Any statistic is only valuable if it has been properly evaluated. A tremendous amount of “information†gets printed and repeated. Much of it is false or just plain silly. Various economists make predictions about “the recovery†of the real estate market. What is the definition of “the recovery� What exactly would one see if it “had recovered�

| RANK | YEAR | MLS UNITS SOLD | EQUITY SELLER | REOÂ | CASH |

| Â | Â | Â | Â | Â | Â |

| # 1 | 2005 | 104,133 | 99% | 0.42% | 12% |

| # 2 | 2004 | 98,294 | 98.4% | 1.66% | 13.5% |

| # 3 | 2009 | 91,757 | 30% | 56.00% | 37% |

| # 4 | 2010 | 90,408 | 37% | 41.30% | 42% |

| # 5 | 2003 | 79,512 | 98% | 1.99% | 13.5% |

| # 6 | 2006 | 74,105 | 99% | 0.18% | 9.2% |

| # 7 | 2002 | 68,411 | 98% | 1.65% | 14% |

| # 8 | 2001 | 62,523 | 98.7% | 1.30% | 16.5% |

| # 9 | 2008 | 59,220 | 64% | 34.50% | 21% |

| # 10 | 2007 | 54,231 | 96.7% | 3.30% | 11.6% |

On the chart you see here note that the highest sales year in history was 2005. The second best year ever was 2004. Take just a moment to observe that last year, 2010 was the fourth best year ever for number of homes sold. Also, notice the relative number of sales starting with the record breaking number of 79,512 homes sold in 2003. Look at how last year (90,408 closed sales in the MLS) compares to the other top years.

So, what is different or “bad†about our current market? Well I suppose it would depend on who you ask. If you ask the hoards of investors currently paying cash what is “bad†you would get a very different answer than if you asked a home seller (a whopping 42% of all sales in 2010 were cash buyers, mostly buying bank foreclosures). What is good or bad is “priceâ€. What you see on the chart is that the REO (Real Estate Owned – commonly called foreclosures) category just a few short years ago was almost non-existent and last year the bank owned houses composed 42% of all the sales (that number for 2009 was even higher, 56% for the year). When the percentage of cash sales rises way above 12 – 14% there is a reason: heavy investor buying. Currently investors are a huge component of our market due to the current low prices.

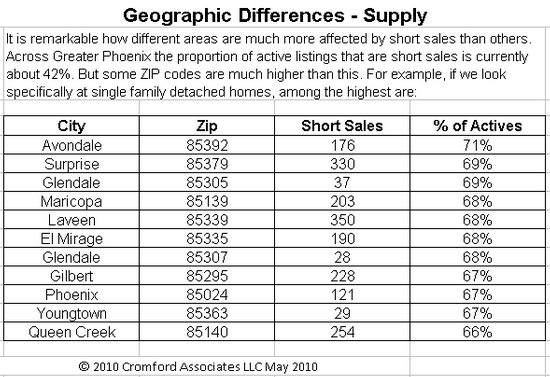

Notice that we now have a category called “Equity Sellerâ€. Just a few short years ago, these people were just called “sellersâ€. The category “short sales†so recently entered our MLS data that we have eliminated it as a category – although it would tend to mirror the REO pattern.

Here are some interesting points on the market from the Cromford Report: “Segmenting by price range we still see the greatest weakness below $100,000 where supply is very high and additional REO supply may be looming as trustees process the backlog from Bank of America’s hiatus last quarter. Even here the situation is much improved because buying activity has accelerated as the pricing has fallen. The strongest price range is currently $400,000 to $800,000 where sales prices have stabilized and even moved very slightly higher over the last four months when measured by price per sq.ft.â€

After unusually low foreclosure numbers in November and December (due to seasonal moratoriums and Bank of America’s temporary halting of foreclosures) the numbers reverted back to normal levels with 6,783 new notices and 4,585 trustee deeds recorded. The net effect was to reduce the number of pending foreclosures to fewer than 40,000 for the first time since March 2009.

Add in to the mix of all this, the government’s proposal to eliminate Fannie Mae and Freddie Mac – or at a minimum move it back to the private sector. This is a bit like locking the barn door after the horse has bolted – but change is warranted and inevitable. Whatever the change, it will no doubt result in a rise in interest rates as less money is available for lending. Rising rates impact affordability and could create downward pressure on pricing. Our hopes are that the change will be implemented gradually to minimize the damage and allow the private sector to fill the gap left by these lending giants.

As always this market continues to provide plenty of topics for the water cooler. We will continue to share the trends as they appear. Please call us with your thoughts or concerns. We are here to help.

Russell & Wendy Shaw