The media continues to push the narrative that interest rates are killing the spring home buying season and that danger lurks everywhere. News of failed banks SVB and Credit Suisse creates fear that the banking crisis of 2007 is repeating. YouTube “experts” claim that foreclosures are on the rise. Yet the facts do not support any of these theories in the greater Phoenix area. What is good for headlines (alarming or controversial news) is not good for reality. What is true is that uncertain times create jitters in the financial sector which can have an impact on housing. Let’s look at what we do know.

𝗜𝗻𝘁𝗲𝗿𝗲𝘀𝘁 𝗿𝗮𝘁𝗲𝘀

As they say, bad news is good for mortgage rates. That has proven to be true – mortgage rates have dropped. In fact, the rates have been unusually unstable. The Cromford Report makes this very point on mortgage rates: “They have been extraordinarily volatile recently with the 30 year FHA rate dropping from 6.20% to 5.75% in just a single day. The VA rate has declined 50 basis points in 2 days, but the 5/1 ARM has risen from 6.14% to 6.55% during the last 3 days. I can’t remember a time when interest rates jumped up and down so fast and frequently. However, FHA and VA loans look particularly attractive right now which will favor the low to mid-range market below $900,000”.

As a note, when you hear on the news “the feds are raising rates” it is referring to the short term interest rates between banks which has little to do with mortgage rates. Mortgage interest rates are inversely tied to Treasury bond rates.

𝗗𝗲𝗺𝗮𝗻𝗱

With interest rates down, that should spur demand, right? After all, if headlines say interest rates are killing the market then shouldn’t lower rates should be jet fuel for the market? Unfortunately, it is not that simple. Multiple factors control demand such as: interest rates, appreciation/depreciation, inbound relocation, population growth, lending practices and consumer sentiment. Right now consumer sentiment is likely playing an outsized, even if temporary, role.

The Cromford Report shares these numbers on listings under contract in mid-March: “At 9,001, contracts are at their 4th lowest count since 2005, the lowest counts were in 2006-2008 and normal range is 11,000-13,000. “

While that sounds alarming, the fact is that demand has been below normal for quite some time. Phoenix demand has been below normal since February 2021. If that is true, then why were prices still dramatically rising until the beginning of first quarter 2022? The answer is low supply.

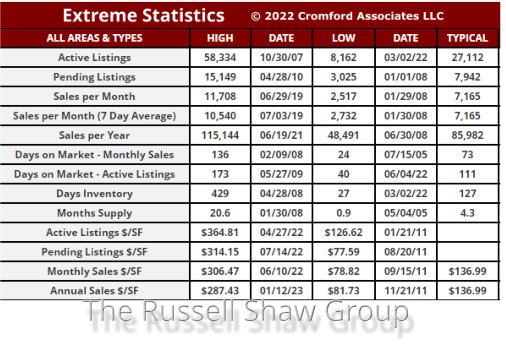

Supply While interest rates may be keeping some buyers out of the market – the impact of higher rates seems to be the greatest on would-be sellers. When sellers cannot comparably replace their current interest rates if they buy – they stay put. So although listings are far more abundant than last year, they are still roughly 40% below the normal range of 20,000-24,000. Here are some interesting facts reported by Tina Tamboer of the Cromford Report:

New listings added to the Arizona Regional MLS are the lowest ever recorded going back at least 23 years. This may be shocking to some as there has been a 200% increase in supply year-over-year, but last year at this time supply was merely 4,820 active listings.

We repeat, the lowest supply of new listings ever recorded in the last 23 years. Gulp. That is the buried headline. When you combine low demand with even lower supply what do you get? The report states:

“Low-level demand combined with even lower-level supply equals a seller’s market for Greater Phoenix. Not a crazy one like the last 2 years, but since coming out of a buyer’s market last December sale price measures have stopped dropping and have risen a modest 3.5% so far.”

To summarize – we are in a gentle sellers’ market. Demand is below normal (as indicated by the contract rate) but supply is even more constrained. At the moment, only 3 exceptions in the valley which fall into a buyer’s market: Queen Creek, Maricopa, Buckeye. Predictably, the outer areas of the valley tend to be the first to tip to a buyer’s market and the last to recover.

Supply is a slow moving number and nothing on the immediate horizon seems likely to increase it. Further, new builds of single family homes which add to the supply, are not being created in sufficient numbers to improve things. For good or bad, demand is far more mercurial. Recent changes in FHA loans (loan limits increased to $530,150 while also lowering buyer expenses) and sellers’ current willingness to help buy down buyer’s interest rates may encourage first time homebuyers to buy. If demand takes off as it is threatening to do, we may once again find ourselves in the midst of a strengthening seller’s market in defiance of the headlines. Time will tell. As always, we are here to answer your questions about your specific neighborhood.

Russell & Wendy

(Mostly Wendy)