When you live in Phoenix, you’re living in scorpion territory. That’s simply a fact that comes with living in the Arizona desert. During the winter, scorpions are less active and can be found indoors. In the summer, scorpions are actively hunting for food or a mate and can be found inside and outside. Scorpions like to shelter in dark cool places with an air flow, like cracks and crevices inside block fence walls or under palms tree bark.

indoors. In the summer, scorpions are actively hunting for food or a mate and can be found inside and outside. Scorpions like to shelter in dark cool places with an air flow, like cracks and crevices inside block fence walls or under palms tree bark.

Living in scorpion territory doesn’t mean you have to live WITH scorpions in your home. If you have scorpions inside your home, contact an experienced scorpion control professional to evaluate the situation and recommend an effective treatment for you.

Arizona’s Scorpion Threat

The Phoenix, Arizona area is in the Sonoran Desert, and scorpions are native to desert environments. If you live in or near Phoenix, chances are you’ll run into scorpions on your property or in your neighborhood sometime. You can refer to recent maps to see where scorpions have been reported in the Phoenix area.

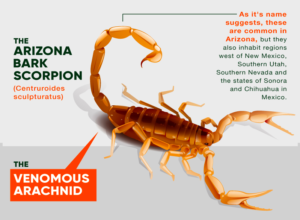

Arizona is home to the Arizona Bark Scorpion, which the most lethal venomous scorpion in the United States.

It can also be found in parts of Nevada, Utah, New Mexico, and Mexico. You can find other scorpion species in Arizona as well, like the desert hairy scorpion. However, other scorpion species in the USA do not pose a medical threat like the Arizona Bark Scorpion.

You can recognize an Arizona bark scorpion by the following:

- Length – From head to stinger, a mature Arizona bark scorpion has a slender body that measures 2.7 to 3.1 inches;

- 2 dark eyes on top of its head, and 3 eyes on each side of the head;

- Eight legs;

- Color. Arizona Bark Scorpions are tan in color. However, they can be yellow or even almost orange when they molt. Though these scorpions typically do not have markings, you could find one with stripes along its body and tail;

- The Arizona Bark Scorpions has a “subaculear tooth”, or a small bump on the tail that juts out beneath its stinger.

- The easiest way to identify an Arizona Bark Scorpions is by watching it! These scorpions lay their tails down parallel with the surface they are on when they’re at rest. Other scorpions keep tails up over their bodies.

When you come into contact with a scorpion, and you’re not sure which species you’re facing, exercise caution and treat it like it is venomous. Arizona bark scorpions are nocturnal and capable of climbing textured surfaces, so be aware that you can find them on walls, ceilings, in trees and high on shelves and furniture. This includes brick walls, stucco walls, wood paneling, and drywall. Scorpions can also survive underwater for hours, so it is possible to find one alive in your swimming pool, sink, bathtub, or toilet. Arizona bark scorpions tend to gather in groups (especially during cooler months) so when you see one, others may not be too far away.

Prevent Scorpion Infestations in your Home

Arizona Bark Scorpions are attracted to cooler, moist areas that have sufficient airflow. Specialized scorpion control treatments treat all cracks and crevices around your home and yard to eliminate scorpions inside and prevent further infestations. Another way you can reduce your chance of scorpion infestations around your home is to seal up any holes or cracks in your foundation, sidewalks, block wall fences, and exterior walls. You should also repair and replace old door sweeps and weather stripping around windows and doors.

Arizona Bark Scorpions eat crickets, cockroaches and other insects. You can help prevent infestations of pests to help discourage a scorpion infestation. After all, scorpions are predators that follow food sources.

A few places where you might find Arizona bark scorpions inside your home include:

- Under Cabinets;

- Running across the floor;

- Between floors and baseboards;

- Inside Sinks and Bathtubs where they get trapped;

- In Shoes and clothing where they go for quick shelter;

- Hanging from the wall or ceiling; and

- Inside any cracks and crevices especially concrete cracks and crevices!

How & When to Hunt Scorpions

The Arizona bark scorpion survives 12 months out of the year. Usually, scorpion season begins when the temperature hits about 70 degrees Fahrenheit, which is usually in the early spring. This is when scorpions become most active.

You can hunt scorpions around your home. Generally, you’ll find them in the dark and just before sunrise with a black light – flashlight. New moon and cloudy nights tend to be the best for hunting scorpions because they’re the darkest.

When you’re searching for scorpions in your home, don’t forget to look up high. As we mentioned, Arizona bark scorpions climb. Shine your flashlight high on walls and ceilings, down by the concrete foundations, and on block wall fences. Instead of using a regular flashlight, use a black light.

Arizona Bark Scorpions glow under black light and look almost fluorescent. Pick scorpions off walls, ceilings, block wall fences, branches, and out of debris piles with needle nose pliers. Place them carefully in jars and screw the lids shut. Using a glass jar to collect scorpions prevent scorpions from climbing out because they can’t climb the smooth glass surface. When you are hunting scorpions, wear thick gloves to prevent stings.

If you do not feel comfortable killing the scorpions yourself or your infestation is too large for you to handle on your own, call a professional pest control company to handle the job. An experienced scorpion control professional will not just kill scorpions on contact, but they prevent scorpion infestations in the future.

Residential Pest Control for Scorpions

Scorpions aren’t like other kinds of pests. They can’t be controlled with general pest control like other types of bugs. Scorpions need to be treated with specialized products formulated to be effective specifically on scorpions. There are several over the counter “scorpion killer” products at home improvement stores but don’t be fooled, this may be best left to the professionals. Over the counter products only kill scorpions when they are sprayed directly. They DO NOT keep killing or repelling scorpions after they dry.

Scorpion populations need to be managed with compounds specifically formulated for scorpions. Unlike other pests, which can be managed with less potent compounds, scorpion control involves potent compounds mixed with extended exposure agents. This is because scorpions tend to hide out in nooks and crannies throughout homes and yards. Effective scorpion control keeps killing scorpions even after treatments have dried and keeps working for about a month.

Work with a Scorpion Pest Control Pro

When you have scorpions in your home and property, work with a scorpion pest control professional who can eliminate the problem and prevent future infestations. Contact Responsible Pest Control today to set up your initial consultation, and start effective scorpion pest control for your home.

running when a treat bag rattles. His treat of choice is Temptations, and he has been known to send volunteers out to the store when the shelter runs low. Sinatra also has a way with the feline ladies. Thelma is his tabby, long-haired girlfriend. If you are looking for two cats, Thelma is also available and her birthday is 5/26/16. Sinatra loves to be up high, so if you have cat trees or shelves, Sinatra will make himself right at home! Home Fur Good open Thursday, Friday and Saturday from 11am – 4pm and is located at 10220 N. 32nd Street in Phoenix. Home Fur Good can also be reached by phone at 602-971-1134 or by emailing

running when a treat bag rattles. His treat of choice is Temptations, and he has been known to send volunteers out to the store when the shelter runs low. Sinatra also has a way with the feline ladies. Thelma is his tabby, long-haired girlfriend. If you are looking for two cats, Thelma is also available and her birthday is 5/26/16. Sinatra loves to be up high, so if you have cat trees or shelves, Sinatra will make himself right at home! Home Fur Good open Thursday, Friday and Saturday from 11am – 4pm and is located at 10220 N. 32nd Street in Phoenix. Home Fur Good can also be reached by phone at 602-971-1134 or by emailing

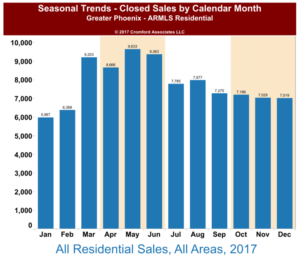

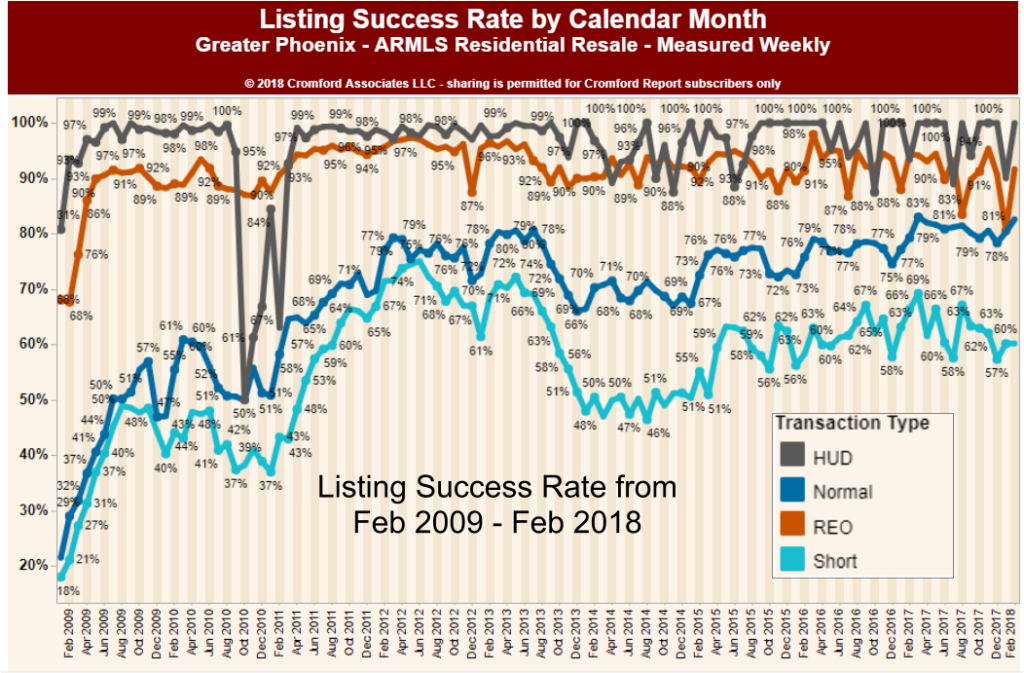

well the housing crises where supply and demand went topsy turvey. As interesting as it may be to listen to national housing statistics, they are generally antidotal. Even in the midst of the housing crisis of the “Great Recession” there were markets that saw little downturn – proving that real estate markets are local. Is the valley in the midst of dwindling demand? The short answer – a slight abating of demand is possibly underway. Is it so great to affect pricing or cause any significant impact to our market? No. This is due to the largely chronic lack of supply. Perhaps some numbers can better put this in perspective.

well the housing crises where supply and demand went topsy turvey. As interesting as it may be to listen to national housing statistics, they are generally antidotal. Even in the midst of the housing crisis of the “Great Recession” there were markets that saw little downturn – proving that real estate markets are local. Is the valley in the midst of dwindling demand? The short answer – a slight abating of demand is possibly underway. Is it so great to affect pricing or cause any significant impact to our market? No. This is due to the largely chronic lack of supply. Perhaps some numbers can better put this in perspective.

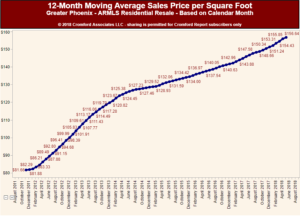

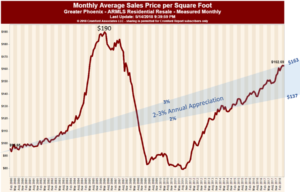

commented in the past that we are not in a “bubble”. But a recent commentary by the Cromford Report on pricing really caught our eye. It is not surprising to us that the press routinely shares erroneous housing market information often using statistics to make a poorly examined point. Homeowners would be well advised to have a skeptic’s heart when accepting the media’s research. As British Prime Minister Benjamin Disraeli so famously said (and Mark Twain popularized) “There are three kinds of lies: lies, damned lies, and statistics.” The latest premise is that housing prices have exceeded the prices set in the 2006 market. Uh… not exactly. As no one says it better than our guru Michael Orr of the Cromford Report, here are his comments (with only bolding by us for emphasis) that explain the facts about the housing numbers:

commented in the past that we are not in a “bubble”. But a recent commentary by the Cromford Report on pricing really caught our eye. It is not surprising to us that the press routinely shares erroneous housing market information often using statistics to make a poorly examined point. Homeowners would be well advised to have a skeptic’s heart when accepting the media’s research. As British Prime Minister Benjamin Disraeli so famously said (and Mark Twain popularized) “There are three kinds of lies: lies, damned lies, and statistics.” The latest premise is that housing prices have exceeded the prices set in the 2006 market. Uh… not exactly. As no one says it better than our guru Michael Orr of the Cromford Report, here are his comments (with only bolding by us for emphasis) that explain the facts about the housing numbers:

know them. She came to the shelter with her two siblings, Tanman and Louise. Yes, all three of them are still looking for homes. Thelma is very cat social, she is most comfortable when she has feline buddies to pal around with. The perfect home for Thelma will have existing cats for her to play and lounge about with. If you are really looking to make Thelma happy, you could adopt her and her siblings. Home Fur Good is located at 10220 N. 32nd Street in Phoenix. The shelter is open Thursday, Friday and Saturday from 11-4. You can call HFG at 602-971-1334. Visit the website at

know them. She came to the shelter with her two siblings, Tanman and Louise. Yes, all three of them are still looking for homes. Thelma is very cat social, she is most comfortable when she has feline buddies to pal around with. The perfect home for Thelma will have existing cats for her to play and lounge about with. If you are really looking to make Thelma happy, you could adopt her and her siblings. Home Fur Good is located at 10220 N. 32nd Street in Phoenix. The shelter is open Thursday, Friday and Saturday from 11-4. You can call HFG at 602-971-1334. Visit the website at  been area specific, so while national trends are interesting, they are not particularly meaningful when interpreting a local market. New listings to MLS in the first quarter of 2018 for Maricopa and Pinal County under 400K are logging the lowest numbers for a first quarter since the Cromford Report began tracking in 2001. Not surprisingly given the low supply, appreciation is higher than it’s been in the last several years. To quote the Cromford Report:

been area specific, so while national trends are interesting, they are not particularly meaningful when interpreting a local market. New listings to MLS in the first quarter of 2018 for Maricopa and Pinal County under 400K are logging the lowest numbers for a first quarter since the Cromford Report began tracking in 2001. Not surprisingly given the low supply, appreciation is higher than it’s been in the last several years. To quote the Cromford Report: motivated and aims to please, so training comes easily. Brooklyn loves to hike and has started her own peak bagging list. She is dog selective, enjoying larger dogs that like to rough house. Brooklyn would be happy in a family with one parent or one full of kids, she only wants to be an active member. Home Fur Good is located at 10220 N. 32nd Street in Phoenix. The shelter is open Thursday, Friday and Saturday from 11-4. You can call HFG at 602-971-1334. Visit the website at

motivated and aims to please, so training comes easily. Brooklyn loves to hike and has started her own peak bagging list. She is dog selective, enjoying larger dogs that like to rough house. Brooklyn would be happy in a family with one parent or one full of kids, she only wants to be an active member. Home Fur Good is located at 10220 N. 32nd Street in Phoenix. The shelter is open Thursday, Friday and Saturday from 11-4. You can call HFG at 602-971-1334. Visit the website at  as inventory is rapidly evaporating in the low price points just like in 2005. But is this really “just like 2005”? No it really isn’t. For good or bad we have been through a number of real estate cycles (Russell entered real estate in 1978 and Wendy in 1982) so it is natural to compare the present with the past. But memory is often faulty and I think she is forgetting the real roller coaster ride of 2005. A couple of facts pulled from the Cromford Report archives for 2005 numbers vs. today’s number illustrate the point:

as inventory is rapidly evaporating in the low price points just like in 2005. But is this really “just like 2005”? No it really isn’t. For good or bad we have been through a number of real estate cycles (Russell entered real estate in 1978 and Wendy in 1982) so it is natural to compare the present with the past. But memory is often faulty and I think she is forgetting the real roller coaster ride of 2005. A couple of facts pulled from the Cromford Report archives for 2005 numbers vs. today’s number illustrate the point: