As we head towards the end of the year, the market seasonally follows a pattern that tends to favor buyers. Typically between September and  December, active listings grow as demand cools. This year is no exception – although the impact is a gentle one at the moment.

December, active listings grow as demand cools. This year is no exception – although the impact is a gentle one at the moment.

2019 was an interesting year. It began with the market heading towards balance – something we hadn’t seen in a while. But by the end of February, it reversed course and began to strengthen on the seller’s side. June, July, and October produced fewer new sellers coming to market. In fact October set records on the scarcity of new sellers. This dearth of new listings has kept the market favoring sellers, and the seasonal shift has only slightly mitigated that power.

Price

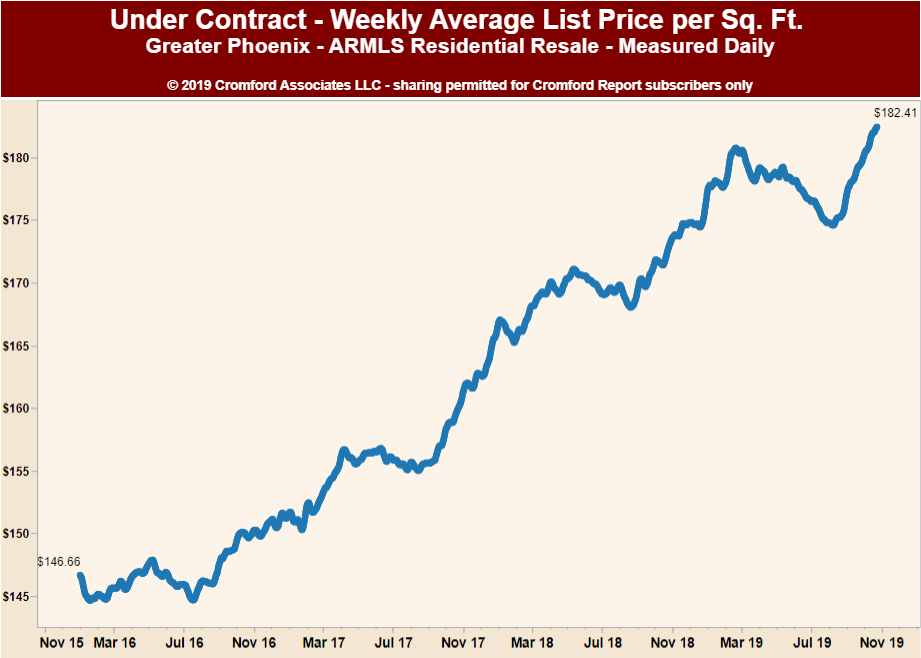

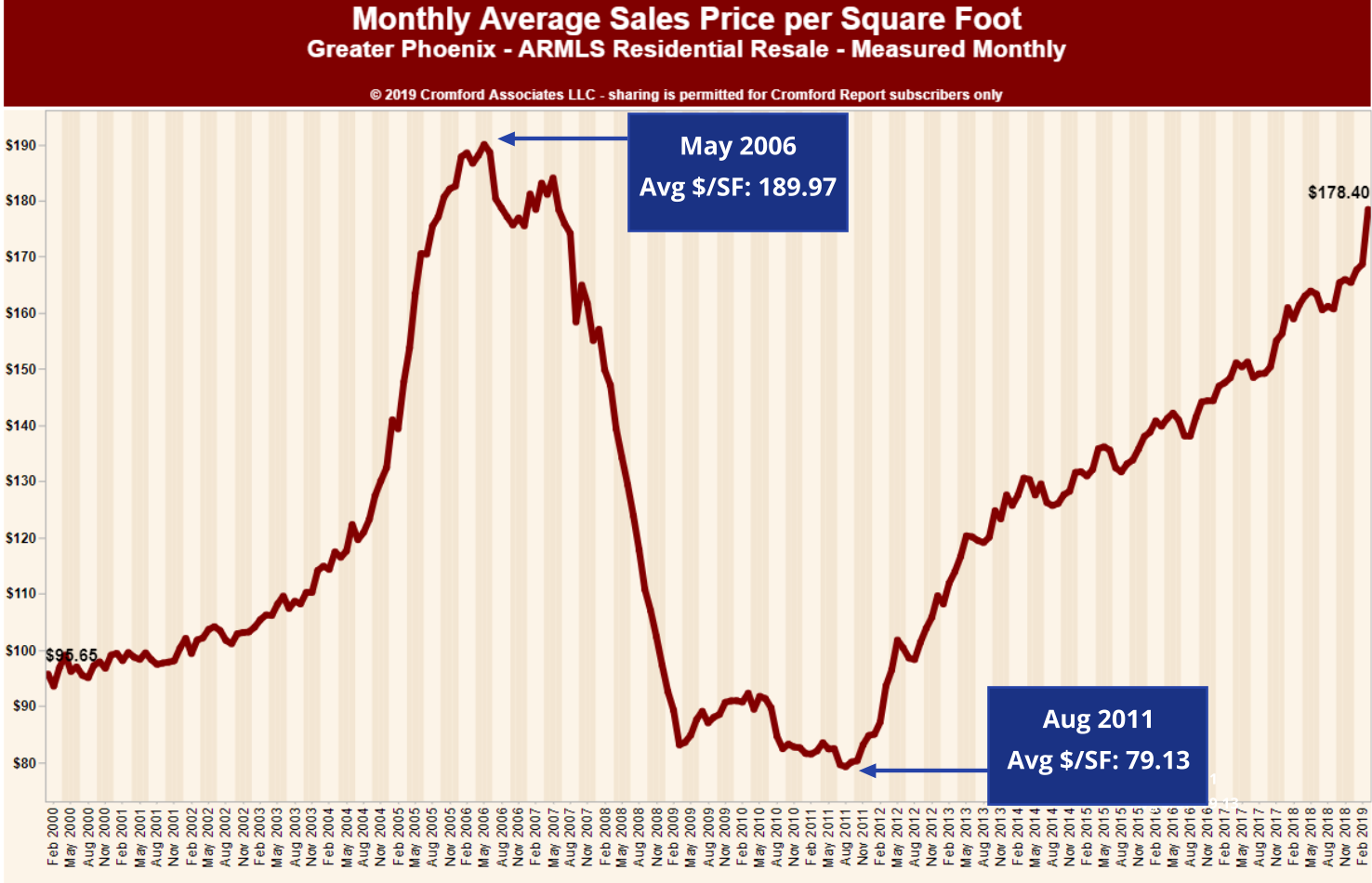

Typically the most interesting thing to real estate buyers and sellers alike, is price. Pricing is a trailing indicator as we have mentioned in the past – often responding 6 months or more to an imbalance of supply and demand. The first place pricing shows up is in list prices followed by pending sales. Price per sq. ft is a pretty reliable indicator. Notice in the chart below how the impact on pricing starts to show up mid – August, literally 6 months after the market shifted in favor of sellers.

As Michael Orr of the Cromford Report comments “This was looking weak during the second and third quarters but has perked up dramatically since August 7…. $181.97 is the highest we have seen since the bubble year of 2005.”

He further comments: “Price momentum is rising, and in normal markets this tends to bring the market closer to balance. It does this by giving sellers better reasons to sell and giving buyers greater affordability problems.” When will the market shift in to balance? That is anyone’s guess but 2020 could be the year.

Bubble

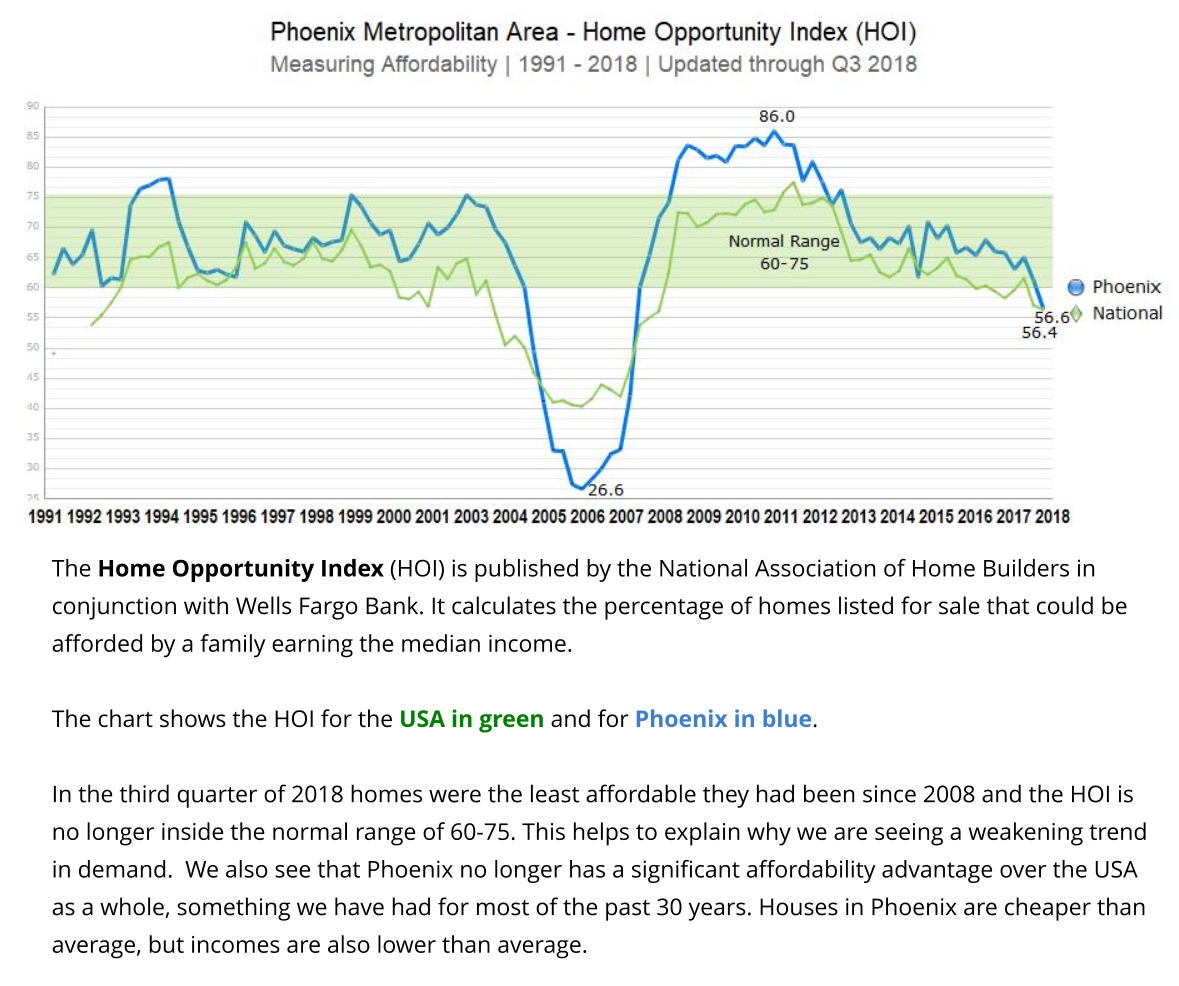

Like any financial market, real estate is subject to two key emotions – fear and greed. When pricing escalates the initial euphoria often gives way to unease. One can hardly blame residents who survived the valley’s market debacle for assuming rising prices equates a bubble. How does one accurately differentiate a bubble from a rising market? Again, Michael Orr provides succinct insight:

“Higher prices should encourage more sellers and discourages buyers which will eventually have a balancing effect on the market. If you ever see that higher prices encourage buyers to buy more, that’s when you have a bubble developing. This is what happened in 2004 and early 2005, but it is not happening now.”

We repeat, a bubble is not happening now. For those who like more in depth analysis of pricing, continue on with Tina Tamboer’s comments:

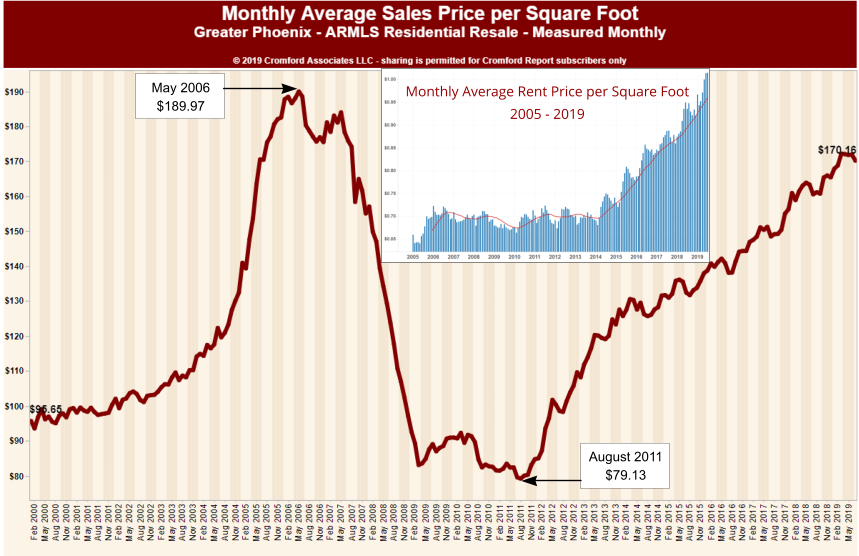

“The news media is filled with short-term predictions regarding the economy and how it will, or will not, affect real estate prices. It’s understandable for buyers to want their home to appreciate in value after they purchase, who doesn’t? However there is far too much attention paid to short-term influences and fluctuations these days and not enough attention paid to the long view. Real estate is a long-term investment for many people. Despite the euphoria of 2005-2007 and the nightmare of 2008-2011, on average homes are selling 81.6% higher today than they were in the year 2000. That’s an average appreciation rate of 4.3% per year over the course of 19 years. Smaller homes appreciated the most over time while larger homes appreciated the least. Homes under 1,000 sf have appreciated 122% since 2000, an average of 6.4% per year. Those between 1,000-2,000 sf appreciated 106%, an average of 5.6% per year. 2,000-3,000 sf appreciated 68% at 3.6% per year. 3,000-4,000 sf appreciated 49% at 2.6% per year and homes over 4,000 sf appreciated 11% at 0.6% per year.

In short, we are in a normal seller’s market. We expect to see prices rising throughout at least the first quarter of 2020 – if not longer. We will follow the numbers and keep you posted as they unveil.

We thank you for allowing us to assist you with your real estate needs in 2019. We consider it our duty to advise and inform our clients – whether that means buying, selling, or staying put. We wish you and those you love a very happy Holiday season. Here’s to a terrific 2020!

Russell & Wendy Shaw

(Mostly Wendy)

now attempt to remedy that. While demand is more elastic (and therefore perhaps the sexier story) supply might actually be the buried headline.

now attempt to remedy that. While demand is more elastic (and therefore perhaps the sexier story) supply might actually be the buried headline.

the Cromford Report

the Cromford Report have been. We ended 2018 with a rather lackluster market due to anemic demand. Entering 2019 it looked like the market was heading towards a balanced market – something we haven’t seen in the valley for years. But buyers suddenly reversed course and began to enter the market place in strong numbers. What turned things around? Two financial factors: interest rates & raised loan limits.

have been. We ended 2018 with a rather lackluster market due to anemic demand. Entering 2019 it looked like the market was heading towards a balanced market – something we haven’t seen in the valley for years. But buyers suddenly reversed course and began to enter the market place in strong numbers. What turned things around? Two financial factors: interest rates & raised loan limits. prognosticators watch closely for signs of market health. In the valley the supply side of the economic seesaw (supply & demand) has been fairly stable, if persistently undersupplied. Supply changes tend to be slow moving. Demand, as we have mentioned in the past, can change far more quickly. Jitters were set off in the last quarter of 2018 when the erosion of summer demand persisted. The erosion should not have been shocking given the hit affordability took both in years of rising prices combined with a rapid rise of interest rates. As Tom Ruff in the ARMLS Blog so brilliantly explains: “The decline in year-over-year sales volume began in October as interest rates rose. Adding angst to the problem, employees saw their 401(k)s shrink as the Dow Jones Industrial and the S&P 500 indexes fell 18.8% and 19.6% respectively between the first of October and Christmas Eve. Attempting to soothe nerves, the federal government shutdown from December 22 thru January 25. Happy Holidays everyone! “

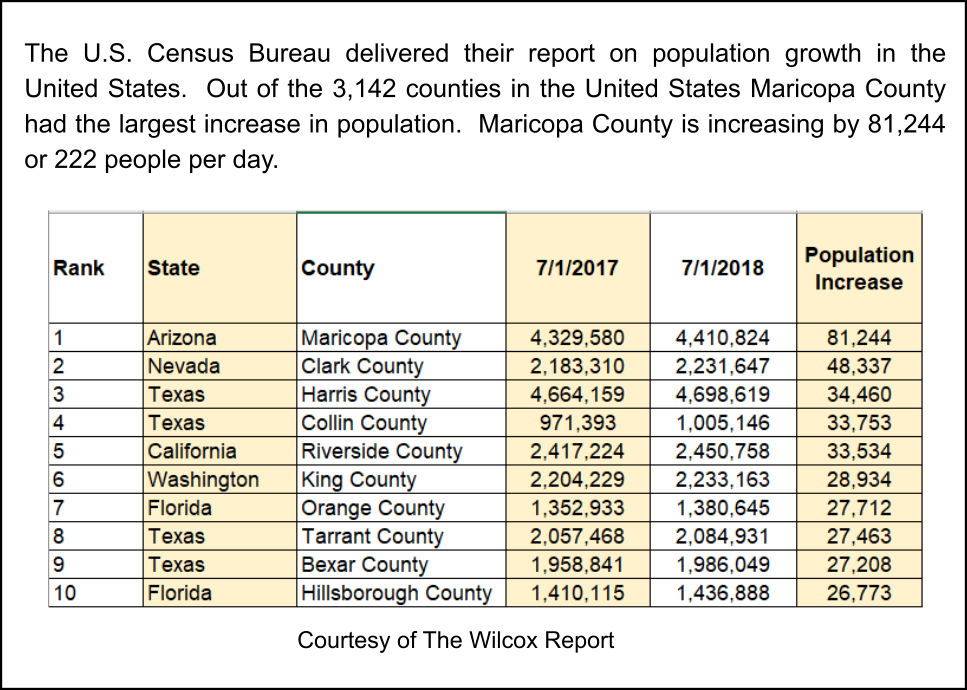

prognosticators watch closely for signs of market health. In the valley the supply side of the economic seesaw (supply & demand) has been fairly stable, if persistently undersupplied. Supply changes tend to be slow moving. Demand, as we have mentioned in the past, can change far more quickly. Jitters were set off in the last quarter of 2018 when the erosion of summer demand persisted. The erosion should not have been shocking given the hit affordability took both in years of rising prices combined with a rapid rise of interest rates. As Tom Ruff in the ARMLS Blog so brilliantly explains: “The decline in year-over-year sales volume began in October as interest rates rose. Adding angst to the problem, employees saw their 401(k)s shrink as the Dow Jones Industrial and the S&P 500 indexes fell 18.8% and 19.6% respectively between the first of October and Christmas Eve. Attempting to soothe nerves, the federal government shutdown from December 22 thru January 25. Happy Holidays everyone! “ compared with the first two weeks of December – and down 10% for the month compared to December 2017). To quote Michael Orr of the Cromford Report “In every respect, December was a weak month for demand, the weakest December we have seen since 2014 for sales … We have not seen listings under contract this low on January 1 since 2008. Clearly buyers are unenthusiastic about buying homes compared with just a few months ago.” In fact, for those who follow our market updates, we had reported that buyer demand first began wavering as early as July 2018. Rising interest rates combined with higher housing prices impacted affordability, putting a gentle damper on demand. But, before we all panic, there is counter balance on dropping demand. The valley is blessed with positive net migration (i.e. population growth) which is still exceeding the current supply. So the real question is what will win in the spring buyer season? Buyers diminished appetite or the inflow of new buyers? Stay tuned, we will have that answer for you in a month or two.

compared with the first two weeks of December – and down 10% for the month compared to December 2017). To quote Michael Orr of the Cromford Report “In every respect, December was a weak month for demand, the weakest December we have seen since 2014 for sales … We have not seen listings under contract this low on January 1 since 2008. Clearly buyers are unenthusiastic about buying homes compared with just a few months ago.” In fact, for those who follow our market updates, we had reported that buyer demand first began wavering as early as July 2018. Rising interest rates combined with higher housing prices impacted affordability, putting a gentle damper on demand. But, before we all panic, there is counter balance on dropping demand. The valley is blessed with positive net migration (i.e. population growth) which is still exceeding the current supply. So the real question is what will win in the spring buyer season? Buyers diminished appetite or the inflow of new buyers? Stay tuned, we will have that answer for you in a month or two. will make you want to reward him with treats just for being so dang cute. Luca will use his looks and charms to get away with whatever he can, just like any typical teenager. He needs an experienced owner who will give him boundaries and structure. He will learn that he is not the one in authority and that by following consistent guidelines set by his owner he can reap the rewards of love and affection. Luca is a smart boy that does want to please. He knows the cue to sit, plays fetch, and enjoys romping with his doggie friends. Luca loves being taken out on walks and he will strut about town. You can meet Luca at Home Fur Good, Thursday, Friday or Saturday between 11 – 4. The shelter is located at 10220 N 32nd Street in Phoenix. His adoption fee is $225 and includes spaying/neutering, age-appropriate vaccinations and microchipping. You can see all the pets available for adoption at homefurgood.org.

will make you want to reward him with treats just for being so dang cute. Luca will use his looks and charms to get away with whatever he can, just like any typical teenager. He needs an experienced owner who will give him boundaries and structure. He will learn that he is not the one in authority and that by following consistent guidelines set by his owner he can reap the rewards of love and affection. Luca is a smart boy that does want to please. He knows the cue to sit, plays fetch, and enjoys romping with his doggie friends. Luca loves being taken out on walks and he will strut about town. You can meet Luca at Home Fur Good, Thursday, Friday or Saturday between 11 – 4. The shelter is located at 10220 N 32nd Street in Phoenix. His adoption fee is $225 and includes spaying/neutering, age-appropriate vaccinations and microchipping. You can see all the pets available for adoption at homefurgood.org.

ultimately resulting in a balanced market.

ultimately resulting in a balanced market.