It is hard to believe that we are in the waning weeks of 2020 – a year not likely soon forgotten. While real estate was certainly not the top headline (pandemic, fires, protests, politics – need we go on?) it was in its own way a valley headline grabber. The chronically short supply of housing was the byword, while buyers proved that even a virus could not dampen their enthusiasm and demand for housing. In fact the virus had seemingly two effects: a temporary pause in buying resulting only in a delay in our seasonal patterns; and sellers more reticent to come to market. The outcome was one of the strongest seller’s markets since 2005.

2005 vs. 2020

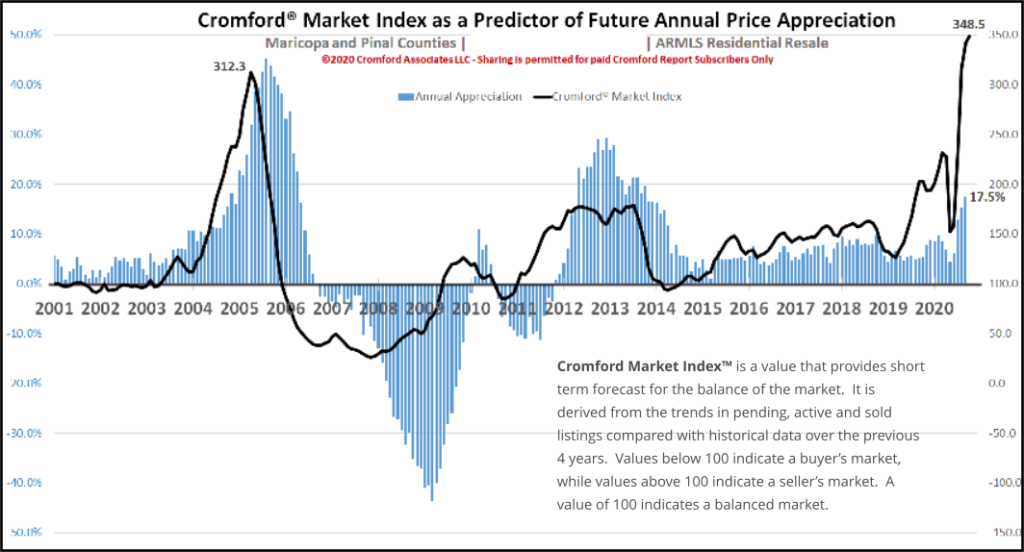

Having lived through the 2005 frenzy and subsequent 2008 collapse of the housing market, fears of history repeating itself are understandable. But the underpinnings of the 2005 market and the 2020 market are very different. No one points out those differences better than Michael Orr of the Cromford Report.

“There are dozens of things that are different now compared with 2005, but the most significant include:

In 2005, thousands of homes were being purchased and left vacant as they were snapped up by speculators

In 2005, rents were low and headed lower because there were more homes than people who wanted to live in them

In 2005, almost anyone could get a 100% loan with minimal documentation, and thus had no skin in the game if prices were to fall (as they did)

In 2005, few people thought the market could decline

Mortgage fraud was rampant creating artificial demand

The developers had built (and would continue to build through 2007) more homes than were demanded by the population growth

For all 6 of these, the opposite condition exists today.

Vacancies are very low

Rents are high and rising sharply

Qualifying for a mortgage requires financial resources (for example, a job) and must be supported by documentation, and almost all home owners have equity

Many people think the market could go down, supported by articles claiming this is likely (although it is not)

Mortgage fraud is at a relatively low level

The developers have built fewer homes than demanded by population growth between 2008 and 2020.

It is not normal for the CMI to be above 200, never mind 300, so it will certainly come down from its current level eventually. However this is more likely to be as a result of much higher prices damping down demand, rather than a flood of supply entering the market. We would need to see almost three times the current level of supply to get back to normal.”

Fears

Many fear that storm clouds are gathering on the horizon given the expiry of both forbearance programs and elevated unemployment pay. Others tie doom and gloom to post election fallout. Ultimately, whatever the source – the fear basically translates into a looming housing price crash. These fears fail to take in to account the most basic fundamental underpinning of the housing market – supply and demand. As the Cromford Report states: “There have been a number of articles written predicting that home prices will fall next year because of the damage to the economy by the COVID-19 pandemic. This will cause some people, those who took those articles seriously, to be very surprised by the huge increase in pricing that is currently going on. The extremely high CMI (CMI = Cromford Market Index; which predicts short term future pricing trends) reading indicates that the upward price trend will continue for the near and medium term, making any price reductions in 2021 rather unlikely. …

The economy has severely damaged the finances of a large number of people. However most of those people were unlikely to be in a position to buy a home anyway. Those who are in a position to buy a home have had their determination to do so increased dramatically by the pandemic. The gap between the haves and the have-nots is widening.”

It is worth repeating a few facts. First, price is a trailing indicator – meaning that it shows up months after the market shifts. Second, we need three times the number of homes on the market to be at a balanced market. Three times! Even in the housing debacle of 2008 it took a few years for the market to shift to a buyer’s market. (2006-2008)

Trends

Although predicting the housing market is really a short term game, there are a few trends in play.

First, price increases. Again the Cromford Report shares this information that may surprise you:

“Over the last 12 months, the average price per sq. ft. has increased over 17% and the current rate of increase in around 2% per month, meaning we are probably headed for an annual rate of over 20% fairly soon.” This is the reason we so adamantly tell our clients to avoid investor offers. The market can move upward without the general population having any idea. Your house is likely worth more than you know and an investor “fair market offer” can really be anything but.

Second, what about the foreclosures that have been temporarily squelched by forbearance programs? Isn’t a flood of foreclosures headed our way? Undoubtedly there will be some delinquencies that will need to be dealt with. But thankfully the numbers the lenders are releasing imply that those numbers will be nothing like the avalanche we saw in 2007-2012. And unlike those years, sellers have equity! There is absolutely no reason to allow a foreclosure on a home with equity. That is just a sale that needs to happen within a timeline. We Realtors’ do that daily – sell a home quickly and hand a check to the seller. To look at actual numbers rather than fears, Black Knight Mortgage Monitor report shares the following facts: “The state of Arizona has 5.7% of first position loans that are delinquent by 30 days or more. Only 0.1% are in foreclosure and the remaining 5.6% are non-current. Arizona ranks 38th among the states, with Mississippi worst (11.7% noncurrent) and Idaho best (3.8% non-current).”

Third, another trend relates to new builds. Buyers who cannot find the resale home of the dreams often turn to new housing. Unlike in days past, some builders are trying to benefit from the rising prices of homes by only accepting contracts on homes that are nearly complete. Locking in pricing 6 months before the completion (traditional new builds) puts equity in the buyer’s hands rather than the builder’s hands. Some builders are trying to change that by building specs and then selling right before completion at “today’s price”. It is an interesting trend and one that will likely only survive in a strong seller market.

For those who have read all the way to this point, our apologies for the length (thanks mom!) We wish you and your family a wonderful upcoming holiday season and we look forward to serving you in 2021.

Russell & Wendy Shaw (Mostly Wendy)