After years of the most brutal buyer’s market the Valley has ever endured, sellers are now enjoying the pendulum  swing favoring them.  Values are continuing to edge upwards and sellers are frequently receiving multiple contracts – often within days of offering their home for sale. With the real estate market so clearly favoring the seller, it would be easy to assume that sellers are bullet proof. Unfortunately this market, like all past strong seller markets, is still fraught with potentially costly seller mistakes. Our hope is by sharing some of these we can protect a seller or two from making the most common mistakes.

swing favoring them.  Values are continuing to edge upwards and sellers are frequently receiving multiple contracts – often within days of offering their home for sale. With the real estate market so clearly favoring the seller, it would be easy to assume that sellers are bullet proof. Unfortunately this market, like all past strong seller markets, is still fraught with potentially costly seller mistakes. Our hope is by sharing some of these we can protect a seller or two from making the most common mistakes.

Zestimates or other automated valuation systems. While Zillow has done a fabulous job of marketing their automated online valuation system, what they haven’t done a fabulous job of is being accurate with that valuation. Too often would-be sellers jump on to their site (or the multitude of sites that are similar) to determine “their home’s valueâ€. Sadly, these systems are no substitute for an appraisal or (even better) the full blown exposure of the home on the open market. Ultimately, a home is worth what an arm’s length buyer will pay. In a market that is generating competition for homes, prices can escalate beyond what any automated value system or appraisal says the home is worth. Valuation systems use preset computer metrics to estimate the value. It is difficult to ever foresee a time when they will be accurate, as determining home values is something of an art. Values are composed of market conditions, the property’s location, features, pricing, accessibility, market exposure (i.e. marketing), and negotiation. There is simply no substitute for someone with real estate expertise actually viewing the property.

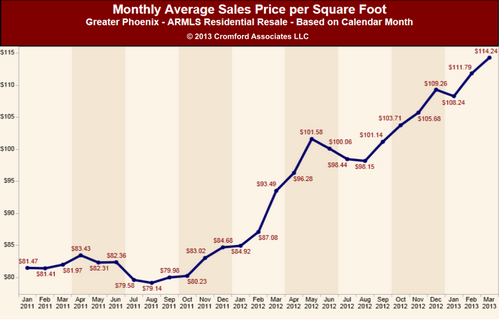

Appraisals. Speaking of values, let’s talk about the weakness of appraisals. Appraisals are an “opinion of value for lending purposesâ€. That is what it is, an opinion of value. This is so true that homes that obtain more than one appraisal often receive entirely different numbers. It isn’t that appraisers aren’t attempting to do good work, it is that they are always using rear view mirrors in looking for value. Appraisers are required to use sales in the last 3-4 months (it used to be in the last 6-12 months!)  The highest likelihood of an appraisal being accurate, is where the homes are homogenous and supply and demand is in equal balance (a four to six month of supply of homes) for an extensive period of time. Balanced markets in the valley have not been common. In a declining market (such as we saw in 2007-2011) appraisals often came in higher than true market value. This is due to the fact that the very definition of a declining market is one where a home today is selling for less than yesterday. Conversely, a rising market has tomorrow selling higher than today.  This is the current problem for sellers – appraisals are often coming in lower than buyers have offered to pay. Without addressing these appraisal issues upfront, sellers can find their value being slashed.

Choosing your agent (friends and family) Too often sellers use the first agent they talk to (so the primary hiring criteria is someone simply being there). Additionally, sellers may pick an inexperienced agent. This does not mean the agent hasn’t “been in real estate for years†but simply they lack experience. Did you know the average agent does approximately 6-8 home sales a year? Compare that to someone doing over 400 sales a year and you can see experience cannot be measured by the year. Another error can be using friends and family. It can be difficult for sellers and their family to have the conversations that are necessary to really sell a home. Comments on pricing, proper staging, and commissions can result in frayed relationships. Again, finding the agent with both knowledge and marketing power can produce results that outperform an average agent by thousands of dollars, not to mention save relationships.

“Saving the commission†At the risk of sounding self-serving, sellers can sometimes be “pound wise and penny foolishâ€. What we mean is that sellers often worry excessively about saving the commission while missing entirely the benefits that commission is really paying for. If it doesn’t matter who sells your home then sellers would always be better served just selling it themselves or paying the part-time agent a small amount to write up the deal. This is not the case however. If an agent cannot produce results above what a seller can do, you simply have the wrong agent. A quality agent can not only counsel sellers on how to prepare the home for market (avoiding the first costly mistake, a badly presented home) but expose the home to the maximum amount of buyers. Competition for a home (demand) is the single most important factor in generating the most money for the home.

As this is a subject near and dear to our hearts, we have plenty more to say on the subject! Hopefully, we have given you a thought or two about protecting your home value. As always, we are here to help and serve you!