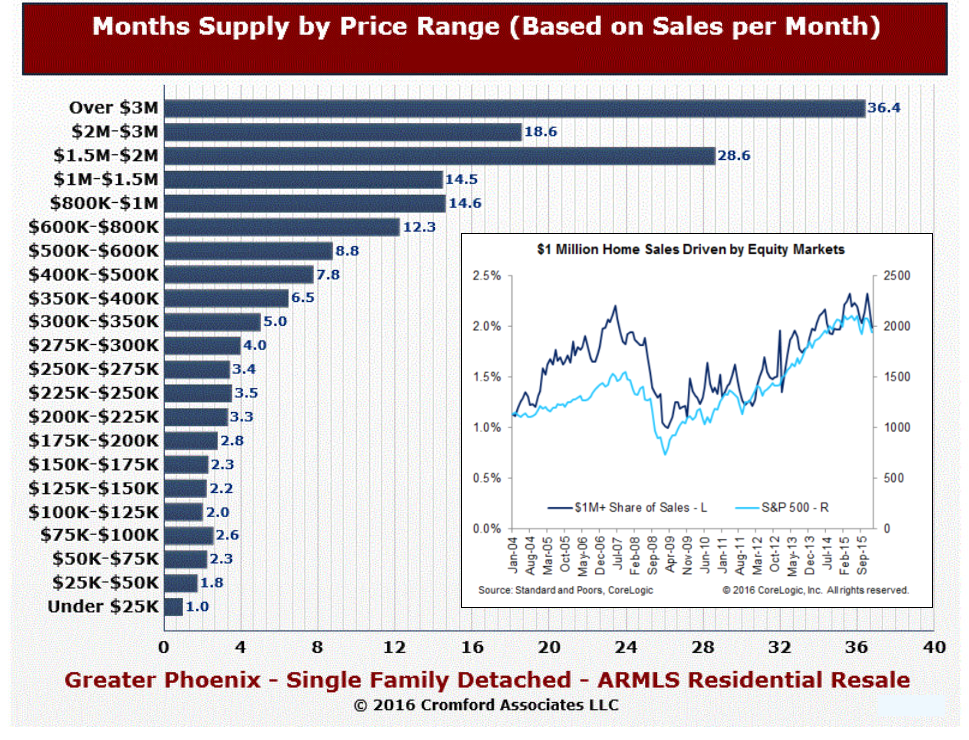

The biggest challenge of the 2016 market has been the intensely low inventory in the $175,000 and under market. The situation began in earnest in 2015 and has only accelerated. Any buyer shopping in the $100,000-$125,000 price point for single family properties can share their own tale of misery – as the inventory in that range has nearly evaporated. As we have mentioned in articles past, supply is the harder side of the equation to move – demand being far more mercurial. Unless we get some institutional owners (hedge firms, investors, etc.) to part with their rental inventory – we see no immediate solution to our entry level, single family home supply issue. As in years past, buyers in that price range are currently faced with only a few options: remain a tenant, increase their buying power (i.e. cosigners or increased down payment/income) purchase a condo, purchase a mobile home, or go out of demand areas to lower priced housing.

Demand has also improved over 2015 – but not dramatically (frankly, we are not unhappy about avoiding “dramatic†trends after the rocket ride of the last 10 years). As our guru, Michael Orr of the Cromford Report opines:

“We are now at the point where inventory hits its minimum level in most years. New listings are arriving only 3% faster than last year and we have seen quite a lot of cancellations, especially at the higher price points. We will be looking to see what sort of inventory growth we get between now and the next peak at the end of November.

Demand is currently holding up, some 5% higher than we would consider normal. However the market conditions are probably going to be determined by changes in the supply.“

We have begun to see the occasional headline warning of an impending drop in demand. Let us offer some thoughts on the matter. First, supply and demand are a balancing scale – meaning that when demand exceeds supply – prices go up. Prices going up, cool off demand. Cooling demand increases supply. In other words, this is exactly what is supposed to happen – supply and demand move up and down in a balancing act. Additionally, our market has uniquely segmented behavior specific to price ranges, rather than the more traditional geographic segments. Demand has already fallen in the high end – attributed perhaps to an aging population who are downsizing, the stock market, and hot temperatures (buyers with funds flee the valley in the summer).   The mid- range market has been mostly flat, and the low end has been appreciating due to the low levels of supply. Most importantly, real estate markets are local – not national. So any broad statement about “the real estate market†should be met with some skepticism. Here is Michael Orr’s brilliant analysis of our market place:

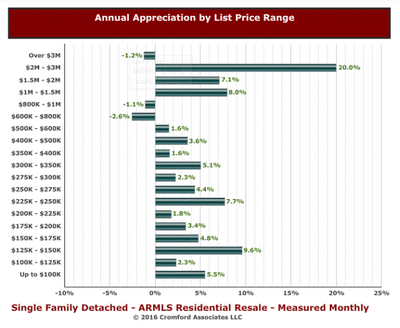

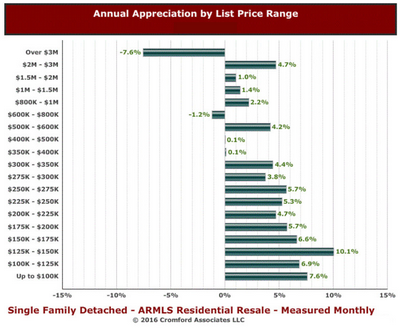

“In the recent couple of years the market trends have been determined far more by price range rather than the traditional location (location, location). This is contrary to normal market behavior. We are not used to our fastest appreciating markets being those with the worst performing schools and the highest rates of crime. However a few numbers will easily prove my point: The figures below are for all property types within Greater Phoenix.

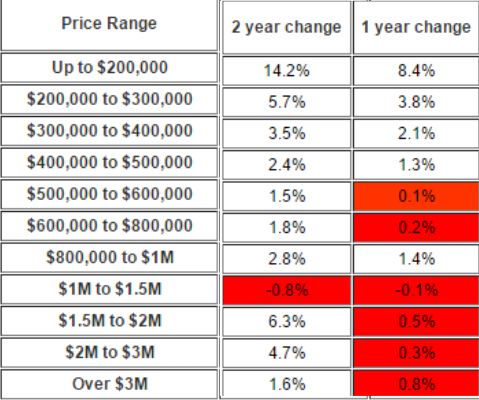

I highlighted in red the price ranges which went backwards in dollars adjusted for inflation (which was 1.01% this year and 0.12% 12 months ago).

I am not sure why the $800,000 to $1M range should be doing better than those either side of it. It is faring as well as the $400,000 to $500,000 range. The rest of the ranges from $500,000 upwards have not performed so well over the past 24 months. The range between $1M and $1.5M shows the weakest trend here.Â

In terms of unit sales through ARMLS, the price ranges at or below $500,000 comprise 93% of the total market while those above $500,000 comprise only 7%. So it is fair to say that the market as a whole is keeping housing assets appreciating well ahead of inflation. This becomes even more true as you head down market.

The picture changes when we look at supply rather than demand. Among the active listings on ARMLS within Greater Phoenix today, listings over $500,000 comprise 24%, and those of $500,000 or less only 76%.â€

If there ever was a case for avoiding Zillow’s erroneous zestimates, the above would prove the point. Markets are nuanced, and there is no substitute for looking. As always, we will do our best to keep you informed on the real trends in our marketplace.

Home Values

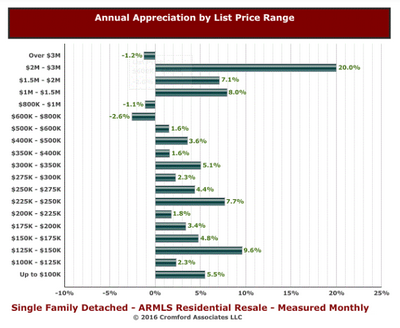

As we have discussed in previous articles, the 2016 market has fragmented in to 3 very distinct markets – based almost

exclusively on price. Understanding the supply/demand equation in each of these price points will guide savvy sellers and agents as to the strategies best suited to that market. Not surprisingly, the appreciation is equally reflected in each of these distinct markets.

The Cromford Report recently published appreciation comparisons in each of these price points by quadrants in the valley.  This reflects comparing the portion of the first quarter of 2016 to the corresponding portion of 2015.

Starting first with Phoenix and the North Valley on single family homes, Michael Orr reports (Bold italics):

- Homes under $250,000 – average rise of 10.6% in $ per sq. ft.

- Homes between $250,000 and $500,000 – average rise of 3.9% in $ per sq.

- Homes over $500,000 – average rise of 1.6% in $ per sq. ft.

Then comparing the Northeast Valley (Scottsdale, Fountain Hills, Rio Verde) you will see lower appreciations rates. This can be attributed to the preponderance of luxury homes (which are in plentiful supply) and the utter lack of homes under 250K where the greatest appreciation is occurring in the valley.

- Homes under $500,000 – average rise of 5.8% in $ per sq. ft.

- Homes between $500,000 and $1,000,000 – average rise of 0.0% in $ per sq. ft.

- Homes over $1,000,000 – average fall of 2.2% in $ per sq. ft.

Turning to the Southeast Valley, single family homes followed the same general pattern:

- Homes under $250,000 – average rise of 9.0% in $ per sq. ft.

- Homes between $250,000 and $500,000 – average rise of 3.1% in $ per sq. ft.

- Homes over $500,000 – average fall of 3.3% in $ per sq. ft.

The small rise in pricing for homes over $500,000 is a better performance than the outer areas of the valley.

Turning our attention to the West Valley single family market, we see even more contrast between the low and high end of the market.

- Homes under $250,000 – average rise of 10.4% in $ per sq. ft. between Feb – Apr 2015 and Feb – Apr 2016

- Homes between $250,000 and $500,000 – average rise of 1.2% in $ per sq. ft.

- Homes over $500,000 – average fall of 5.0% in $ per sq. ft.

What do these statistics mean for sellers? Clearly the strategies for selling a home vary depending on the area and price point. Sellers in the 250K and under category have strong bargaining power with buyers and likely have more flexibility as to condition issues and concessions to buyers. Multiple offers are common at this price point – requiring a strong agent strategy for successfully maximizing this opportunity to get every penny. Between 250K-500K, sellers still retain a slight advantage over the buyers – but not nearly the power the under 250K sellers have. Condition issues are more likely to need to be addressed by these sellers and they may or may not receive multiple offers. Typically the first 3 weeks on the market is vital to these sellers as far as defending their value. The over 500K market & luxury market is unquestionably suffering with an abundance of supply – causing sellers to have to compete with superior condition and strategic pricing and marketing.

Whatever the price point or location, we are happy to counsel our clients on maximizing their net. As always we are here to help you make the best selling (or buying) decisions for your situation.

Market at a Glance

The trends that were forming in the first quarter of 2016, now are affirmed. As usual, the two  most important laws of economics – the laws of supply and demand – are the driving force behind the trends.  Demand – the more fluid and fickle of the two- is up. In fact demand has returned to levels not seen since 2013. Supply, the slower moving component, has fractured into distinct market segments. No one captures this market snapshot better than Michael Orr of the Cromford Report when he states:

most important laws of economics – the laws of supply and demand – are the driving force behind the trends.  Demand – the more fluid and fickle of the two- is up. In fact demand has returned to levels not seen since 2013. Supply, the slower moving component, has fractured into distinct market segments. No one captures this market snapshot better than Michael Orr of the Cromford Report when he states:

Below $275K we therefore see continued strong appreciation, short times on market and low cancellation and expiry rates.

From $275K to $350K we see very healthy market conditions with new supply and closed sales both up significantly from last year.

From $350K-$400K the growth in supply was strong, but sales growth was much weaker than average, suggesting there may be a few problems developing for sellers. However from $400K to $500K the percentage growth in new listings was matched by the growth in closed sales. I would describe this sector of the market as normal, healthy and growing, with no major shortages of buyers or sellers.

From $500K to $800K new supply outstripped the growth in sales, so even though there was a healthy increase in volume we see more competition building between sellers.

From $800K to $1M the increases were balanced but we do see 3 times as many new listings as we see closed sales. This is likely to mean higher cancellation and expiry rates and long times to sell ahead. It also means minimal upward pressure on pricing.

The issue for sellers with homes priced over a million is that the number of new listings outpaced sales by at least 3.4 to 1. This is not unusual for this segment, where new listings comfortably exceed closed sales at all times. The bad news is that sales were slightly down (-1.4%) from last year, primarily due to surprisingly poor performance by the segment from $1M to $1.5M. Yet new listings were up almost 15% for homes over $1M. This is a good situation for luxury home buyers, but it is not very good news for sellers who would like to see some appreciation. The current market environment over $1 million is consistent with a flat to slight downward trend in prices, long times on market and high rates of cancelled and expired listings. There are some very fashionable locations (close to urban centers) where this does not apply, but the bulk of the luxury market has reasonably good demand but excessive supply. Because of the good demand, agents will be happy with the transaction volume, but sellers are likely to be disappointed with the sales prices that can be achieved, and how long it takes to achieve them. These sellers hear about prices rising both locally and nationally, but unfortunately it does not apply to them.

Â

The question of why inventory has jumped so markedly in the 500K+ range has garnered some attention lately. National analysts have begun speculating on this trend, much as they did last year when bemoaning the apparent lack of interest in home ownership by millennials (a theory we do not subscribe to).

A theory put forward by several national analysts, particularly Stephen Kim of Barclays, is that a long term secular change is under way. They believe a wave of empty nesters is seeking to downsize, and now that the market has recovered from the crisis of 2006-2009 they are planning to do so in growing numbers. If a large number of baby boomers want to sell their suburban luxury homes at the same time, we are going to see an imbalance of supply and demand. ..We are seeing a rise in discretionary renting, where older homeowners sell their large homes and move into smaller rental homes. They appear to prefer upgrades and amenities to square footage. They are probably using their home equity as a source of funds to enjoy their retirement.

Although we are no analysts, the jump in supply does not seem particularly shocking to us. To our minds, this is the same “coiled spring†theory that demand operates on – so why not supply? When demand is artificially held down for an extended period of time, the recoil once released is greater than expected. So too, we believe, does supply follow the same “coiled springâ€. The homeowners who lost their homes in the greatest volume were those in the lower end of the market. The higher end homeowners faced with negative equity – simply had to wait out the market. Having waited for years for appreciation to make home selling an option again, that coiled spring released numerous sellers back in to the market. At least according to our theory.

Whatever the reason, supply and demand continue to be an interesting equation in our housing market. No matter the reasons, we will do our best to keep you informed on housing trends. As always, we appreciate the continuing confidence of the clients we are so lucky to serve.

The Tale of Two (or perhaps three?) Markets

The spring buying season is now underway (sadly accompanied by the flu season) and trends are now becoming observable. Supply is up – 8.5% over 2015, 3.3% higher than 2014, and 13.2% more than in 2013. This would be good news for buyers,

except the mix of the new listings in not matching the mix of the demand. More on that in a moment, but first a word on demand. Demand, which was looking rather neutral at the start of 2016, is up – reflected in the 5% increase in all greater Phoenix sales over this time last year. However, that number is misleading in a couple of aspects. A closer look shows the sales numbers are being held down in the lower price points based on lack of supply. Homes under 200K are in very scarce supply (and in the range of 125K-175K the lack of supply is extreme) with the demand far outpacing the inventory. This has resulted in a lower number of sales in this price range than last year – over 10% lower – due only to the fact that buyers cannot find enough homes to buy. This is not going to improve, as we opined before, as we see no additional supply in single family homes forthcoming. This lack of supply has changed what is selling. Entry level buyers, unable to find homes to purchase under 200K, are turning in greater numbers to manufactured homes and townhomes/condominiums. Sales for attached homes are up 10% and an astonishing 14% for mobile and manufactured homes. As Michael Orr of the Cromford Report explains (in italics and quotes):

“At the lowest end of the market, supply was already very low last year and it had gone down another 20%. Under contract listings are barely higher and closed sales are down more than 10%. This is a market crippled by far too little supply and consequently average appreciation is over 8%. This market cannot be described as healthy because of the chronic supply problem, but it is a great market for sellers as long as they are not over-ambitious with their pricing.â€

The picture changes for the mid range – the $250,000-$500,000 priced homes. Demand is much stronger than 2015, and supply is slightly increased. However, this increase is largely confined to the 400K-500K range. Again, deferring to Michael Orr who says is best:

“In the mid range, supply is modestly higher than last year while demand is sharply higher. Despite the stronger demand it is not enough to eat into the supply, but it is good enough to give us moderate appreciation of 2.6%. This is the picture of a very healthy and expanding market, good for sellers and buyers.â€

The picture changes dramatically for the $500,000 and up market. Here supply has increased strongly and demand while improved, is simply normal. This is not a good recipe for sellers in this range.

“In total contrast to the low end, the market above $500,000 is wallowing in too much supply. Note that we have almost as many active listings above $500,000 as we have below $250,000. Yet we see almost 7 times as many homes sold below $250,000 than we see over $500,000. Supply was already high last year and has increased by another 15%. The contract writing and closing activity is good and we can conclude that demand is stronger than last year. But despite February sales being up 30% and a strong 21% rise in listings under contract, new listings keep flooding into the market and there is still well over a year of supply. Competing among themselves, most sellers have the weaker hand in negotiations and so pricing is suffering. Based on the monthly average $/SF, the current annual average appreciation rate for homes over $500,000 is a negative 5%.

With sales down 10% below $250,000 and up 30% above $500,000, the overall market price statistics are all being skewed much higher. The true pricing environment for the luxury market is far worse than most sellers appreciate. Even for mid range sellers, appreciation is more modest than many of them realize. Only for homes below $250,000 are the overall market’s price appreciation numbers a realistic guide.

It is still fair to describe the bulk of the market as healthy, because only 8% of the homes that sell are over $500,000. That means 92% of sales are coming from appreciating markets. However 30% of sellers are trying sell homes over $500,000 and for them, the market is not looking so great right now.â€

So no matter what the headlines state or your friends who just sold their home, the experience when buying and selling in 2016 is going to depend on which segment of the market you are participating in. A $250,000 seller is going to have a very different experience from the 1.5 million dollar seller. No matter the price or area, we can help you decipher “your marketâ€. As always, we are here to help.

Supply Shifts

February showed some signs of life for homes going under contract after surprisingly  lackluster activity levels in January. But as we warned, trends take time to form, and so a good or bad month does not make a year. 2016 had been heralded by most to be a likely breakout year. Demand was expected to leap due to the continuing rise in rental rates, the boomerang buyers returning to the market (those who lost their homes and return to buy after credit recovery), Millennials beginning to buy, and the valley’s overall positive net migration. Despite the compelling reasons for a demand surge, the indicators so far have been underwhelming. Demand has remained in a pretty neutral range, neither retreating nor advancing significantly. The number of homes under contract is higher in 2016 than in the same time in 2015 by approximately 8%. That would be encouraging if that % was growing rather than eroding.

lackluster activity levels in January. But as we warned, trends take time to form, and so a good or bad month does not make a year. 2016 had been heralded by most to be a likely breakout year. Demand was expected to leap due to the continuing rise in rental rates, the boomerang buyers returning to the market (those who lost their homes and return to buy after credit recovery), Millennials beginning to buy, and the valley’s overall positive net migration. Despite the compelling reasons for a demand surge, the indicators so far have been underwhelming. Demand has remained in a pretty neutral range, neither retreating nor advancing significantly. The number of homes under contract is higher in 2016 than in the same time in 2015 by approximately 8%. That would be encouraging if that % was growing rather than eroding.

Interestingly the purchasers are much more dominated by local buyers – up by about 18%. Buyers with out of state addresses are running 8% less as they did in 2015. Anyone tracking the weakened Canadian dollar will understand why very few Canadians are buying these days – down 64% compared to January 2015 (but they are wisely selling – up 26% from a year ago).

The new listings to market are up over 2015 by 6.2%. This is higher than 2014 and 2013 as well – notoriously low years for homes coming to market. The low rate of homes coming to market in the last 3 years was the market’s saving grace (at least for sellers) given that demand was also lower than normal. With demand in neutral, a continuing arrival of new inventory is starting to shift the balance of the market in some areas and price points. Michael Orr of the Cromford Report offers this interesting breakdown by cities:

The active listing count has increased in all the major cities, as is normal for the time of year, but the largest percentage monthly increases are in:

- Goodyear 17%

- Scottsdale 17%

- Tempe 15%

- Surprise 15%

- Avondale 12%

- Chandler 12%

These increases give buyers a lot more choice. Scottsdale now has more active listings (including UCB) that at any time since 2011.

Queen Creek stands out by having the smallest increase of less than 2%, unusually low for the time of year.

Among the secondary cities the fastest growing active listing counts are in:

- Apache Junction 28%

- Sun City 20%

- Buckeye 18%

- Sun Lakes 16%

- Anthem 16%

- Cave Creek 15%

- Sun City West 14%

- Maricopa 12%

- Paradise Valley 10%

- Tolleson 10%

The inventory in the 55+ active adult areas is growing significantly faster than usual. Sun Lakes has the highest number of active listings (including UCB) since early 2011. Cave Creek beats this by having the largest number of active listings since 2010.

Conspicuously slow growth in active listings can be seen in:

- Litchfield Park -1%

- Laveen 0%

- Casa Grande 2%

Â

Despite these geographically supply shifts, we cannot overemphasize that price point is still a major factor in the supply/demand analysis. Below 200K, we still see very constrained inventory with multiple offers being the norm. Even with demand in neutral, it is outpacing and exceeding supply. We see no relief in sight at the moment.

We will continue to watch 2016 and report the trends that affect our clients. As always, we are here to evaluate your particular neighborhood and provide a supply/demand analysis so you can make informed decisions.

Market Clues

December 2015 ended with a bang – with higher levels of activity and demand than is typical  for December. This of course would lead most to believe that if December was that strong, then surely January would follow suit.  Ever the contrarian, the market started 2016 with the whimper typical of most Januaries. This left prognosticators grasping at straws for trends. After so many years of uncertainty, one can appreciate the need for certainties. But the fact is, 2016 is still in its infancy and it will be the end of February before any definitive trends appear.

for December. This of course would lead most to believe that if December was that strong, then surely January would follow suit.  Ever the contrarian, the market started 2016 with the whimper typical of most Januaries. This left prognosticators grasping at straws for trends. After so many years of uncertainty, one can appreciate the need for certainties. But the fact is, 2016 is still in its infancy and it will be the end of February before any definitive trends appear.

Before you toss this article in the trash (you weren’t really going to, were you?) there are a few things we can examine. As the real estate market is in essence a study in supply and demand, it is always worthwhile to take a glance at those two components.

Of these two factors, let’s begin with supply – the slower moving of the two and therefore perhaps the easier one to examine. Supply also can tell us a lot about the health of the market; is supply being consumed rapidly or is it accumulating? 2016 started with a 10% drop in inventory compared to 2015 but – like most statements – this one has a slight qualifier. As we’ve mentioned in previous articles, a more concise evaluation of the supply situation appears when you look at specific price points. Not surprisingly, supply is most constrained and likely to continue to be so, at the 300K and under range. The reason is really two-fold. Builders, whom are building at higher rates than we have seen in years, are largely building single family homes in the 400K+ range. The sheer cost of the land and commodities essentially make it prohibitive to build single family homes for less. Additionally, as the values of homes continue their gentle climb upwards – the lower price ranges begin to further erode. Even at a moderate increase of 4-6% yearly, a $275,000 home exceeds $300,000 in just a couple of years. Add to that the fact that FHA financing (the most commonly used financing in the valley) currently caps out at $271,050 – putting the largest pool of buyers in the smallest group of available sellers.

Summing up the supply situation is Michael Orr of the Cromford Report:

“The price ranges with the biggest loss in new listings year over year are:

- Under $100K – down 41% from 425 to 252

- $2M to $3M – down 35% from 40 to 26

- $125K to $150K – down 33% from 492 to 332

- $1M to $1.5M – down 25% from 117 to 88

- $100K to 125K – down 22% from 253 to 197

Luxury home sellers will be pleased to see that we have not seen a large increase in new listings at elevated price points. Only $1.5M to $2M increased by 10% and all other ranges above $800K are down year over year. Entry level buyers will be disappointed that the supply situation below $175K is just going from bad to worse.

The middle of the market between $300K and $800K is where the increases are concentrated – there are at least 10% more new listings here than last year in each of the price ranges.

Here we see clearly that luxury home buyers have quite a bit more choice than last year. In fact from $400,000 upwards there are more homes for sale. Yet the overall supply is down because supply below $275,000 is so weak. Last year there was already a shortage of affordable homes, so the situation has worsened for buyers, which is obviously good news for sellers.

Sellers of homes over $400,000 need to be aware that news of short supply does not apply to them. They have more competition from other sellers than they had a year ago.â€

This leads us to the more fickle component – demand. If this year follows last year’s trend, the spring buying season will bring a leap in demand. We certainly felt the first signs of that after MLK day. If this continues, we can expect 2016 to be a seller’s market for most price points up to a million. Even if demand should falter, the 300K and under market will still retain a strong seller advantage. Add to this the fact that the rental supply also continues to remain very low pushing rental rates upwards. A certain group of renters, finding no relief in rental rates, may look to become purchasers. Additionally, the boomerang buyers (buyers who lost their homes in the distress market) are still re-entering the market. So it would appear that only economic factors (global and national) would slow the demand side of the equation. Although Arizona is not immune to the economic component, it is far less vulnerable than many other states that rely on the price of commodities (energy, etc). Therefore we believe the odds favor demand showing up in 2016.

No matter the market swings, we will do our best to keep you informed once the trends have been confirmed. As always, we are here to answer questions and help you make informed decisions whether buying or selling.