Demand for homes has been a complete non-issue in the valley for the last 3 years – so much so that the  current drop in demand has come as a bit of a shock to anyone observing it. Supply has been beyond abundant through our recent distressed market. Banks were overwhelmed with the volume of short sales and foreclosures swamping them – and unlike “normal sellers†the banks had to sell – no matter the price. The number of listings on the market hit all-time new highs. In short, the only headline was supply, supply, supply. As the supply of homes surged, so did demand. Investors swarmed Phoenix to pick up bargain basement values that were everywhere. Tax credits lured the first time home buyers to the market. Net migration was up (i.e. more people moving in to the valley than were moving out). New builds were effectively at zero – meaning no new supply was being created.  Sellers were swamped with multiple offers, many cash. It seemed like that party would never end.

current drop in demand has come as a bit of a shock to anyone observing it. Supply has been beyond abundant through our recent distressed market. Banks were overwhelmed with the volume of short sales and foreclosures swamping them – and unlike “normal sellers†the banks had to sell – no matter the price. The number of listings on the market hit all-time new highs. In short, the only headline was supply, supply, supply. As the supply of homes surged, so did demand. Investors swarmed Phoenix to pick up bargain basement values that were everywhere. Tax credits lured the first time home buyers to the market. Net migration was up (i.e. more people moving in to the valley than were moving out). New builds were effectively at zero – meaning no new supply was being created.  Sellers were swamped with multiple offers, many cash. It seemed like that party would never end.

Of course the only thing that stays the same is change. So the pendulum has swung (however temporarily) and now the real estate headline has switched to the drop in demand.  This drop is inciting the “doom and gloom†gang to heat up once again (although we cannot recall them ever really cooling off). These are the same people who refused to believe there was no “shadow inventory†being stashed by the banks which would “be released†and crash the market. That theory never materialized, but gave birth to the newest version: demand is down and therefore the “recovery has stalledâ€. Like the earlier rumor, we don’t believe there is any basis to this theory. As Michael Orr so brilliantly states:

In the normal world, no market improves every month without a rest now and then. There are always changes going on, and we are way overdue for a cooling off.

A move towards normality should not be regarded as a sign of impending doom, just a sign of impending normality.

A move towards normality does not mean prices will come down. Unlike the stock market, prices almost never move downwards in a normal real estate market. Sellers only lower their price expectations when very desperate. Desperate times do occur a few times per century, but they are very rare. For a while in 2004 and 2005 we forgot that they could ever happen. Now the public knows all too well they do and consequently expects prices to drop at any moment, even when it is least likely to happen.

So if “everything is fine†why is the market stalling? Affordability and Psychology. Buyers have been hit by a double whammy – rising prices and interest rates. Affordability in an area is monitored by pricing, interest rates, and income. It is a pretty safe bet that income has not jumped much in the last 2 years – and certainly no where near the level that prices and interest rates have jumped. So although local real estate is still (in our opinion) undervalued, affordability has taken a hit. The fact that long term trends for “normal interest rates†fall around 8%, placing today’s rates at well below normal, the psychology of affordability has kicked in. Buyers, hoping that either rates or pricing will come down, move to the sidelines as emotion overtakes logic. The bulk investors, the hedge funds, have done the bulk of their purchasing here and that also adds to the drop in demand. This should be good news to the “normal†buyer who often lost out when competing with these “professional†buyers. Michael Orr further explains:

“Buyers probably need some love and to be treated with more respect. There is still a long term shortage of supply and prices are unlikely to come down, but ordinary buyers need more convincing of the virtues of stepping into the market at this time. Large scale investors are backing off. They have made the bulk of their purchases already. If the market is to run at full speed we need more owner-occupier buyer motivation to overcome the sticker-shock…

Going forward, we should expect buyers to feel like they have the option to say no. More marketing and selling is going to be required to maintain the speed of the recovery. Without that, the recovery will probably slow and price increases will moderate. We are still in an early phase of a long term recovery, but right now home buyers will need much more convincing of that fact.

This is probably a temporary phenomenon, like the lull in demand after the tax credit expired in 2010. However at the moment it is still unclear how long it will last

What does dropped demand do to supply? One would suppose that the lessened demand would create a large surplus of supply, but the story is more nuanced than that. Michael Orr further explains:

So far in September we have only 2,988 new listings added to ARMLS. That is the lowest number in 13 years. However 1,848 of those listings are priced between $150,000 and $500,000. That is the largest number for this period since 2009 and it is 29% more than last year. Between $250,000 and $500,000 we have the most new listings during this early part of September since 2008. So supply is growing in the mid-range and in contrast the low-end under $150,000 has seen new listings drop by 40%. I’m sure a lot of buyers wish there were more homes available under $150,000. Above that mark buyers now have a lot more choice, but can they afford them?

What does this mean for home sellers? If the trend towards normalcy continues, we can expect fewer offers, slower price appreciation, and more competition for buyers. Sellers, who have been waiting for price appreciation to peak, might consider if that time is approaching. Buyers who are waiting for lower rates and price drops, are likely to be disappointed and should get off the sidelines.

Doesn’t “normal†sound like a place we all want to be? As always, we will strive to keep you apprised of the ever changing market.

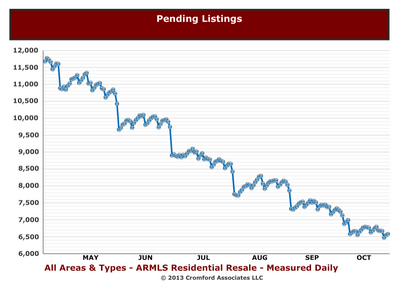

reported last month, demand has dampened significantly. Many observers will attribute this to the “seasonal effect†– meaning that the market has its peaks and valleys every year in a somewhat predictable pattern – the fall season being one of the valleys. They would be wrong; this is beyond the season. This fall, pending listings are falling faster in 2013 than any fall since 2000. To restate again what is causing the steep drop in demand, as much as the psychology of buyers can be generalized, here is what we believe is happening:

reported last month, demand has dampened significantly. Many observers will attribute this to the “seasonal effect†– meaning that the market has its peaks and valleys every year in a somewhat predictable pattern – the fall season being one of the valleys. They would be wrong; this is beyond the season. This fall, pending listings are falling faster in 2013 than any fall since 2000. To restate again what is causing the steep drop in demand, as much as the psychology of buyers can be generalized, here is what we believe is happening: