𝗧𝗵𝗲 𝗨𝗻𝗽𝗿𝗲𝗰𝗲𝗱𝗲𝗻𝘁𝗲𝗱 𝗦𝘂𝗽𝗽𝗹𝘆 𝗗𝗶𝗹𝗲𝗺𝗺𝗮

It can be difficult to write about a slow moving train such as our Greater Phoenix housing market. The market is remarkably quiet right now making poor fodder for attention grabbing headlines. Both buyers and sellers seem content to sit on the sidelines waiting. For what? For a reason to act. The most obvious motivator would be lower interest rates.

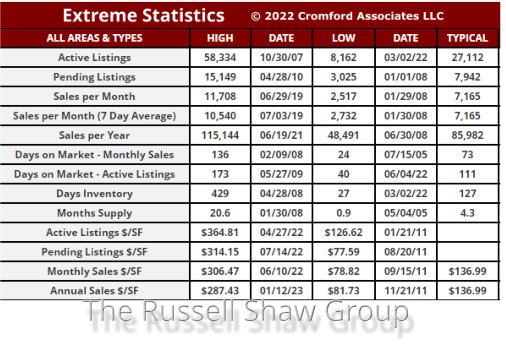

Demand is currently 22% below normal. In fact, it dropped below normal in June of 2022 where it has remained ever since. Not shockingly, that shift was a response to the jump in interest rates. But the real story is not lack of demand, but rather lack of supply. Supply currently is at 52% below normal and is 40% below last year. In fact, supply hasn’t been at normal levels since 2011 (although we briefly approached normal in 2014). It is not an overstatement to say the valley is chronically undersupplied, despite a healthy new build market creating new supply.

As the Cromford Report explains: “So far in the third quarter of 2023 we have seen 7,447 new listings. The equivalent number last year was 12,439 and in 2021 it was 11,712. We are down 40% from last year and down 36% from 2021. This annual drop in new supply is unprecedented and is having a far bigger impact on the market than the affordability issues caused by the high interest rates.” (Emphasis added)

What is going on with supply? There is a simple answer. Roughly 4 in 5 homeowners with mortgages have an interest rate below 5%, and nearly one-quarter have a rate below 3% according to Redfin. Low interest rates are handcuffing sellers to their current home – as very few want to or are able to double their interest rate to change homes.

Neither buyers nor sellers seem anxious to act, creating a very low transaction market. But there is some movement in this stillness: prices. Let us explain. Lack of supply has kept our market gently favoring sellers. When demand – even tepid demand – is higher than supply, prices rise. Admittedly, this is a slow rise in pricing compared to the last 3 years. But by the end of the year we likely will see our annual appreciation come in between 5-8% on average.

The Cromford Report further confirms this:

Some badly informed observers still think there is a bubble popping situation ahead, but they completely misunderstand the situation. For prices to fall, we have to have an excess supply compared to demand. Even though demand is very weak, supply actually got 2.6% smaller over the last month. There is very low delinquency in residential real estate lending right now, so it takes a ridiculous leap of great imagination to believe that foreclosures are going to have any significant effect on supply in the foreseeable future.

… we have a seller’s market where overall pressure on prices is up not down, despite the lack of enthusiasm on both sides of the negotiation. Once we get to the end of September and it starts to cool down, the luxury market will be fully contributing to the price numbers…

When will the market heat up again? That depends on demand rising – dropping interest rates alone are likely to spark demand. Typically, demand reacts far more quickly to change than supply. But supply is soon to follow. If nothing else, time will overcome static conditions. For a market that favors sellers – it is a good time to sell. Buyers as well should be buying in low volume marketplace. When the volume shifts, they will find the competition makes for a much more stressful buying experience.

Russell & Wendy

(Mostly Wendy)

𝗠𝗮𝗿𝗸𝗲𝘁 𝗧𝗮𝗸𝗲𝗮𝘄𝗮𝘆𝘀

Supply is down 52% below normal

4 out of 5 homeowners have an interest rate below 5% handcuffing them to their loan

Demand is down 22% below normal

Prices are gently rising in market that favors sellers

Low activity from sellers and buyers primarily due to interest rates