A Balancing Act

By now most homeowners have heard the news “the market has shifted”. While that is true, as usual the story is more complex.

In the first quarter of 2022, Sellers held every card. Now they are handing them back one by one. As financial markets tend to run on two emotions (either fear or greed) understandably in the first quarter greed drove the market. Now? Hello, fear. Likely too many people remember the debacle of 2008 and fearing a repeat, the market reacted swiftly. Therefore, we have rapidly and officially arrived at a balanced market.

So why all the hand wringing? Isn’t a balanced market a dream come true? An egalitarian market – favoring neither seller nor buyer? The first thing to realize, is that the last time we were in a balanced market was in 2015. Many real estate agents have never even seen a balanced market. Further, after 7 years the abnormal starts to feel normal. Additionally, not all areas and price points are moving in sync – despite the fact they have all shifted. The lack of consistency across all areas and prices creates further uncertainty- and moving targets are hard to precisely pin down while in flux. So what is known? Recently the Cromford Report examined the 17 largest cities and found that 6 cities have now moved in to a buyer’s market (i.e. a market where supply exceeds demand – therefore buyers have the negotiating power). Those currently in the buyer’s market: Surprise, Tempe, Gilbert, Buckeye, Queen Creek and Maricopa. Six cities are in the balanced zone: Chandler, Peoria, Glendale, Phoenix, Mesa and Avondale. A balanced market is one which neither favors buyers nor sellers on negotiation. This leaves 5 cities still hanging on to a gentle seller’s advantage: Fountain Hills, Cave Creek, Paradise Valley, Scottsdale, and Goodyear.

But just as the location is affecting the relative strength or weakness of the market, so is the price point. As a case in point, The Cromford Report analyzed the changes in the average sale price per square foot in Phoenix (the largest market) from mid-May to the beginning of August. They found the peak for closed prices was May (but note, those are contracts that actually went together in April when demand began to erode). They found the median sales price from just Mid-May to the start of August eroded 6.25% – an average of 2% per month. Looking more closely at individual price points – the largest drop was for properties between $1M-$1.5M – with an average decline of 3.2% per month. The runner up was the $500K-$800K with an average decline of 1.2% per month. Not shockingly the low end and high end are fared the best. The high end of the market is not interest rate sensitive. The low end of the market simply has restricted supply with negligible new supply being created. Proving once again that housing is very neighborhood/price specific.

What you should know

So what should would be sellers take away from all this? A few points:

1.If you sell now, today’s value is still above this time last year’s value.

2. This a market that is rebalancing. Yes, it is still eroding, but the rate of decline is slowing. What will future values look like? No one can predict. See point 1 for today’s answer.

3. Supply and demand are determining who holds the strength in negotiations. The answer is area specific and price point specific. Get hyper-specific when evaluating your home. This is a moving target.

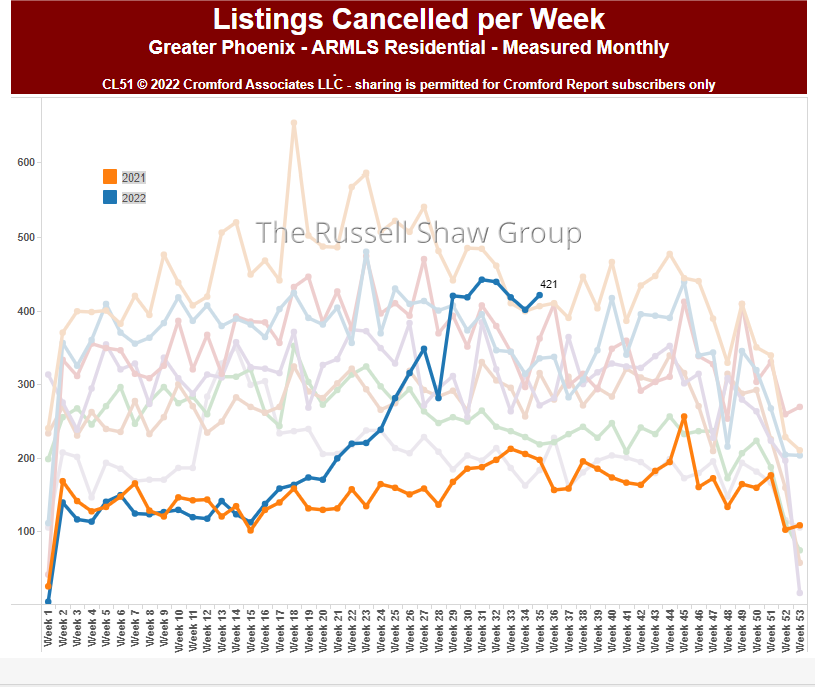

4. You need a good real estate agent again. At the peak of the market, 93.3% of all homes on the market sold. That number is now 70.4% (the lowest number for this time of year since 2010 which came in at 58.1%). The difference between selling now or not, is back to the agent’s marketing and knowledge.

We are back in the land of normal – although it will likely take a bit for everyone to absorb that fact. The slowing of the rate of decline is our earliest hope that this market will settle in to the much overdue correction. As always, we will keep our friends and clients aware to the changes. We are here to inform.

Russell & Wendy

(mostly Wendy)